Get the free BTR BUSINESS TAX RECEIPT APPLICATION

Show details

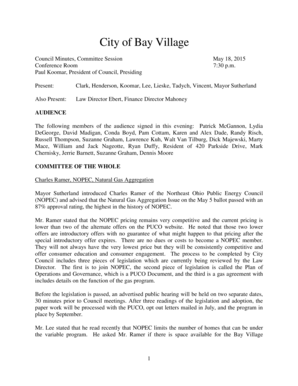

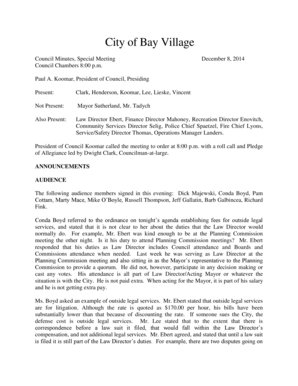

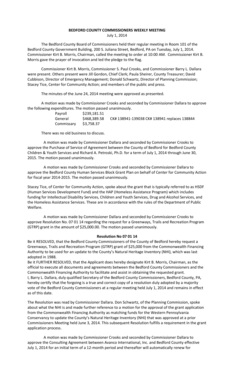

THE VILLAGE OF NORTH PALM BEACH COMMUNITY DEVELOPMENT DEPARTMENT 420 U.S. HWY 1 SUITE 21 NORTH PALM Beaches, FLORIDA 33408 PHONE 561.841.3365 FAX 561.841.8242 WWW.VILLAGE.ORG BTR #: BUSINESS TAX RECEIPT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign btr business tax receipt

Edit your btr business tax receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your btr business tax receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit btr business tax receipt online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit btr business tax receipt. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out btr business tax receipt

How to Fill Out BTR Business Tax Receipt:

01

Begin by gathering all the necessary information and documents required to fill out the BTR business tax receipt. This may include details about your business, such as its name, address, owner information, and the nature of the business activities.

02

Once you have all the required information, you can often download the BTR application form from your local government website or obtain a physical copy from the appropriate department or agency. Make sure you have the correct version of the form for the current year.

03

Start by filling out the basic business information section on the form. This typically includes the legal name, trade name (if applicable), address, contact details, and the start date of your business. Provide accurate and up-to-date information to avoid any delays or complications in the process.

04

Next, you may need to provide additional details about your business activities or classifications. This could include selecting the appropriate business category or industry from a provided list, specifying if you engage in any special activities that require separate permits or licenses, or providing specific details related to your business operations.

05

Certain localities may require you to provide information regarding the number of employees, square footage of your facility, or other relevant details. Make sure to provide accurate and honest answers to these questions.

06

After completing all the required sections, review the form thoroughly to ensure all the information provided is correct and complete. Double-check for any errors or missing information that may cause delays or complications.

07

Once you are satisfied with the accuracy and completeness of the form, sign and date it as required by your local government. In some cases, you may also need a witness or notary public to authenticate the form.

Who Needs BTR Business Tax Receipt:

01

Business Owners: Any individual or entity engaged in business activities within a particular jurisdiction may need a BTR business tax receipt. This includes self-employed individuals, partnerships, corporations, or any other legal entity operating a business.

02

Local Regulations: The requirement of a BTR business tax receipt is usually mandated by local regulations, such as city or county ordinances. It aims to ensure businesses comply with relevant laws, zoning regulations, and licensing requirements while generating revenue for the local government.

03

Specific Industries: Depending on the jurisdiction, certain industries or types of businesses may have specific requirements for obtaining a BTR business tax receipt. These industries could range from food establishments, entertainment venues, professional services, construction companies, or home-based businesses.

04

Compliance with Tax Laws: Acquiring a BTR business tax receipt is often necessary for businesses to demonstrate compliance with local tax laws. It helps track taxable business activities and ensures the proper payment of applicable taxes, such as sales tax, use tax, or other local levies.

05

Potential Consequences: Failure to obtain or renew a BTR business tax receipt when required can result in various consequences, including fines, penalties, legal actions, or even closure of the business. It is essential to understand and adhere to the local regulations to maintain your business's legality and operate without any issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is btr business tax receipt?

A BTR (Business Tax Receipt) is a type of license or permit that allows a business to operate within a specific jurisdiction.

Who is required to file btr business tax receipt?

Any individual or business operating within a specific jurisdiction is required to file for a BTR (Business Tax Receipt).

How to fill out btr business tax receipt?

To fill out a BTR (Business Tax Receipt), you will need to provide information about your business including business name, address, type of business, and estimated gross revenue.

What is the purpose of btr business tax receipt?

The purpose of a BTR (Business Tax Receipt) is to ensure that businesses are operating legally within a specific jurisdiction and to generate revenue for the local government.

What information must be reported on btr business tax receipt?

Information that must be reported on a BTR (Business Tax Receipt) includes business name, address, type of business, and estimated gross revenue.

How do I modify my btr business tax receipt in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your btr business tax receipt and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get btr business tax receipt?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the btr business tax receipt in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I fill out btr business tax receipt on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your btr business tax receipt. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your btr business tax receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Btr Business Tax Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.