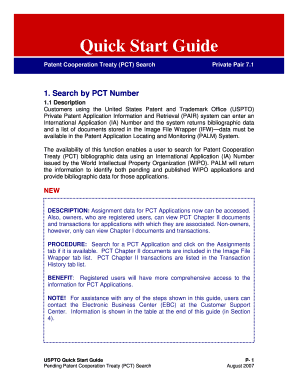

Get the free AR01 Annual return You may use this form to confirm that the company information is ...

Show details

AR01 2015 In accordance with Section 854 of the Companies Act 2006. Annual Return Go online to file this information www.gov.uk/companieshouse A fee is payable with this form Please see How to pay

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ar01 annual return you

Edit your ar01 annual return you form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ar01 annual return you form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ar01 annual return you online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ar01 annual return you. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ar01 annual return you

How to fill out ar01 annual return:

01

Obtain the necessary forms: Start by obtaining the ar01 annual return form from the relevant government or regulatory authority. You may be able to download it online or request a physical copy.

02

Provide company details: Begin by providing the necessary company details, such as the company's registered name, registered number, and registered office address. Ensure that this information is accurate and up to date.

03

Include share capital details: If the company has share capital, you will need to provide details regarding the number and class of shares issued by the company. This may include the nominal value of each share and the total value of share capital.

04

Declare director and secretary details: Provide the names and addresses of the company's directors and company secretary, if applicable. Also, mention the date when the director(s) or secretary was appointed, resigned, or changed.

05

Disclose shareholder details: Include the names and addresses of the company's shareholders, along with the number of shares held by each shareholder. This information is essential for maintaining an accurate record of the company's ownership structure.

06

Submit financial statements: Depending on the requirements of your jurisdiction, you may need to submit annual financial statements along with the ar01 annual return form. Ensure that the financial statements are prepared in accordance with the applicable accounting standards.

07

Sign and date the form: Once you have completed all the necessary information, ensure that the ar01 annual return form is signed and dated by an authorized person, such as a director or secretary of the company.

Who needs ar01 annual return:

01

Companies registered under the specific jurisdiction: The ar01 annual return is typically required for companies that are registered under a specific jurisdiction's laws and regulations. It helps maintain accurate company records and ensure compliance with regulatory requirements.

02

Directors and company secretaries: The responsibility of filling out and submitting the ar01 annual return often falls on the directors or company secretaries of the company. They must ensure that the information provided in the return is accurate and up to date.

03

Regulatory authorities and government agencies: The ar01 annual return is important for regulatory authorities and government agencies to monitor and oversee companies operating within their jurisdictions. It provides them with vital information about the company's structure, ownership, and financial status.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ar01 annual return you from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your ar01 annual return you into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send ar01 annual return you for eSignature?

When your ar01 annual return you is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the ar01 annual return you electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your ar01 annual return you and you'll be done in minutes.

What is ar01 annual return?

The AR01 annual return is a document that UK companies are required to file each year with Companies House.

Who is required to file ar01 annual return?

All UK registered companies, including public and private limited companies, must file an AR01 annual return.

How to fill out ar01 annual return?

AR01 annual return can be filled out online using the Companies House website or by completing a paper form and mailing it to Companies House.

What is the purpose of ar01 annual return?

The purpose of the AR01 annual return is to provide updated information about the company, such as details of directors, shareholders, and registered address.

What information must be reported on ar01 annual return?

The AR01 annual return must include details of the company's registered office address, directors, shareholders, share capital, and SIC code.

Fill out your ar01 annual return you online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ar01 Annual Return You is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.