Get the free Personal Financial Statement - postalcuorg

Show details

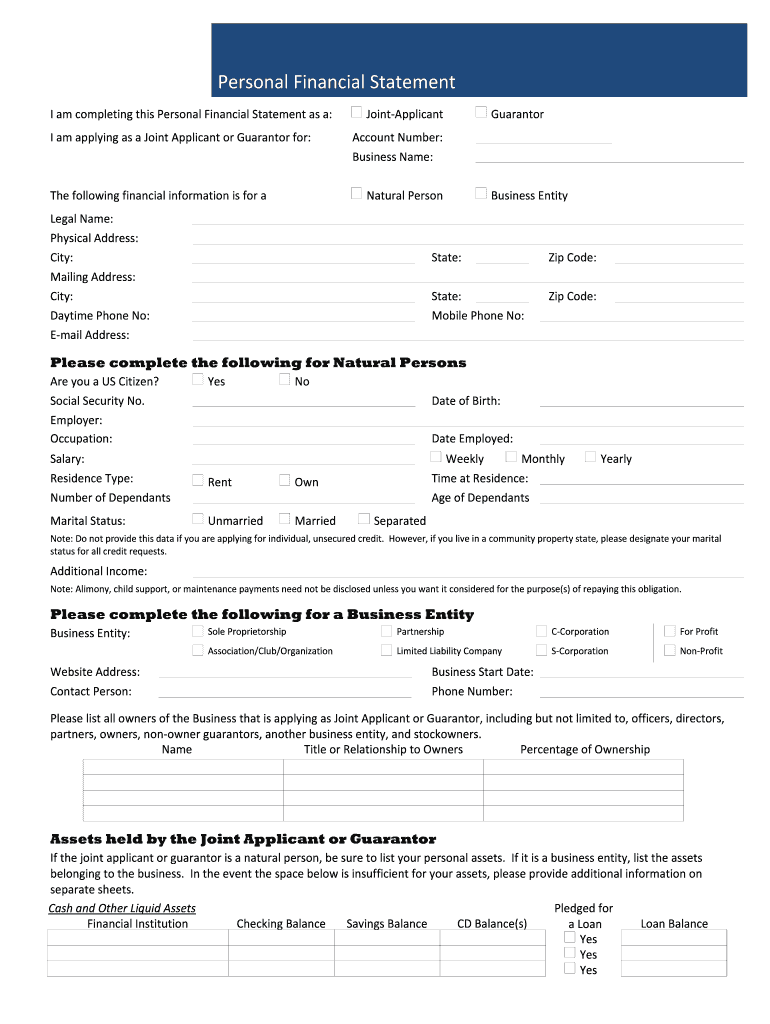

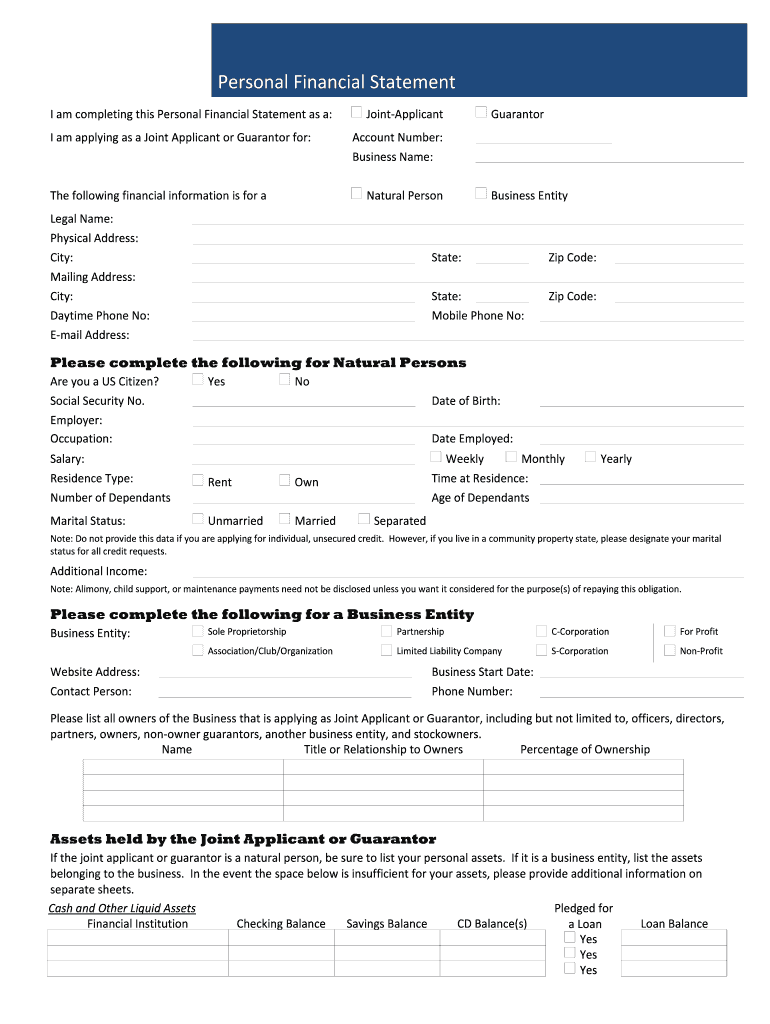

PersonalFinancialStatement IamcompletingthisPersonalFinancialStatementasa: IamapplyingasaJointApplicantorGuarantorfor: JointApplicant Guarantor AccountNumber: Businessman: NaturalPerson Thefollowingfinancialinformationisfora

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial statement

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal financial statement online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal financial statement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial statement

How to fill out a personal financial statement:

01

Start by gathering all necessary financial documents, including bank statements, investment statements, loan documents, and tax returns.

02

Begin with the section for personal information, which typically includes your name, address, contact details, and social security number.

03

Provide details about your assets, such as cash, savings accounts, retirement accounts, real estate properties, vehicles, and any other valuable possessions you own.

04

List your liabilities, including mortgages, loans, credit card debts, student loans, and any other outstanding debts you may have.

05

Calculate your net worth by subtracting your total liabilities from your total assets. This will give you an overview of your financial standing.

06

Include information about your income, such as salary, bonuses, rental income, dividends, or any other sources of income you have.

07

Document your monthly expenses, including housing costs, utilities, transportation, groceries, insurance, education, and any other recurring expenses you incur.

08

Summarize your financial goals, such as saving for retirement, paying off debt, or funding your children's education. This will demonstrate your financial plans and motivations.

09

Provide any additional information that may be relevant, such as outstanding legal matters, significant financial transactions, or any other factors that might impact your financial situation.

Who needs a personal financial statement:

01

Individuals who are applying for loans or mortgages often need to submit a personal financial statement to lenders to assess their creditworthiness and ability to repay the loan.

02

Entrepreneurs and business owners may require a personal financial statement when seeking financing for their business or applying for business loans.

