Get the free Section A Beneficial owner - Australian Taxation Office - ato gov

Show details

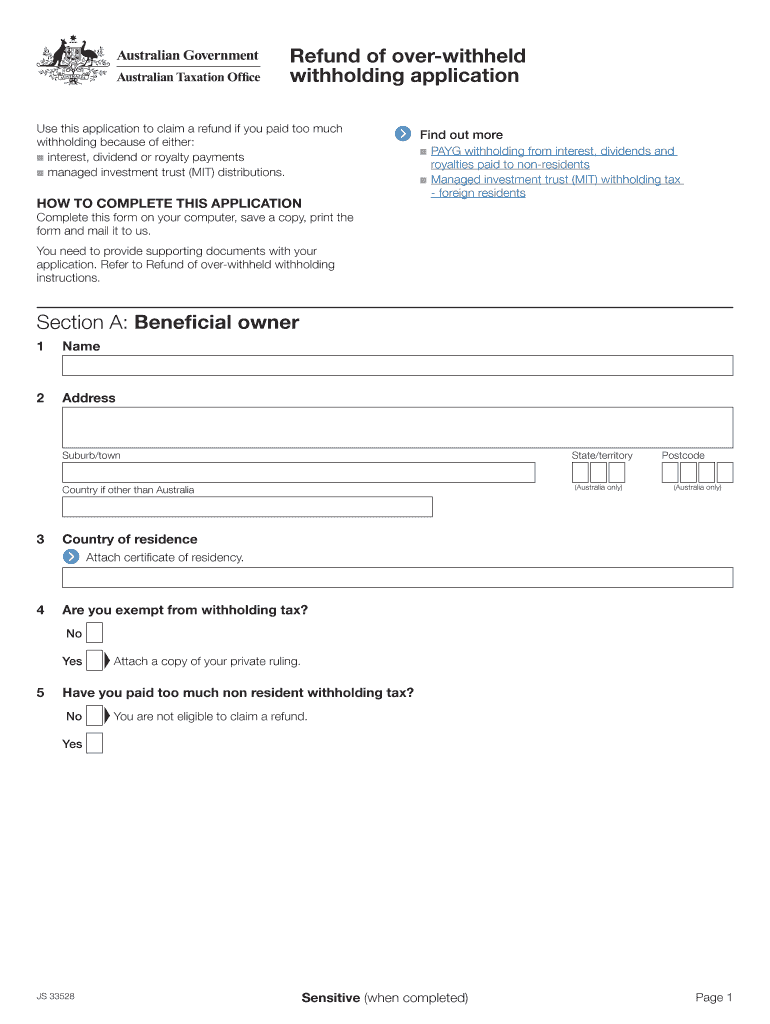

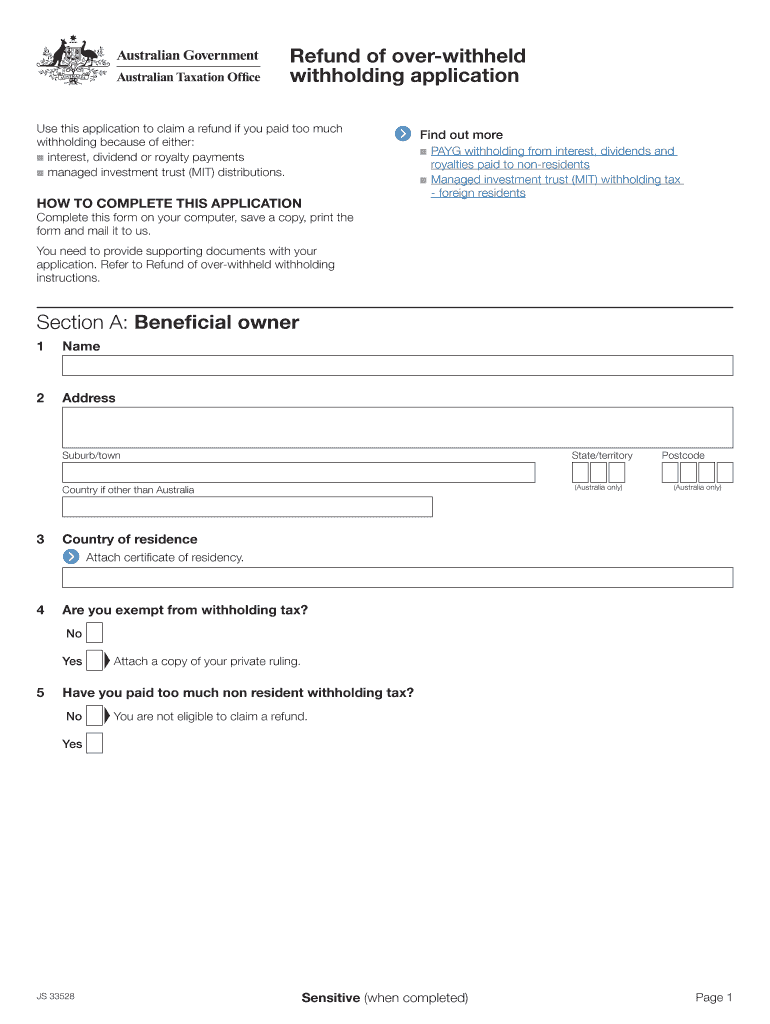

Refund of over withheld withholding application Use this application to claim a refund if you paid too much withholding because of either: n interest, dividend or royalty payments n managed investment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section a beneficial owner

Edit your section a beneficial owner form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section a beneficial owner form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section a beneficial owner online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit section a beneficial owner. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section a beneficial owner

How to fill out section a beneficial owner:

01

Start by providing your full legal name as the beneficial owner. Make sure to use your current and official name as it appears on your identification documents.

02

Next, include your complete residential or mailing address. This should be the address where you currently reside or receive important correspondence.

03

Specify your date of birth, including the day, month, and year. This information helps establish your identity and ensures accurate identification.

04

Indicate your citizenship or nationality. Provide the country in which you hold citizenship or have legal nationality.

05

Include your passport or identification number. This unique identifier is essential for verifying your identity and ensuring compliance with regulations.

06

Specify the percentage of ownership or control you have in the entity or organization for which this form is being filled. This percentage reflects your beneficial interest in the company or entity.

07

Finally, sign and date the section to certify that the information provided is accurate and complete. By signing, you acknowledge that you are the beneficial owner and take responsibility for the accuracy of the details provided.

Who needs section a beneficial owner?

01

Any individual who has a beneficial interest in an entity or organization may need to fill out section A. This includes individuals who have a significant ownership stake, hold controlling positions, or exercise substantial control over the entity's affairs.

02

