Get the free LODGINGTAX EXAMPLES Austin - Americans for the Arts

Show details

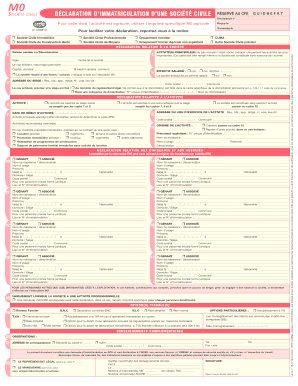

LODGING EXAMPLES Austin TITLE 11. TAXATION. CHAPTER 112. HOTEL OCCUPANCY TAX. CHAPTER 112. HOTEL OCCUPANCY TAX. ARTICLE 1. GENERAL PROVISIONS. 1121 Definitions 1122 Tax Levied; Exceptions 1123 Collection

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lodgingtax examples austin

Edit your lodgingtax examples austin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lodgingtax examples austin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lodgingtax examples austin online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lodgingtax examples austin. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lodgingtax examples austin

How to fill out lodgingtax examples austin:

01

Start by gathering all the necessary documents and information, such as income statements, expense receipts, and any other relevant financial records.

02

Use an online tax software or obtain a lodging tax form from the local tax authority in Austin.

03

Begin filling out the form by providing your personal details, including your name, address, and social security number.

04

Follow the instructions on the form to input your income from lodging or rentals in Austin. This may include rental income from properties you own or income earned from home-sharing platforms like Airbnb.

05

Deduct any eligible expenses related to your lodging activity, such as mortgage interest, property taxes, repairs, and maintenance costs. Ensure you have proper documentation to support your deductions.

06

Calculate your lodging tax owed by applying the applicable tax rate in Austin to your rental income after deducting eligible expenses.

07

Include any additional information or attachments required by the lodging tax form, such as schedules or supplemental forms.

08

Double-check all the information you have entered on the form to ensure accuracy. Incorrect or incomplete information could lead to delays or penalties.

09

Sign and date the lodging tax form, and submit it to the appropriate tax authority in Austin before the deadline.

10

Keep a copy of the completed lodging tax form and all supporting documents for your records.

Who needs lodgingtax examples austin:

01

Property owners in Austin who receive rental income from lodging activities, including individuals who own and rent out vacation homes, rental properties, or rooms through home-sharing platforms.

02

Individuals who earn income from short-term rentals in Austin, such as renting out a spare room in their primary residence.

03

Business owners operating hotels, motels, bed and breakfasts, or other lodging establishments in Austin.

Overall, anyone engaging in lodging activities in Austin and earning income from such activities may need lodging tax examples to understand how to accurately fill out their tax forms and comply with the local tax regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my lodgingtax examples austin in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your lodgingtax examples austin and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find lodgingtax examples austin?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific lodgingtax examples austin and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my lodgingtax examples austin in Gmail?

Create your eSignature using pdfFiller and then eSign your lodgingtax examples austin immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is lodgingtax examples austin?

The lodging tax examples in Austin typically refer to the tax imposed on short-term rentals such as hotels, motels, vacation rentals, and bed & breakfast establishments.

Who is required to file lodgingtax examples austin?

Any individual or business who owns or operates a lodging establishment in Austin and collects payment for lodging services is required to file lodging tax examples.

How to fill out lodgingtax examples austin?

To fill out lodging tax examples in Austin, you need to accurately report the total amount of lodging revenue collected during the reporting period and calculate the applicable tax rate.

What is the purpose of lodgingtax examples austin?

The purpose of lodging tax examples in Austin is to generate revenue to support tourism, cultural arts, historic preservation, and convention center facilities in the city.

What information must be reported on lodgingtax examples austin?

The information that must be reported on lodging tax examples in Austin includes the total amount of lodging revenue, the number of occupied room nights, and any exemptions or deductions claimed.

Fill out your lodgingtax examples austin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lodgingtax Examples Austin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.