Get the free Increase Credit Limit Request

Show details

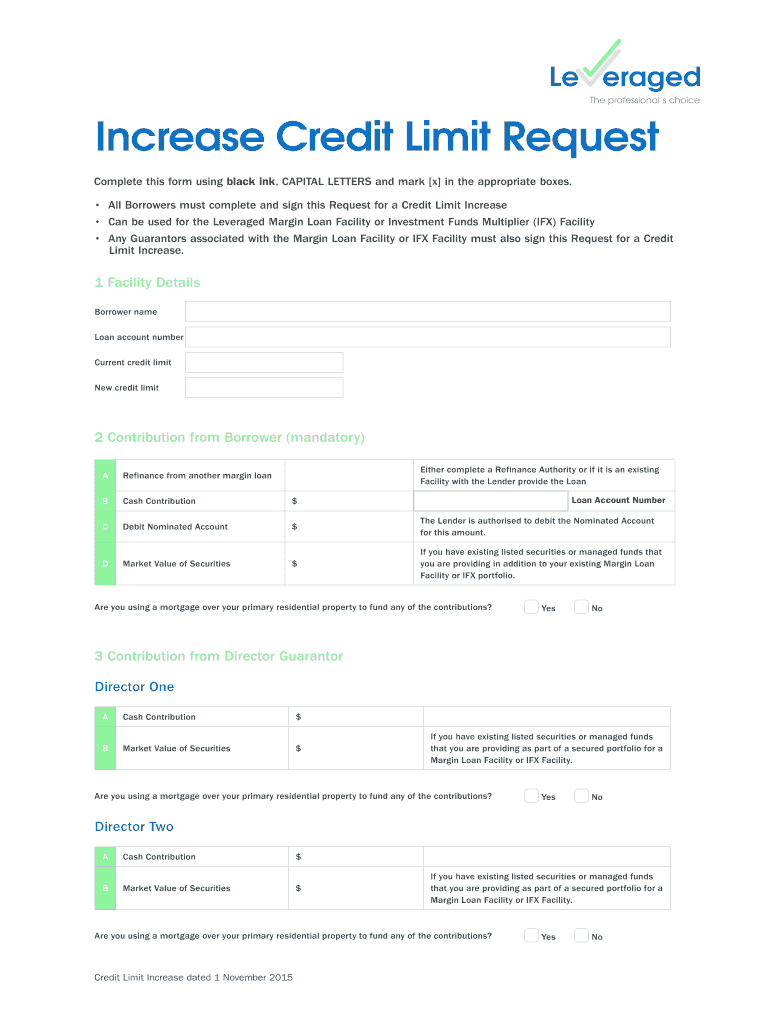

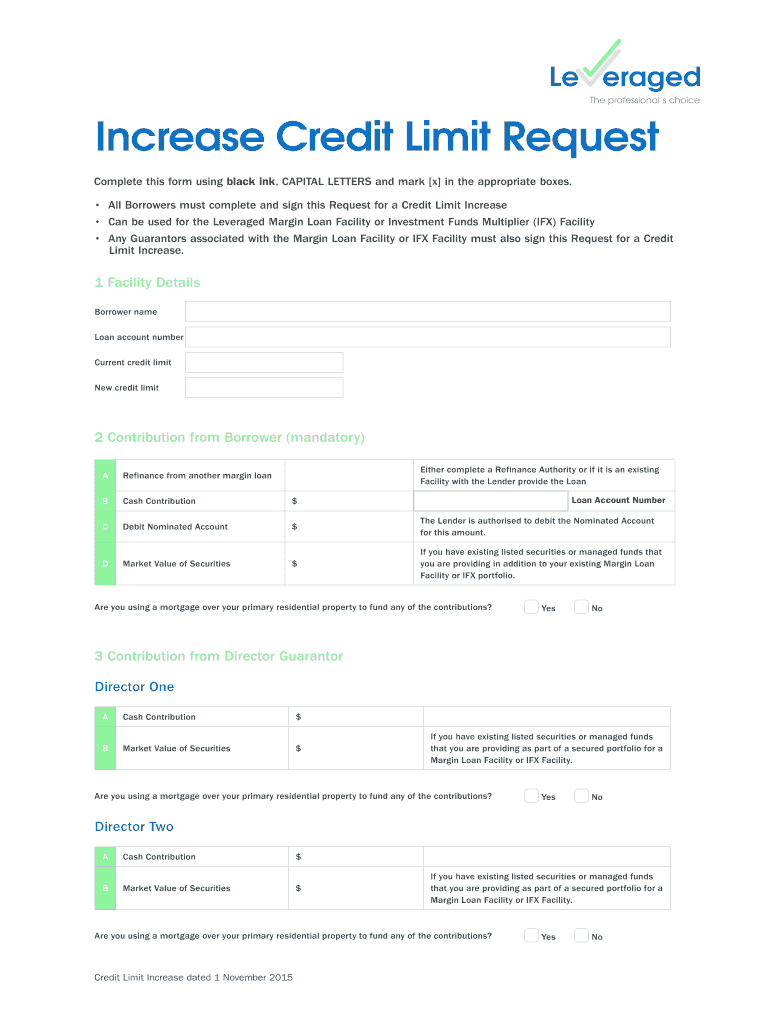

Increase Credit Limit Request Complete this form using black ink, CAPITAL LETTERS and mark x in the appropriate boxes. All Borrowers must complete and sign this Request for a Credit Limit Increase

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign increase credit limit request

Edit your increase credit limit request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your increase credit limit request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit increase credit limit request online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit increase credit limit request. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out increase credit limit request

How to fill out increase credit limit request:

01

Start by gathering all the necessary documents and information required for the request. This may include your current credit card statement, income proof, employment details, and any other supporting documents.

02

Carefully read the instructions and guidelines provided by your credit card issuer. Ensure that you understand the requirements and any specific format or documentation needed for the request.

03

Begin filling out the request form or application. Provide accurate and up-to-date information about yourself, such as your full name, contact details, social security number, and credit card account number.

04

Clearly state the reason for requesting a credit limit increase. Whether it's due to increased expenses, a change in financial circumstances, or to take advantage of better credit opportunities, explain your situation briefly and concisely.

05

Include any relevant supporting documents to strengthen your request. This may include recent pay stubs, bank statements, proof of additional income, or any other documentation that validates your ability to handle a higher credit limit.

06

Double-check all the information you have provided before submitting the request. Ensure that there are no errors or missing details that could delay the processing of your application.

07

Once you have completed the form, submit it according to the instructions provided by your credit card issuer. Some issuers allow online submissions, while others may require you to mail or fax the request.

08

It is important to wait for a response from your credit card issuer. They may require additional documentation or contact you for further verification. Be patient and keep track of any communication regarding your request.

09

If your request is approved, your credit card issuer will notify you of the increased credit limit. Remember to use the higher limit responsibly and avoid overspending or accumulating unnecessary debt.

10

If your request is denied, don't be discouraged. You can always ask your credit card issuer for the reason behind the denial and take necessary steps to improve your creditworthiness or reconsider applying in the future.

