Get the free GENERAL LIABILITY LOSS CLAIM FORM - Cloquet

Show details

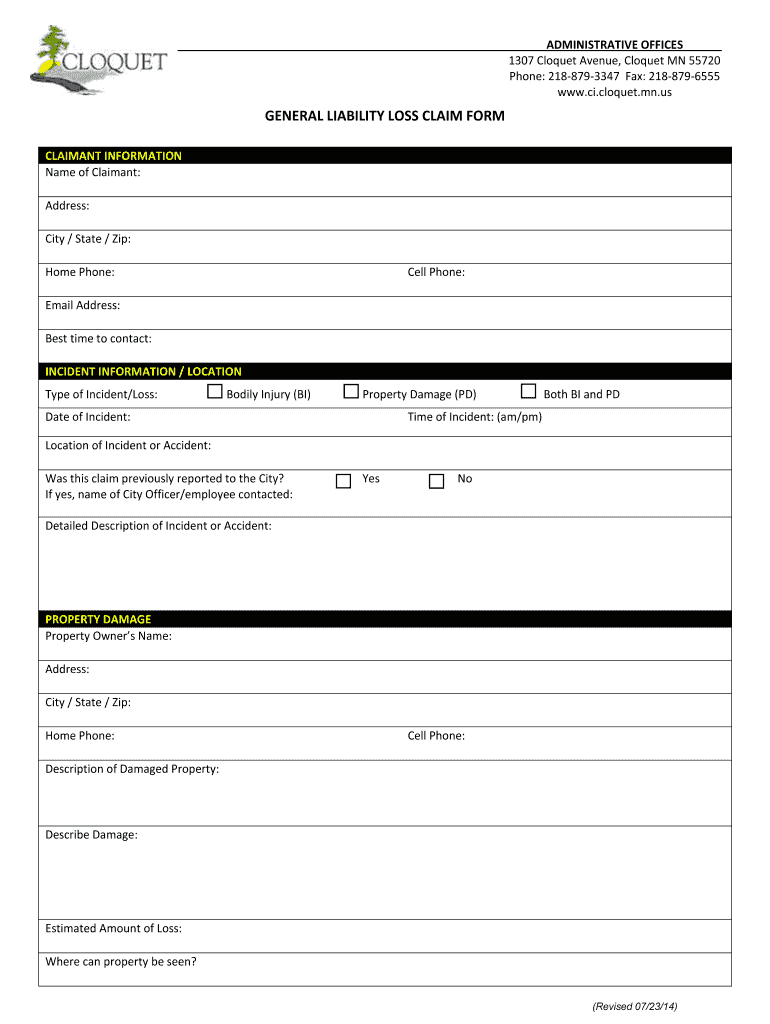

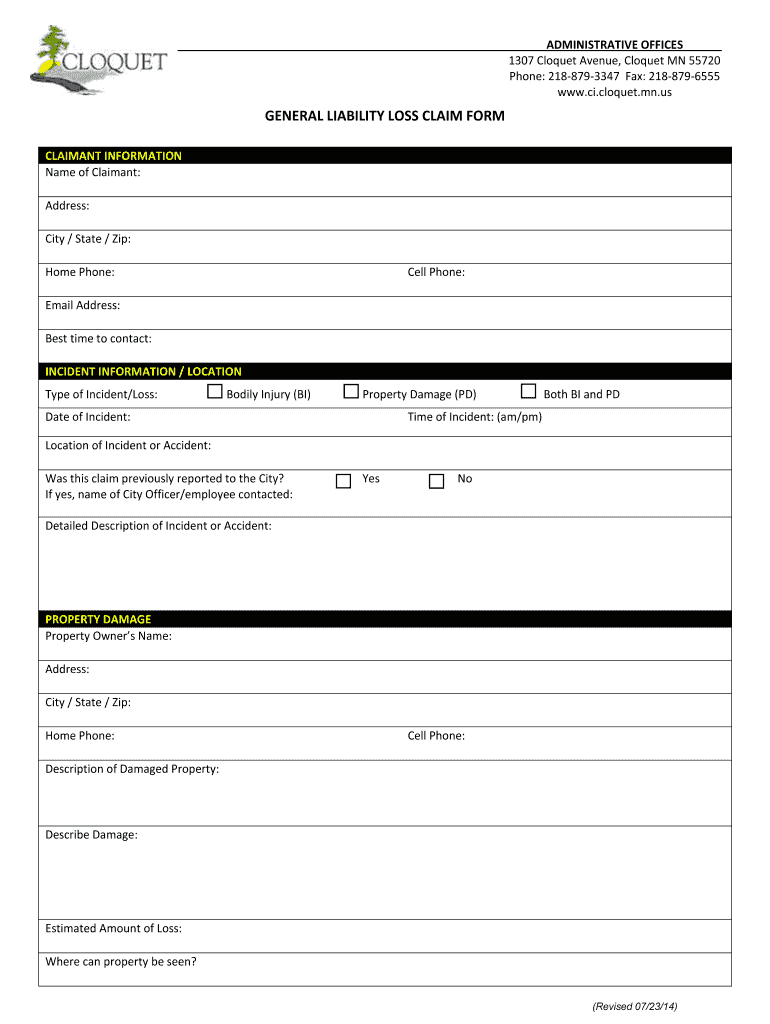

ADMINISTRATIVE OFFICES 1307 Croquet Avenue, Croquet MN 55720 Phone: 2188793347 Fax: 2188796555 www.ci.cloquet.mn.us GENERAL LIABILITY LOSS CLAIM FORM CLAIMANT INFORMATION Name of Claimant: Address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general liability loss claim

Edit your general liability loss claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general liability loss claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing general liability loss claim online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit general liability loss claim. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out general liability loss claim

How to fill out a general liability loss claim:

01

Gather all relevant information: Before filling out the general liability loss claim, make sure you have all the necessary information. This can include details about the incident, such as the date, time, and location, as well as any witnesses or parties involved.

02

Provide accurate and detailed descriptions: When filling out the claim, it is essential to provide accurate and detailed descriptions of the incident. Include specific information about what happened, how it occurred, and any damages or injuries that resulted.

03

Attach supporting documentation: To support your claim, attach any relevant documents, such as photographs of damages, medical reports, or witness statements. This additional evidence can strengthen your case and provide a clearer picture of the incident.

04

Contact your insurance provider: It is crucial to notify your insurance provider immediately after an incident occurs. They will guide you through the claim process, providing you with the necessary forms and instructions to complete them accurately.

05

Follow the instructions provided: Carefully read through all instructions and guidelines outlined by your insurance provider. Ensure you understand the required information and any specific documentation they may require. This will help prevent any delays or additional requests for information during the claims process.

Who needs general liability loss claim?

01

Business owners: General liability loss claims are commonly used by business owners to report incidents or accidents that occur on their premises. Whether it's a slip and fall accident or property damage caused by negligence, business owners need to file a general liability loss claim to protect themselves and their businesses.

02

