Get the free New Incentives for Small Businesse Edited.docx

Show details

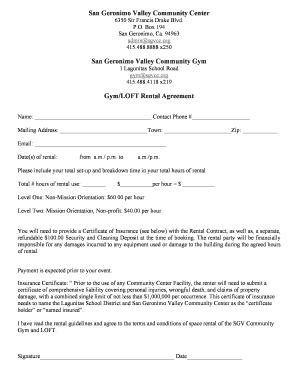

INCENTIVES FOR SMALL BUSINESSES CITY OF LONG BEACH INCENTIVE TO RELOCATE OR EXPAND A SMALL BUSINESS Approximately $$350520. Qualification: A small business who relocates from outside of Long Beach

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new incentives for small

Edit your new incentives for small form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new incentives for small form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new incentives for small online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit new incentives for small. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new incentives for small

How to fill out new incentives for small:

01

Research and understand the available incentives: Begin by conducting thorough research to identify the various incentives available for small businesses. This may include tax breaks, grants, subsidies, and loan programs. Familiarize yourself with the eligibility criteria, application process, and any supporting documents required for each incentive.

02

Assess your specific needs and goals: Consider the specific needs and goals of your small business. Determine which incentives align with your objectives and can provide the most value. For example, if you aim to expand your workforce, focus on incentives that offer hiring incentives or training grants.

03

Gather the necessary documentation: Review the application requirements for each incentive and gather the necessary documentation. This may include financial statements, business plans, tax returns, and proof of eligibility. Ensure that all documentation is accurate, up-to-date, and presented in the required format.

04

Complete the application forms: Carefully fill out the application forms for each selected incentive. Pay attention to details, provide accurate information, and answer all questions thoroughly. Double-check your answers before submission to minimize errors and improve your chances of approval.

05

Seek professional advice if needed: If you find the application process complex or overwhelming, consider seeking professional advice. Consult with accountants, business advisors, or legal experts who have experience in navigating incentive programs. Their expertise can help ensure that you maximize your chances of successfully obtaining the incentives.

Who needs new incentives for small?

01

Small businesses looking for financial support: Small businesses that require financial assistance to start, expand, or sustain their operations can greatly benefit from new incentives. These incentives can provide the necessary funds to invest in equipment, hire more staff, or explore new markets.

02

Entrepreneurs and startups: New startups and entrepreneurs often face challenges in securing sufficient funding to launch their ventures. New incentives for small can act as a catalyst, enabling them to bring their ideas to life and thrive in competitive markets.

03

Businesses seeking to invest in innovation and research: Incentives specifically designed to promote innovation and research can attract businesses that want to invest in developing new products, technologies, or processes. These incentives can stimulate growth, generate employment, and enhance competitiveness in the market.

04

Local communities and economies: New incentives for small can have a positive impact on local communities and economies. By supporting small businesses, these incentives can create job opportunities, foster entrepreneurship, and contribute to economic growth at the grassroots level.

In conclusion, filling out new incentives for small requires thorough research, understanding of needs, gathering necessary documentation, completing application forms accurately, and seeking professional advice if necessary. Small businesses, entrepreneurs, businesses investing in innovation, and local communities can benefit from these incentives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new incentives for small?

New incentives for small are government programs or benefits aimed at supporting small businesses by providing financial assistance or tax breaks.

Who is required to file new incentives for small?

Small business owners or entrepreneurs who meet the eligibility criteria set by the government are required to file for new incentives for small.

How to fill out new incentives for small?

To fill out new incentives for small, small business owners need to complete the application form provided by the government and provide all necessary information and supporting documents.

What is the purpose of new incentives for small?

The purpose of new incentives for small is to help small businesses grow, create jobs, and stimulate economic development.

What information must be reported on new incentives for small?

The information that must be reported on new incentives for small includes details about the business, its financial situation, the requested incentives, and how the incentives will be used.

How can I modify new incentives for small without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including new incentives for small, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find new incentives for small?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the new incentives for small in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out new incentives for small on an Android device?

Complete new incentives for small and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your new incentives for small online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Incentives For Small is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.