Who needs increase credit limit request:

01

Individuals who have a demonstrated responsible credit history and wish to have more purchasing power available to them.

02

People who have experienced an increase in their expenses, such as due to a change in lifestyle, additional financial obligations, or unexpected emergencies.

03

Business owners or self-employed individuals who need a higher credit limit to manage fluctuating cash flows, invest in their business, or take advantage of business-related opportunities.

04

Individuals who want to improve their credit utilization ratio by increasing their available credit, which can positively impact their credit score.

05

Consumers who have received offers for credit limit increases from their credit card issuers and wish to take advantage of the opportunity.

06

People who want to have a buffer for unexpected expenses or emergencies without relying on other forms of credit, such as loans or lines of credit.

07

Individuals who are planning for major purchases or events that require a higher credit limit, such as weddings, vacations, or home renovations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my increase credit limit request directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your increase credit limit request and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in increase credit limit request?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your increase credit limit request to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit increase credit limit request on an Android device?

You can make any changes to PDF files, such as increase credit limit request, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is increase credit limit request?

An increase credit limit request is a formal request made by a borrower to their creditor to increase the maximum amount of credit available to them.

Who is required to file increase credit limit request?

Any individual or business entity who wants to have their credit limit increased must file an increase credit limit request.

How to fill out increase credit limit request?

To fill out an increase credit limit request, the borrower must provide their personal or business information, current credit limit, reasons for requesting an increase, and any supporting documents.

What is the purpose of increase credit limit request?

The purpose of an increase credit limit request is to request for additional borrowing capacity in order to have access to more funds when needed.

What information must be reported on increase credit limit request?

The increase credit limit request must include detailed information about the borrower, current credit limit, reasons for requesting an increase, and any additional supporting documents.

Fill out your increase credit limit request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Increase Credit Limit Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.