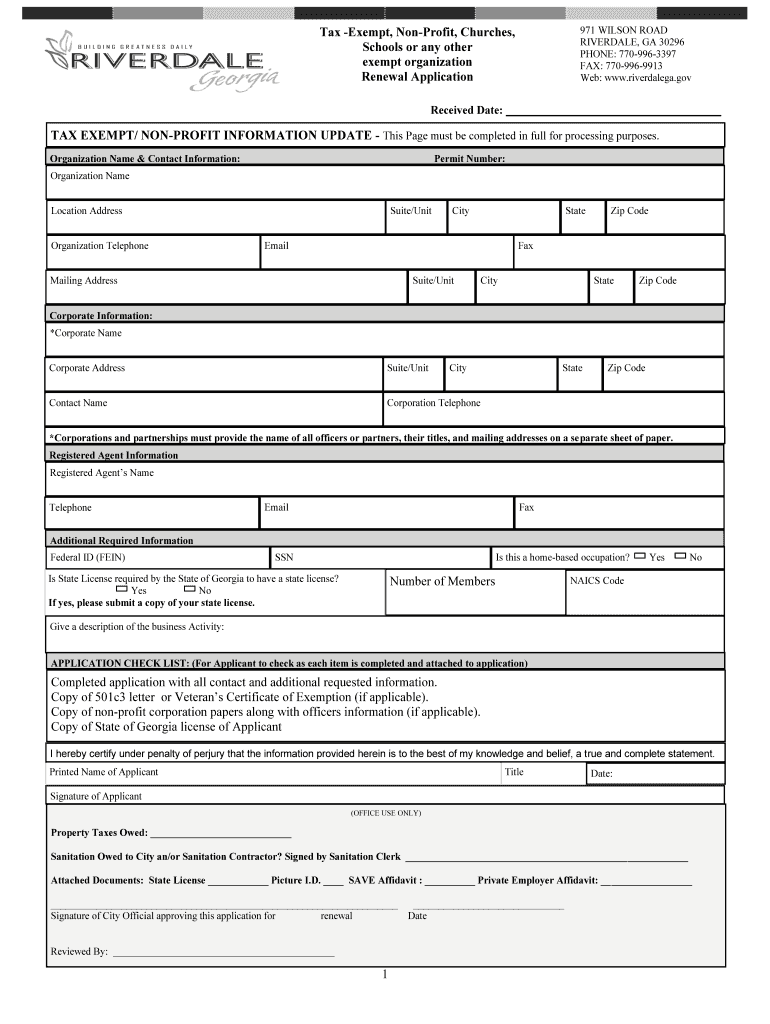

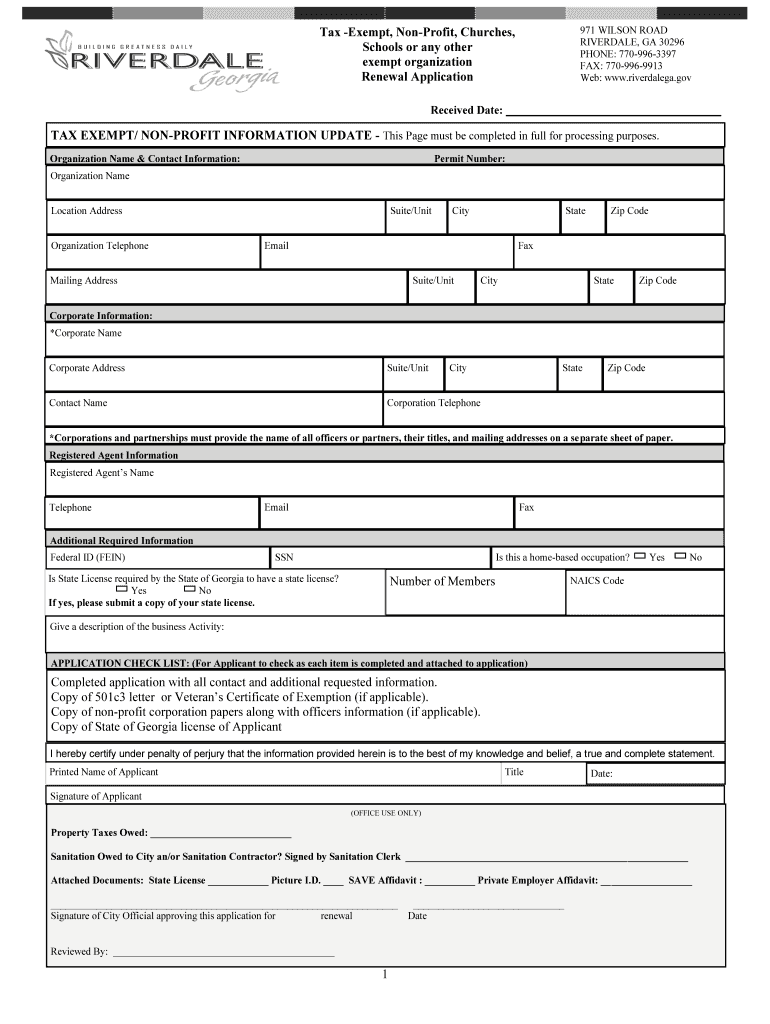

Get the free TAX EXEMPT NON-PROFIT INFORMATION UPDATE - This Page must

Show details

971 WILSON ROAD RIVERDALE, GA 30296 PHONE: 7709963397 FAX: 7709969913 Web: www.riverdalega.gov Tax Exempt, Nonprofit, Churches, Schools or any other exempt organization Renewal Application Received

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax exempt non-profit information

Edit your tax exempt non-profit information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt non-profit information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax exempt non-profit information online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax exempt non-profit information. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax exempt non-profit information

How to fill out tax exempt non-profit information:

01

Gather all necessary documents: Before filling out the tax exempt non-profit information, make sure you have all the required documents in hand. This may include your organization's Articles of Incorporation, bylaws, financial statements, and any other relevant paperwork.

02

Complete the Form 1023: The Form 1023 is the application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. Fill out each section carefully, providing accurate information about your non-profit organization, its activities, governance structure, and financial details.

03

Provide supporting documentation: Along with the Form 1023, you will need to submit various supporting documents. This may include your organization's mission statement, financial projections, budgets, and fundraising plans. Ensure that all supporting documents are organized and clearly labeled.

04

Review and double-check: After completing the form and gathering all the necessary documentation, review everything thoroughly. Take the time to ensure that all information provided is accurate and consistent. Pay close attention to details to avoid any mistakes or omissions.

05

Submit the application: Once you are confident that the tax exempt non-profit information is accurate and complete, it's time to submit the application. Follow the instructions provided by the IRS and submit the Form 1023 along with all the supporting documents. Keep a copy of everything for your records.

Who needs tax exempt non-profit information?

01

Non-profit organizations seeking tax-exempt status: Any non-profit organization that wants to be recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code needs to provide tax exempt non-profit information. This includes charitable, religious, educational, scientific, and other organizations dedicated to specific public or community services.

02

