Get the free AUTHORIZATION - Payroll Services

Show details

STATE: Clear Form PRINT SAVE SUI ID: AUTHORIZATION KNOW ALL MEN BY THESE PRESENTS: THAT THE UNDERSIGNED, (COMPANY NAME AS SHOWN ON VEIN REGISTRATION) a Federal Employer Identification No. , (CORPORATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign authorization - payroll services

Edit your authorization - payroll services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authorization - payroll services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing authorization - payroll services online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit authorization - payroll services. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out authorization - payroll services

How to fill out authorization - payroll services:

01

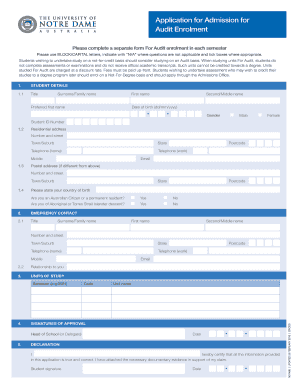

Start by obtaining the authorization form from your payroll services provider. This can usually be done online or by contacting their customer support.

02

Read the instructions and guidelines provided with the authorization form carefully. Make sure you have a clear understanding of what information needs to be included and any specific requirements.

03

Begin by providing your company or organization's details. This may include the name, address, contact information, and any relevant tax identification numbers.

04

Next, provide the employee or individual details for whom the authorization is being submitted. Include their full name, employee identification number, and any other necessary identifying information.

05

Specify the type of payroll services you are authorizing. This could include salary/wage payments, payroll tax deductions, direct deposit information, and any additional services you may require.

06

If necessary, indicate any special instructions or preferences related to the payroll services. This could include specific dates or frequencies for payments, deductions, or notifications.

07

Review the completed authorization form carefully to ensure all the information provided is accurate and complete. Make any necessary corrections or additions before submitting the form.

08

Finally, sign and date the authorization form. Depending on the requirements of your payroll services provider, you may need additional signatures from authorized individuals within your organization.

Who needs authorization - payroll services:

01

Companies or organizations that outsource their payroll processing to a third-party payroll services provider typically require authorization.

02

Employers who want to ensure that accurate and timely payments are made to their employees, including salary/wages, bonuses, and overtime, may need to authorize payroll services.

03

Organizations that want to comply with tax regulations and ensure proper deductions, withholdings, and reporting often rely on authorized payroll services.

04

Companies that offer direct deposit options for their employees may use authorization to set up and manage the necessary banking information securely.

05

Employers who wish to streamline payroll processes, increase efficiency, and avoid the costs and complexities associated with in-house payroll management may benefit from authorizing payroll services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit authorization - payroll services from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your authorization - payroll services into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the authorization - payroll services in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your authorization - payroll services directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit authorization - payroll services on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share authorization - payroll services from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is authorization - payroll services?

Authorization for payroll services is the process of granting permission to a service provider to access and manage an organization's payroll system and related functions.

Who is required to file authorization - payroll services?

Employers or business owners who wish to outsource their payroll functions to a third-party service provider are required to file authorization for payroll services.

How to fill out authorization - payroll services?

Authorization for payroll services can typically be filled out online through the service provider's website or by filling out a physical form provided by the provider.

What is the purpose of authorization - payroll services?

The purpose of authorization for payroll services is to ensure that the payroll service provider has permission to access and manage the employer's payroll system and process payroll on their behalf.

What information must be reported on authorization - payroll services?

Information required on authorization for payroll services typically includes the employer's name, contact information, tax ID number, and any specific instructions or preferences for payroll processing.

Fill out your authorization - payroll services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authorization - Payroll Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.