Get the free Business Loan Application - ESL Federal Credit Union - esl

Show details

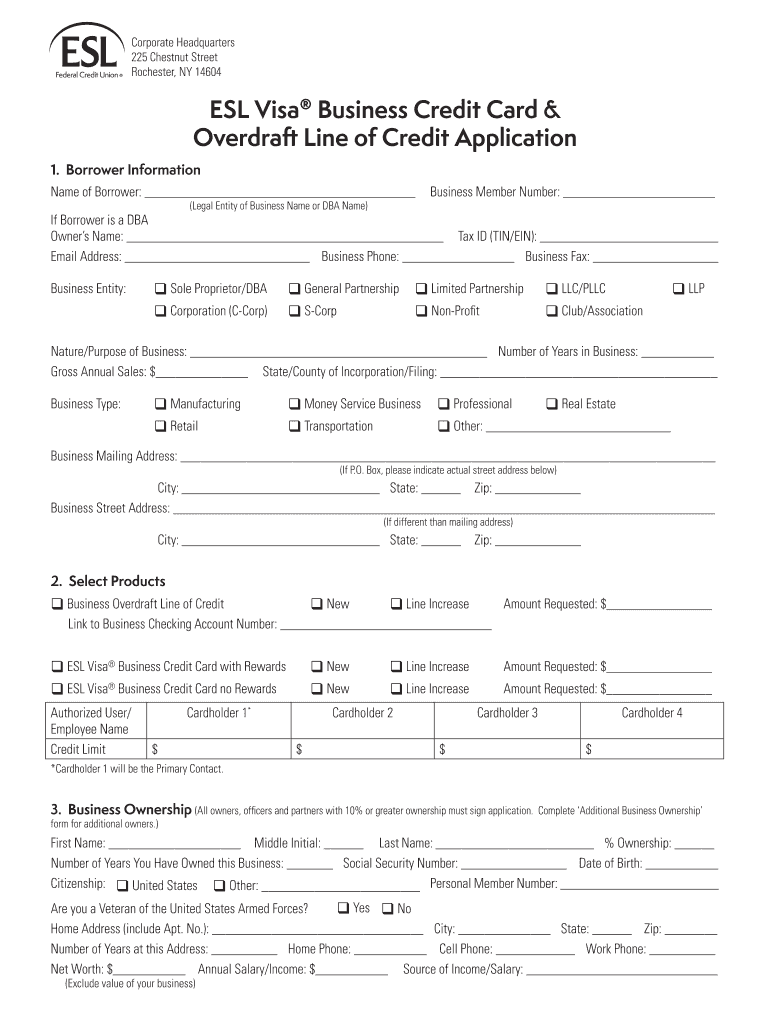

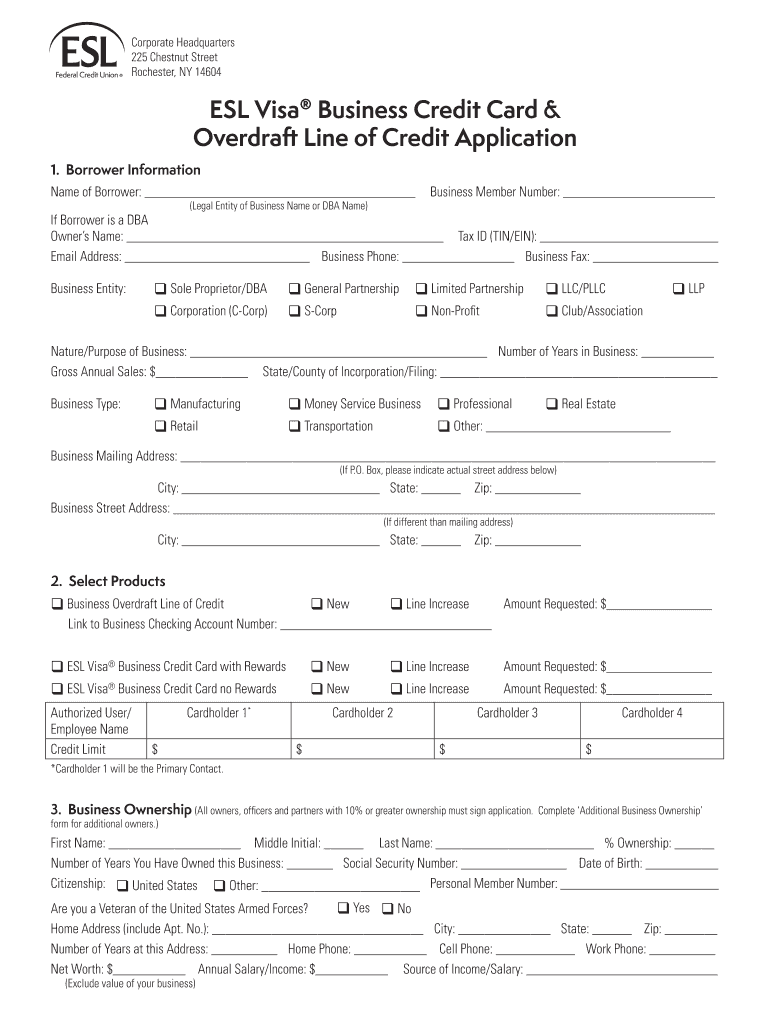

Corporate Headquarters 225 Chestnut Street Rochester, NY 14604 ESL Visa Business Credit Card & Overdraft Line of Credit Application 1. Borrower Information Name of Borrower: (Legal Entity of Business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loan application

Edit your business loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business loan application online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business loan application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loan application

How to fill out a business loan application?

01

Gather all the necessary documents: Before starting the application process, make sure you have all the required documents handy. These may include your business plan, financial statements, tax returns, bank statements, and any other relevant paperwork.

02

Provide accurate and detailed information: When filling out the application, ensure that all the information you provide is accurate and up-to-date. This includes details about your business, such as its legal structure, industry, and years in operation. Be prepared to provide information about your personal background as well, including your education and employment history.

03

Complete the financial section: The financial section of the application is crucial, as it helps lenders assess your business's financial health. Include income statements, balance sheets, and cash flow projections to give lenders a clear understanding of your business's financial position.

04

Describe the purpose of the loan: Clearly explain why you need the loan and how it will be used to benefit your business. This could be for expansion, purchasing equipment, working capital, or any other specific purpose. Providing a detailed outline of your plan will help lenders understand your objectives.

05

Include collateral and personal guarantee details: If required by the lender, be prepared to provide information about any collateral you are willing to put up as security for the loan. Additionally, you may need to submit details about personal guarantees, which hold the borrower personally responsible for loan repayment.

Who needs a business loan application?

01

Entrepreneurs starting a new business: If you are launching a new business and need financial assistance, a business loan application is essential for approaching lenders and securing the funding you require.

02

