Get the free Personal Financial Statement - centralwcuorg

Show details

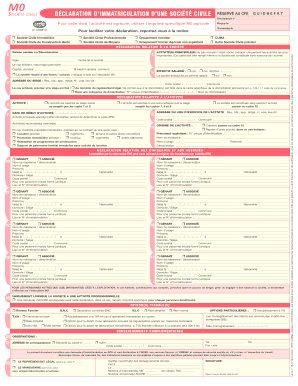

Personal Financial Statement Name: Date of Birth: Address: City, ST Zip Code: CHECK AS APPLICABLE Applicant is applying for this loan: Individually, without a cosigner or guaranty of a relative or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial statement

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal financial statement online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal financial statement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial statement

Who needs a personal financial statement?

01

Individuals applying for loans: Banks and financial institutions often require a personal financial statement when individuals apply for loans. This statement helps lenders assess the borrower's financial situation and determine their creditworthiness.

02

Entrepreneurs and business owners: Personal financial statements are also useful for entrepreneurs and business owners who need to demonstrate their financial standing to investors, creditors, or potential partners. It provides a comprehensive overview of the individual's personal assets, liabilities, and net worth.

03

Investors and financial advisors: Investors may request a personal financial statement from individuals seeking funding for their ventures. Additionally, financial advisors might require this statement to better understand their clients' complete financial picture and provide appropriate guidance.

How to fill out a personal financial statement:

01

Gather necessary documents: Collect all relevant financial documents, such as bank statements, investment statements, credit card statements, and loan documents. Ensure that you have accurate and up-to-date information.

02

List your assets: Begin by listing all your assets, including cash, savings accounts, investment accounts, real estate, vehicles, and personal property. It's important to provide accurate valuations for each asset.

03

Detail your liabilities: Identify and document all outstanding debts and liabilities, such as mortgages, car loans, student loans, credit card debt, and outstanding taxes. Specify the name of the creditor, the outstanding balance, and the monthly payment.

04

Calculate your net worth: Subtract your total liabilities from your total assets to determine your net worth. This figure represents your overall financial health and is an essential component of a personal financial statement.

05

Provide income and expenses information: Detail your monthly income from various sources, such as your job, investments, and rental income. Additionally, outline your monthly expenses, including mortgage payments, utilities, insurance premiums, loan payments, and other regular expenses.

06

Summarize your personal financial goals: Briefly outline your short-term and long-term financial goals in this section. It could include goals such as saving for retirement, paying off debts, or saving for a specific purchase.

07

Review and update regularly: As your financial situation evolves, it's crucial to review and update your personal financial statement periodically. This will help ensure that it reflects your current financial status accurately.

Remember, it is advisable to consult with a financial professional or accountant while preparing your personal financial statement to ensure accuracy and compliance with any specific requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my personal financial statement directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your personal financial statement as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute personal financial statement online?

pdfFiller makes it easy to finish and sign personal financial statement online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit personal financial statement on an iOS device?

Create, modify, and share personal financial statement using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is personal financial statement?

A personal financial statement is a document that provides an individual's financial information, including assets, liabilities, income, and expenses.

Who is required to file personal financial statement?

Certain government officials, such as elected officials, appointed officeholders, and candidates for public office, are required to file personal financial statements.

How to fill out personal financial statement?

Personal financial statements can be filled out manually or electronically, following the specific guidelines and instructions provided by the respective governing body.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to provide transparency and accountability regarding an individual's financial situation to prevent conflicts of interest or unethical behavior.

What information must be reported on personal financial statement?

Typically, personal financial statements require reporting of assets, liabilities, income sources, and financial interests in any business entities.

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.