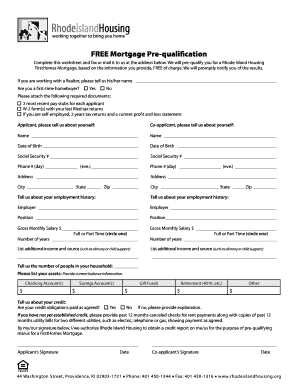

AR Malvern National Bank Mortgage Pre-Qualification Form 2014-2025 free printable template

Show details

Mortgage PreQualification Form Get started now! Just fill out this simple form to begin the prequalification process for your new home. For your convenience, you can drop it by any of our Tavern National

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mortgage pre qualification form

Edit your mortgage pre qualification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage pre qualification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage pre qualification form online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage pre qualification form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage pre qualification form

How to fill out AR Malvern National Bank Mortgage Pre-Qualification Form

01

Obtain the AR Malvern National Bank Mortgage Pre-Qualification Form from the bank's website or branch office.

02

Complete your personal information, including your name, address, and contact details.

03

Provide information about your employment status, including your employer's name and your job title.

04

Detail your financial information, including your monthly income and expenses.

05

Disclose any outstanding debts or loans, such as car loans or student loans.

06

Indicate the estimated purchase price of the home you wish to buy.

07

Sign and date the form to certify that the information provided is accurate.

Who needs AR Malvern National Bank Mortgage Pre-Qualification Form?

01

Individuals or families looking to buy a home who want to assess their eligibility for a mortgage.

02

First-time homebuyers seeking guidance on their financing options.

03

Real estate agents assisting clients in understanding their purchasing power.

04

Anyone wanting to streamline the mortgage application process by obtaining pre-qualification.

Fill

form

: Try Risk Free

People Also Ask about

Do lenders give pre-approval letters?

Lenders typically check your credit before issuing a preapproval letter, and the letter may have an expiration date on it (typically 30 to 60 days). For these reasons, many people wait to get a preapproval letter until they are ready to begin shopping seriously for a home.

Do I have to get pre-approved for a mortgage?

While preapproval is an optional step in the home financing process, it can be a practical necessity in highly competitive housing markets, especially if rival buyers are able to pay in cash. It's important to arrange mortgage preapproval only when you're serious about making an offer on a home.

What to ask a lender for pre-approval letter?

Important Questions You May Want to Ask During Your Mortgage Preapproval Process: What is the maximum purchase price I can qualify for? What will my monthly housing payment be at that price? How much should I be prepared to pay in total closing costs for this transaction?

How do I fill out a pre-qualification form?

Fill out the pre-qualification form Contact details such as your address and phone number. Your annual income and details about your employment. Other financial information, such as whether you have savings, retirement or investment accounts. Your desired loan amount and loan purpose.

How do I get a prequalification letter?

Get a prequalification or preapproval letter Decide when to get a preapproval letter. Find out what the lender's preapproval process is. Request a preapproval. Ask questions. Different lenders use the terms “prequalification” and “preapproval” differently.

Should the mortgage lender give you a pre-approval form?

Anyone can make an offer, pre-approval letter or no. But your offer is likely to be taken much more seriously by the seller and real estate agent if you have one. Indeed, the seller might accept a lower offer with a pre-approval letter than from someone with only a pre-qualification letter or no letter at all.

How long does it take to get a preapproval letter?

On average, it takes 7-10 days to get a pre-approval, although in some cases it may take less time. To speed up the home loan pre-approval time, you should gather your financial documents that the lender will require (e.g., W2s, proof of income, tax returns, etc.).

What information is needed for prequalification?

Pre-approval requires proof of employment, assets, income tax returns, and a qualifying credit score. Mortgage pre-approval letters are typically valid for 60 to 90 days. Upon pre-approval, the lender will provide the maximum loan amount, which helps set a price range for the home shopper.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mortgage pre qualification form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign mortgage pre qualification form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for signing my mortgage pre qualification form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your mortgage pre qualification form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit mortgage pre qualification form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing mortgage pre qualification form.

What is AR Malvern National Bank Mortgage Pre-Qualification Form?

The AR Malvern National Bank Mortgage Pre-Qualification Form is a document that potential homebuyers complete to assess their eligibility for a mortgage loan from Malvern National Bank.

Who is required to file AR Malvern National Bank Mortgage Pre-Qualification Form?

Individuals who are looking to secure a mortgage loan from Malvern National Bank are required to file the AR Malvern National Bank Mortgage Pre-Qualification Form.

How to fill out AR Malvern National Bank Mortgage Pre-Qualification Form?

To fill out the AR Malvern National Bank Mortgage Pre-Qualification Form, applicants should provide personal information, financial details, employment history, and information about the property they intend to purchase.

What is the purpose of AR Malvern National Bank Mortgage Pre-Qualification Form?

The purpose of the AR Malvern National Bank Mortgage Pre-Qualification Form is to help potential borrowers understand their borrowing capacity and get a preliminary assessment of their financial readiness for a mortgage.

What information must be reported on AR Malvern National Bank Mortgage Pre-Qualification Form?

The information that must be reported on the AR Malvern National Bank Mortgage Pre-Qualification Form includes personal identification details, income, debts, assets, employment information, and the desired loan amount.

Fill out your mortgage pre qualification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Pre Qualification Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.