Get the free PETTY CASH REIMBURSEMENT

Show details

This document outlines the policies and procedures for petty cash reimbursements at the university, including acceptable purchases, approval requirements, and documentation needed.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petty cash reimbursement

Edit your petty cash reimbursement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petty cash reimbursement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing petty cash reimbursement online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit petty cash reimbursement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petty cash reimbursement

How to fill out PETTY CASH REIMBURSEMENT

01

Gather all receipts and documentation for expenses paid out of petty cash.

02

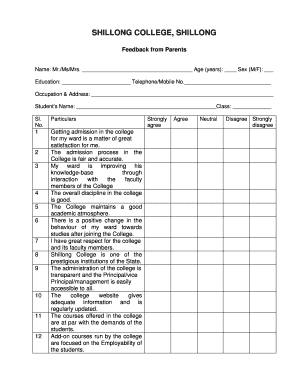

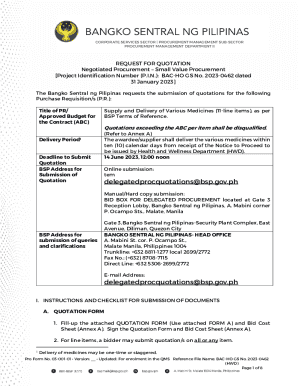

Obtain a Petty Cash Reimbursement Form from the finance department or relevant office.

03

Fill out your personal information on the form, including your name, department, and date.

04

List each expense in the provided sections, including the date, amount, and a brief description of the expense.

05

Attach all receipts to the form, ensuring they are organized and clearly visible.

06

Calculate the total amount being requested for reimbursement.

07

Sign and date the form to certify its accuracy.

08

Submit the completed form along with the receipts to the designated approver for review.

09

Follow up with the finance department to ensure the reimbursement is processed.

Who needs PETTY CASH REIMBURSEMENT?

01

Employees who have incurred expenses on behalf of the company and have used petty cash to cover those costs.

02

Departments that routinely manage small expenses and require reimbursement for operational costs.

03

Anyone responsible for handling petty cash and requires reimbursement to maintain cash flow.

Fill

form

: Try Risk Free

People Also Ask about

What is a cash reimbursement?

Reimbursement is when a business pays back an employee, client, or other people for money they spent out of their pocket or for overpaid money. Some examples are getting money back for business costs, insurance premiums, and overpaid taxes.

What is petty cash disbursement?

PETTY CASH DISBURSEMENT PROCEDURES. Petty Cash is a method of facilitating payment of small amounts of the purchase of minor office supplies items and small expenses payments such as carfares. This method of payment is used when it is impractical to have a check written.

What is considered a reimbursement?

Reimbursable expenses are costs that employees incur on behalf of their employer while performing work-related tasks, which the employer agrees to pay back. These expenses typically include travel, meals, lodging, and other business-related costs, as outlined in the company's expense policy.

What do you mean by reimbursement of money?

A reimbursement is a money that an organization or business gives back to an employee for any out-of-pocket costs they had to pay or any overpayments made by a client or other entity that the organization or business works with.

Is a reimbursement the same as a refund?

If your business issues a refund to a customer, you should also cancel the related invoice with a credit note. Reimbursement is the act of giving someone money if they've purchased something on your behalf, so they're not out of pocket for the amount they have spent.

How do you record reimbursement of petty cash?

1. How do you record the reimbursement of the petty cash fund? Begin by recording the total amount of cash from the petty cash fund. Record the individual transactions that make up the total amount. Once all transactions are recorded, the petty cash fund should be replenished with the total amount taken out.

What is cash reimbursement?

Reimbursement is when a business pays back an employee, client, vendor, customer or other people for money they spent out of their pocket or for overpaid money.

What is a petty cash reimbursement?

A petty cash reimbursement form may be used to replenish a petty cash fund, or reimburse a department or employee, who paid out-of-pocket for an unplanned departmental purchase. Approval from the department manager is needed prior to the purchase.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PETTY CASH REIMBURSEMENT?

Petty cash reimbursement is the process by which employees are reimbursed for small expenditures made for business purposes using petty cash funds.

Who is required to file PETTY CASH REIMBURSEMENT?

Employees who have made purchases or incurred costs on behalf of the organization using petty cash are required to file for petty cash reimbursement.

How to fill out PETTY CASH REIMBURSEMENT?

To fill out a petty cash reimbursement form, include details such as the date of the expenditure, the amount spent, the purpose of the expense, and any supporting receipts or documentation.

What is the purpose of PETTY CASH REIMBURSEMENT?

The purpose of petty cash reimbursement is to ensure that employees are reimbursed for minor expenses incurred for business operations, maintaining proper financial records.

What information must be reported on PETTY CASH REIMBURSEMENT?

The information that must be reported includes the date of the expense, the total amount being reimbursed, the reason for the expense, receipts or documentation, and the signature of the employee requesting reimbursement.

Fill out your petty cash reimbursement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petty Cash Reimbursement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.