Non-profit organizations undergoing changes: If your non-profit organization has experienced significant changes in its structure, activities, or financial operations, you may need to update your tax exempt non-profit information. This ensures that your organization stays in compliance with IRS requirements and maintains its tax-exempt status.

03

Government agencies, donors, and auditors: Tax exempt non-profit information may be required by government agencies, donors, or auditors to verify your organization's eligibility for tax benefits, grants, and funding. Providing accurate and up-to-date tax exempt non-profit information helps build trust and credibility with these stakeholders.

Overall, accurately filling out tax exempt non-profit information is crucial for organizations seeking tax-exempt status and maintaining compliance with IRS regulations. It ensures transparency and accountability while helping organizations access various tax benefits and funding opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax exempt non-profit information?

With pdfFiller, the editing process is straightforward. Open your tax exempt non-profit information in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the tax exempt non-profit information electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your tax exempt non-profit information in seconds.

How do I fill out the tax exempt non-profit information form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign tax exempt non-profit information and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is tax exempt non-profit information?

Tax-exempt non-profit information refers to the financial and operational details of organizations that are exempt from paying certain taxes due to their non-profit status.

Who is required to file tax exempt non-profit information?

Non-profit organizations that have tax-exempt status granted by the IRS are required to file tax-exempt non-profit information.

How to fill out tax exempt non-profit information?

Tax-exempt non-profit information can be filled out by using the appropriate IRS forms and providing detailed financial and operational data about the organization.

What is the purpose of tax exempt non-profit information?

The purpose of tax-exempt non-profit information is to provide transparency and accountability regarding the finances and activities of tax-exempt organizations.

What information must be reported on tax exempt non-profit information?

Tax-exempt non-profit information must include details on the organization's revenue, expenses, assets, liabilities, activities, and compliance with IRS regulations.

Fill out your tax exempt non-profit information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exempt Non-Profit Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.