03

When going through divorce proceedings, a personal financial statement may be necessary to determine the division of assets and liabilities between spouses.

04

Financial advisors and wealth managers may request a personal financial statement from their clients to assist in developing personalized financial plans or investment strategies.

05

Lastly, individuals who want to gain a better understanding of their overall financial situation can benefit from creating a personal financial statement. It helps in evaluating their net worth, budgeting, setting financial goals, and identifying areas for potential improvement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my personal financial statement in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your personal financial statement and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out personal financial statement on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your personal financial statement, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out personal financial statement on an Android device?

Use the pdfFiller mobile app to complete your personal financial statement on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is personal financial statement?

A personal financial statement is a document that outlines a person's financial status by detailing their assets, liabilities, income, and expenses.

Who is required to file personal financial statement?

Certain individuals, such as public officials, government employees, and candidates for public office, may be required to file a personal financial statement.

How to fill out personal financial statement?

To fill out a personal financial statement, one must gather information on their assets, liabilities, income, and expenses, and then input this data into the appropriate sections of the form.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to provide an overview of an individual's financial situation, which can be useful for monitoring financial health, applying for loans, or complying with reporting requirements.

What information must be reported on personal financial statement?

Information such as assets (e.g. bank accounts, real estate), liabilities (e.g. loans, mortgages), income, and expenses must be reported on a personal financial statement.

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.