Get the free CONSUMER LOAN APPLICATION - Home NBKC

Show details

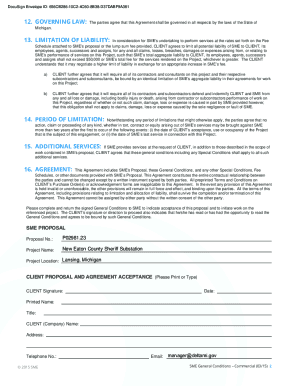

CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint Amt. Requested # of Payments We intend to apply for joint credit. Preferred PMT. Amt. Preferred PMT. Day Market Survey

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer loan application

Edit your consumer loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer loan application online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consumer loan application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer loan application

How to fill out a consumer loan application:

01

Gather all necessary documents: Before you begin filling out the consumer loan application, make sure you have all the required documents handy. These may include your identification proof, income statements, bank statements, and any other documents requested by the lender.

02

Provide personal information: The application will typically ask you to provide your personal details such as your full name, date of birth, social security number, and contact information. Ensure that you enter all information accurately to avoid any potential issues during the loan process.

03

Specify the loan amount and purpose: Indicate the amount you wish to borrow and provide a brief explanation of how you plan to use the funds. This information helps the lender assess your loan request and determine whether it aligns with their lending policies.

04

Input your employment details: Include your current employment information, such as your employer's name, your job title, the duration of your employment, and your income. Be honest and provide accurate details about your employment status, as this can greatly impact the lender's decision.

05

Disclose your financial information: The loan application will typically require you to provide details about your financial situation. This may involve stating your monthly income, listing your assets and liabilities, and providing information about your existing debts or financial obligations.

06

Provide references or guarantors: Depending on the loan requirements, the application might ask you to provide references or guarantors who can vouch for your creditworthiness. Ensure that you have their contact information readily available and obtain their consent before including them in your application.

07

Review and sign the application: Take the time to carefully review all the information you have entered before submitting the application. Double-check for any errors or missing details that may need to be rectified. Once you are confident that everything is accurate, sign the application as per the provided instructions.

Who needs a consumer loan application?

01

Individuals seeking financial assistance: A consumer loan application is necessary for individuals who require financial assistance to meet their personal or household needs. This may include funding for education, purchasing a car, covering medical expenses, consolidating debt, or any other legitimate purpose.

02

Banks and financial institutions: Banks and financial institutions need consumer loan applications to collect all the relevant information about the borrower to assess their creditworthiness and eligibility for the loan. This helps them in evaluating the risk associated with lending money and making informed lending decisions.

03

Loan officers and underwriters: Loan officers and underwriters involved in the loan approval process rely on consumer loan applications to evaluate the applicant's financial situation, repayment ability, and credit history. This information assists them in determining the terms of the loan and whether it aligns with the lender's lending criteria.

Note: The specific requirements and process of filling out consumer loan applications may vary based on the lender and the particular type of loan being sought. It is essential to follow the instructions provided by the lender and seek clarification if needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit consumer loan application online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your consumer loan application to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit consumer loan application on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign consumer loan application on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit consumer loan application on an Android device?

You can edit, sign, and distribute consumer loan application on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is consumer loan application?

Consumer loan application is a form that individuals need to fill out when applying for a loan from a financial institution.

Who is required to file consumer loan application?

Anyone seeking a loan from a financial institution is required to file a consumer loan application.

How to fill out consumer loan application?

Consumer loan application can be filled out online or in person by providing personal and financial information.

What is the purpose of consumer loan application?

The purpose of consumer loan application is to assess the borrower's eligibility for a loan based on their financial standing and credit history.

What information must be reported on consumer loan application?

Consumer loan application typically requires information such as personal details, income, employment history, assets, liabilities, and credit score.

Fill out your consumer loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.