Get the free Petroleum resource rent tax PRRT deductible expenditure - ato gov

Show details

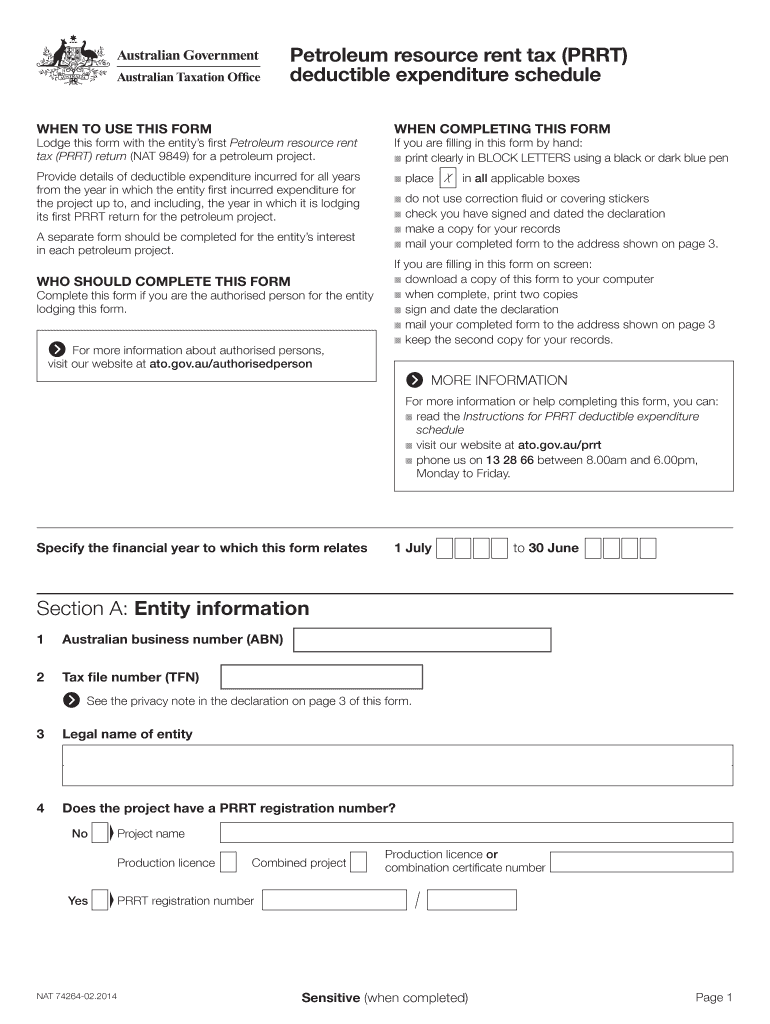

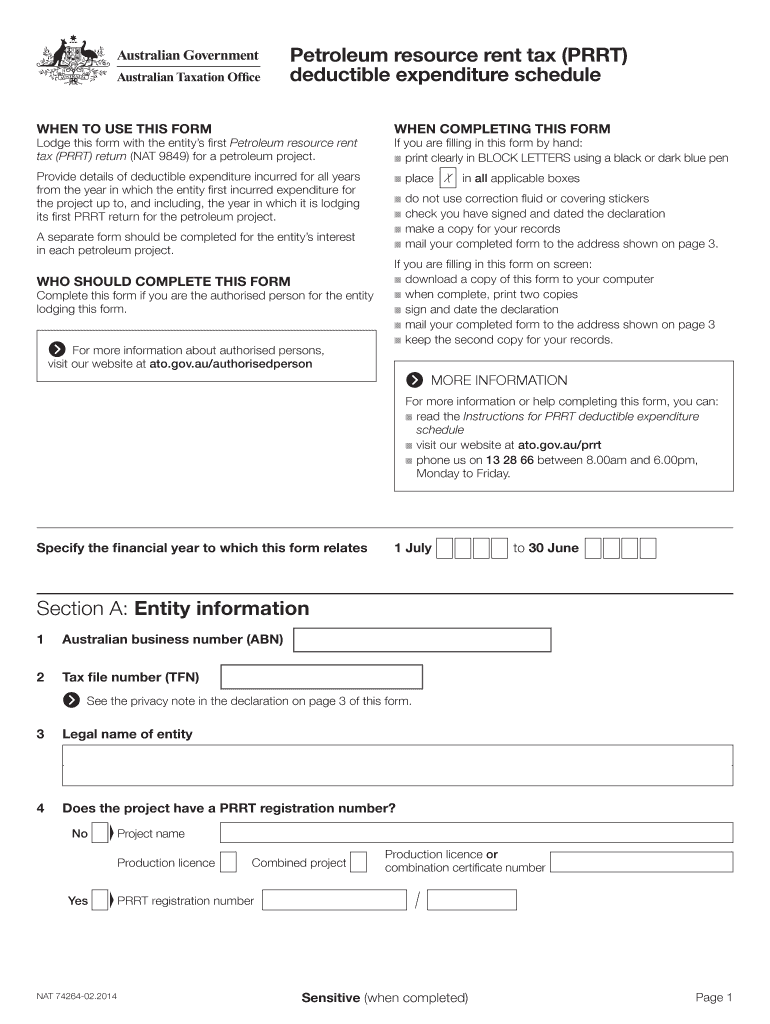

Petroleum resource rent tax (PART) deductible expenditure schedule WHEN TO USE THIS FORM WHEN COMPLETING THIS FORM Provide details of deductible expenditure incurred for all years from the year in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petroleum resource rent tax

Edit your petroleum resource rent tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petroleum resource rent tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petroleum resource rent tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit petroleum resource rent tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petroleum resource rent tax

How to fill out petroleum resource rent tax:

01

Gather all necessary documentation: Start by collecting all the relevant documents required for filling out the petroleum resource rent tax. This may include details about your petroleum production activities, records of sales, and any exploration or drilling costs incurred.

02

Understand the tax regulations: Familiarize yourself with the specific regulations and guidelines related to the petroleum resource rent tax. This will ensure that you comply with all the necessary reporting and payment obligations.

03

Calculate taxable petroleum profits: Determine the taxable petroleum profits by subtracting deductible expenses from your total gross revenue. Examples of deductible expenses may include exploration costs, drilling expenses, and any other necessary production expenditures.

04

Assess the applicable tax rate: Determine the appropriate tax rate based on your taxable petroleum profits. The petroleum resource rent tax rates may vary depending on the specific jurisdiction and legislation governing your operations.

05

Complete the relevant forms: Use the prescribed forms or online platforms to accurately report your petroleum resource rent tax. Provide all the requested information, such as your company details, revenue figures, deductible expenses, and calculated tax liability.

06

Make the tax payment: Ensure that you meet all the payment deadlines and remit the correct amount of tax owed. Follow the instructions provided by the tax authorities to make the payment through the designated channels.

Who needs petroleum resource rent tax:

01

Companies engaged in petroleum production: Petroleum resource rent tax is primarily applicable to companies involved in the extraction and production of petroleum resources. This includes oil companies, gas exploration companies, and other entities involved in petroleum-related activities.

