Get the free bank, serving our communities by offering a wide range

Show details

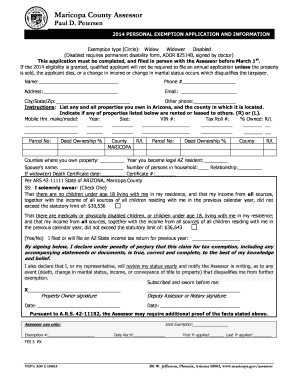

2014ANNUAL Recommission Statement continue as a progressive and growing community

bank, serving our communities by offering a wide range

of competitive services for our customers, resulting in a

profitable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank serving our communities

Edit your bank serving our communities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank serving our communities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank serving our communities online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bank serving our communities. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank serving our communities

How to fill out a bank serving our communities:

01

Research community needs: Before starting a bank serving our communities, it is essential to conduct thorough research on the needs of the target community. This research will help identify the financial services that are lacking or in high demand, such as small business loans, affordable housing mortgages, or financial education programs.

02

Develop community-driven services: Based on the research findings, develop a range of services and products that cater to the specific needs of the community. This could include specialized loan programs for local businesses, financial literacy workshops targeted at underserved populations, or innovative mobile banking solutions to reach remote areas.

03

Establish partnerships: Collaborate with local organizations, community leaders, and nonprofits to form strategic partnerships. These partnerships can help leverage resources, expand outreach efforts, and create synergies to address community needs effectively. For example, partnering with local schools can enable the bank to offer financial education programs to students and their families.

04

Recruit and train staff from the community: To foster trust and cultural understanding, prioritize hiring staff from within the community. Provide comprehensive training programs to ensure employees are equipped with the necessary skills to meet the unique challenges of serving the community effectively. This can include training on cultural sensitivity, language skills, and knowledge of local resources.

05

Offer personalized and inclusive services: Ensure that the bank's services are accessible and inclusive to all members of the community. This can involve providing bilingual customer support, offering affordable banking options, or implementing alternative banking channels such as mobile banking or virtual assistance to cater to individuals with disabilities or limited mobility.

06

Create a community-driven marketing strategy: Develop a marketing strategy that reflects the diverse voices and values of the community. Engage with the community through various channels, such as social media platforms, local events, or community forums. Actively seek feedback from customers to continuously improve services and address any concerns promptly.

Who needs a bank serving our communities?

01

Underserved populations: Individuals and businesses that have limited access to traditional banking services, such as low-income households, minority-owned businesses, or rural communities in remote areas.

02

Nonprofits and community organizations: Organizations that work towards community development, economic empowerment, or financial inclusion can greatly benefit from a bank that is dedicated to serving their needs. They require financial partners who understand their unique challenges and can provide tailored solutions.

03

Local businesses: Small and medium-sized enterprises often struggle to access financing or obtain fair terms from conventional banks. A bank serving our communities can offer specialized loan programs, business development support, and financial advice to help local businesses thrive.

In conclusion, filling out a bank serving our communities involves understanding the specific needs of the community, developing tailored services, forging strategic partnerships, and ensuring inclusivity and cultural sensitivity. The target audience for such a bank includes underserved populations, nonprofits, community organizations, and local businesses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute bank serving our communities online?

With pdfFiller, you may easily complete and sign bank serving our communities online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit bank serving our communities in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your bank serving our communities, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I fill out bank serving our communities on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your bank serving our communities, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is bank serving our communities?

Bank serving our communities refers to financial institutions that provide essential services to local residents and businesses.

Who is required to file bank serving our communities?

Banks and other financial institutions are required to file bank serving our communities.

How to fill out bank serving our communities?

Bank serving our communities can be filled out online or on paper forms provided by the regulatory authorities.

What is the purpose of bank serving our communities?

The purpose of bank serving our communities is to ensure that financial institutions are meeting the needs of the local population and contributing to the growth of the community.

What information must be reported on bank serving our communities?

Information such as the types of services offered, number of loans provided, and demographic data of customers must be reported on bank serving our communities.

Fill out your bank serving our communities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Serving Our Communities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.