Individuals involved in accidents: If you have suffered injuries or damages due to someone else's negligence or actions, you may need to file a general liability loss claim. This can include situations such as car accidents, product defects, or injuries sustained on someone else's property.

03

Contractors and professionals: Contractors or professionals who provide services to clients may also need to file general liability loss claims. If they are accused of causing property damage or bodily harm while performing their duties, a claim can help protect their interests and cover any potential liability.

In summary, anyone who has experienced property damage, injuries, or losses due to someone else's actions or negligence may need to fill out a general liability loss claim. It is essential to follow the appropriate procedures and provide accurate information to ensure a smooth claims process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find general liability loss claim?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific general liability loss claim and other forms. Find the template you need and change it using powerful tools.

How do I complete general liability loss claim online?

pdfFiller has made it easy to fill out and sign general liability loss claim. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit general liability loss claim on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing general liability loss claim, you can start right away.

What is general liability loss claim?

General liability loss claim is a formal request made to an insurance company for compensation for a loss or damages covered under a general liability insurance policy.

Who is required to file general liability loss claim?

Any individual or business that has suffered a loss or damages covered under their general liability insurance policy is required to file a general liability loss claim.

How to fill out general liability loss claim?

General liability loss claim can be filled out by providing detailed information about the loss or damages, including the date, time, location, and nature of the incident, as well as any supporting documentation such as photographs or witness statements.

What is the purpose of general liability loss claim?

The purpose of general liability loss claim is to request compensation from an insurance company for a covered loss or damages that have occurred.

What information must be reported on general liability loss claim?

The information that must be reported on a general liability loss claim includes details about the incident, such as the date, time, location, and nature of the loss or damages, as well as any supporting documentation.

Fill out your general liability loss claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Liability Loss Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.