02

Jurisdictions with petroleum reserves: The need for petroleum resource rent tax arises in jurisdictions that possess significant petroleum reserves. These governments levy the tax as a means to capture a portion of the economic rent earned by companies exploiting their natural resources.

03

Countries with specific tax legislation: Petroleum resource rent tax is required in countries that have enacted specific tax legislation to govern the extraction and production of petroleum. These laws establish the legal framework for reporting, assessing, and collecting the tax from eligible entities.

Note: The specifics of petroleum resource rent tax and its applicability may vary depending on the jurisdiction and legislation in place. It is advisable to consult with tax professionals or relevant authorities to ensure accurate compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit petroleum resource rent tax online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your petroleum resource rent tax to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete petroleum resource rent tax on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your petroleum resource rent tax. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Can I edit petroleum resource rent tax on an Android device?

You can make any changes to PDF files, such as petroleum resource rent tax, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is petroleum resource rent tax?

Petroleum resource rent tax is a tax imposed on the profits generated from the extraction of petroleum resources.

Who is required to file petroleum resource rent tax?

Companies or individuals who extract petroleum resources are required to file petroleum resource rent tax.

How to fill out petroleum resource rent tax?

To fill out petroleum resource rent tax, you need to report the profits generated from the extraction of petroleum resources.

What is the purpose of petroleum resource rent tax?

The purpose of petroleum resource rent tax is to ensure that those who benefit from the extraction of petroleum resources contribute a fair share of their profits to the government.

What information must be reported on petroleum resource rent tax?

Information such as profits generated from the extraction of petroleum resources, expenses related to extraction, and any deductions allowed by the tax laws must be reported on petroleum resource rent tax.

Fill out your petroleum resource rent tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petroleum Resource Rent Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.