Existing business owners: Whether you want to expand your business, purchase equipment, hire additional staff, or meet any other financial needs, a business loan application is necessary for existing business owners who require capital injection.

03

Small business owners: Small businesses often face challenges in accessing traditional forms of financing. Therefore, small business owners may need to complete a business loan application to apply for loans from banks, credit unions, or other financial institutions.

04

Established companies: Even established companies may need to fill out a business loan application if they are seeking additional financing for large-scale projects, acquisitions, or other strategic initiatives.

Remember, each lender may have specific requirements and criteria for their loan application process. It's always a good idea to research and understand the lender's guidelines before starting the application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business loan application for eSignature?

business loan application is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit business loan application online?

The editing procedure is simple with pdfFiller. Open your business loan application in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my business loan application in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your business loan application right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is business loan application?

Business loan application is a formal request for financial assistance from a lending institution to support the operations or expansion of a business.

Who is required to file business loan application?

Any business entity or individual looking to secure funding for their business is required to file a business loan application.

How to fill out business loan application?

To fill out a business loan application, one must provide detailed information about the business, its financial standing, and the purpose of the loan. Additionally, supporting documentation such as financial statements, business plans, and personal information may be required.

What is the purpose of business loan application?

The purpose of a business loan application is to request funding to support various business needs such as starting a new business, expanding operations, purchasing equipment, or covering operational expenses.

What information must be reported on business loan application?

Information that must be reported on a business loan application includes details about the business, its financial history, the purpose of the loan, collateral (if applicable), and personal information of the business owner(s).

Fill out your business loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.