Banks and financial institutions often require individuals to fill out section A when opening accounts or conducting certain financial transactions. This helps ensure compliance with anti-money laundering and know-your-customer regulations.

03

Corporate entities may also need section A filled by the beneficial owners of their shareholders or partners. This information is crucial for maintaining transparency and understanding the ownership structure of the entity.

In summary, anyone with a beneficial interest in an entity or organization should fill out section A as it captures important details about their identity, ownership, and control.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get section a beneficial owner?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific section a beneficial owner and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the section a beneficial owner in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your section a beneficial owner in minutes.

How do I fill out the section a beneficial owner form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign section a beneficial owner and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is section a beneficial owner?

Section A beneficial owner refers to the individual who ultimately owns or controls a legal entity, and whose information must be reported to regulatory authorities.

Who is required to file section a beneficial owner?

The legal entity is required to file section A beneficial owner by providing information about the individual who ultimately owns or controls the entity.

How to fill out section a beneficial owner?

Section A beneficial owner can be filled out by providing the required information about the individual, such as their name, address, nationality, and percentage of ownership or control.

What is the purpose of section a beneficial owner?

The purpose of section A beneficial owner is to increase transparency and prevent money laundering and terrorism financing by identifying the individuals who have significant control or ownership of legal entities.

What information must be reported on section a beneficial owner?

The information reported on section A beneficial owner typically includes the individual's name, address, nationality, date of birth, and details of their ownership or control of the legal entity.

Fill out your section a beneficial owner online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section A Beneficial Owner is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.