Get the free Payroll Cost Transfer Request - research tamucc

Show details

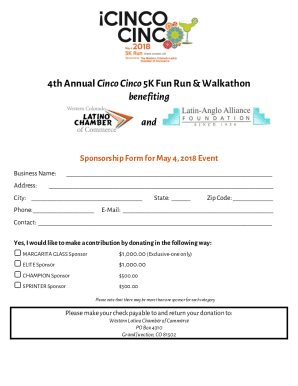

The Payroll Cost Transfer Request form is required for transferring past payroll expenses between sponsored project accounts. It includes questions about the expense origins, reasons for transfer,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll cost transfer request

Edit your payroll cost transfer request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll cost transfer request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll cost transfer request online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payroll cost transfer request. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll cost transfer request

How to fill out Payroll Cost Transfer Request

01

Gather necessary information, including employee details and cost centers.

02

Obtain the Payroll Cost Transfer Request form from the HR or payroll department.

03

Fill out the employee's name, ID, and department in the designated fields.

04

Specify the original cost center and the new cost center in the request.

05

Indicate the date of the transfer and the period it covers.

06

Provide a detailed explanation for the transfer in the comments section.

07

Attach any supporting documents if required.

08

Review the completed form for accuracy.

09

Submit the form to the HR or payroll department for approval.

Who needs Payroll Cost Transfer Request?

01

Employers who need to allocate payroll expenses to different departments.

02

Supervisors requesting adjustments for employee payroll allocations.

03

HR personnel managing employee payroll transfers for budgeting purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the cost transfer method?

A cost transfer is a transfer of charges within or between cost centers, internal orders, or WBS elements. Although costs should always be charged to the correct WBS cost object when they are incurred, cost transfers are sometimes needed (for example, to bill interdepartmental costs or adjust billing errors).

What is a labor cost transfer?

Definition. Labor cost transfers are defined as allocations of labor expense impacting sponsored project(s) after the effort certification period has closed. This procedure applies to all sponsored projects with both federal and non-federal awards.

What is an example of a cost transfer?

A researcher initially charges $1,000 of laboratory supplies to a sponsored research project. Later, it's determined that $200 of those supplies were used on another non-sponsored project. To correct this, a cost transfer would be initiated to move $200 of the expense total to a non-sponsored project.

What is the meaning of cost of transfer?

A cost transfer is when an expense is transferred from one account to another account after the expense was initially recorded in the financial accounting system or is an after-the-fact reallocation of expenses (e.g., P-card reallocations). Cost Transfers can be for salary or non-salary expenses.

What is an example of a cost transfer?

A researcher initially charges $1,000 of laboratory supplies to a sponsored research project. Later, it's determined that $200 of those supplies were used on another non-sponsored project. To correct this, a cost transfer would be initiated to move $200 of the expense total to a non-sponsored project.

What is a salary cost transfer?

A Salary Cost Transfer is the reassignment of a payroll expense from one chart string to another. Proactive salary planning and payroll management based on the anticipated projects and activities will reduce the volume of cost transfers, and are highly encouraged.

How does the organization ensure that all cost transfers are legitimate and appropriate?

The transfers must be supported by documentation that fully explains how the error occurred and a certification of the correctness of the new charge by a responsible organizational official of the recipient, consortium participant, or contractor.

What is included in the labor cost?

Labor cost is the total of wages, benefits, and payroll taxes paid to and for all employees. It's divided into two categories: direct and indirect labor costs. Direct labor costs are the wages paid to the employees that produce products or services. Indirect labor costs are costs that facilitate that production.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payroll Cost Transfer Request?

A Payroll Cost Transfer Request is a formal document used to reallocate payroll expenses from one budget account to another within an organization.

Who is required to file Payroll Cost Transfer Request?

Typically, department heads or managers are required to file Payroll Cost Transfer Requests when they need to adjust payroll allocations for their staff.

How to fill out Payroll Cost Transfer Request?

To fill out a Payroll Cost Transfer Request, include details such as the employee's name, the original budget code, the new budget code, the amount being transferred, and the reason for the transfer.

What is the purpose of Payroll Cost Transfer Request?

The purpose of a Payroll Cost Transfer Request is to ensure accurate budget management and accounting by allowing organizations to correct or modify payroll allocations as necessary.

What information must be reported on Payroll Cost Transfer Request?

The information that must be reported includes the employee's name, employee ID, original and new budget codes, amount to be transferred, reason for transfer, and the approval signatures.

Fill out your payroll cost transfer request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Cost Transfer Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.