Get the free US Charitable Gift Trust Scholarship - rrcnetorg

Show details

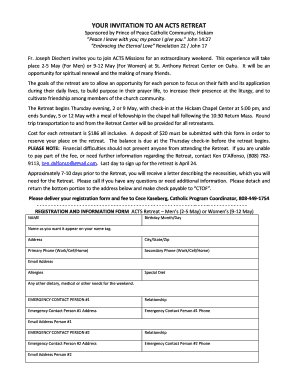

U.S. Charitable Gift Trust Scholarship 1. Must be a Red Rock Central graduate or graduating senior 2. Must be pursuing a degree in education Preference will be given to elementary education, but education

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us charitable gift trust

Edit your us charitable gift trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us charitable gift trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit us charitable gift trust online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit us charitable gift trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us charitable gift trust

How to fill out a US charitable gift trust?

01

Research and select a reputable charitable organization: Start by identifying a charitable organization that aligns with your philanthropic goals and values. Research their mission, reputation, and financial stability. It's important to ensure that the organization is eligible to receive tax-deductible contributions.

02

Contact the charitable organization: Reach out to the organization directly to inquire about their charitable gift trust program. They will provide you with the necessary information and paperwork to start the process.

03

Understand and gather the required documentation: Familiarize yourself with the specific documentation needed to establish a charitable gift trust. This may include personal identification documents, financial statements, and any legal contracts or agreements that need to be signed.

04

Consult a professional advisor: Before proceeding with the charitable gift trust, it's always advisable to seek advice from a qualified professional, such as an attorney or financial advisor. They can provide guidance on the implications, benefits, and legal considerations of setting up a charitable gift trust.

05

Complete the trust documents: Work closely with your professional advisor or use the provided paperwork to complete all necessary trust documents accurately and thoroughly. This will typically involve outlining the trust's purpose, designating beneficiaries, and specifying the distribution rules.

06

Fund the trust: Decide on the assets or funds you wish to contribute to the charitable gift trust. It can be cash, stocks, real estate, or other valuable assets. Follow the instructions provided by the charitable organization regarding how to transfer or contribute these assets.

07

Review and finalize the trust: Carefully review all the completed trust documents, ensuring that they accurately reflect your intentions and comply with legal requirements. Make any necessary revisions or amendments before finalizing the trust.

08

Distribute income or assets to charitable beneficiaries: Once the charitable gift trust is established and funded, the income or assets can be distributed to the designated charitable beneficiaries according to the trust's terms and conditions. Follow the trust's guidelines for making distributions, whether it's periodic payments, lump-sum grants, or other specified arrangements.

Who needs a US charitable gift trust?

01

Individuals or families with philanthropic goals: Those who have a genuine desire to contribute to charitable causes and make a lasting impact often consider establishing a charitable gift trust. It allows them to contribute to organizations they care about while potentially enjoying tax benefits.

02

High-net-worth individuals seeking tax advantages: Charitable gift trusts can offer significant tax benefits, especially for individuals with a high net worth. By donating appreciated assets to a trust, such as stocks or real estate, individuals may receive a considerable income tax deduction while potentially minimizing capital gains tax.

03

Estate planning purposes: Charitable gift trusts can also form part of a comprehensive estate plan. Individuals or families looking to leave a philanthropic legacy or minimize estate taxes may utilize a charitable gift trust as a tool to achieve these objectives.

Overall, anyone who wishes to support charitable organizations, optimize their tax situation, and plan their estate strategically may benefit from a US charitable gift trust. However, it's crucial to consult with professionals to determine if this option aligns with your specific financial and charitable objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is us charitable gift trust?

A US charitable gift trust is a legal entity that allows individuals to make donations to a charitable organization while receiving tax benefits.

Who is required to file us charitable gift trust?

Individuals or organizations that have set up a charitable gift trust are required to file it with the IRS.

How to fill out us charitable gift trust?

To fill out a US charitable gift trust, one must provide details about the trust, including information about the charitable organization, the assets being donated, and the beneficiaries.

What is the purpose of us charitable gift trust?

The purpose of a US charitable gift trust is to allow individuals to donate assets to a charitable organization in a tax-efficient manner.

What information must be reported on us charitable gift trust?

Information such as the name of the charitable organization, the assets donated, the beneficiaries, and any income generated by the trust must be reported on the US charitable gift trust.

How do I modify my us charitable gift trust in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your us charitable gift trust along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find us charitable gift trust?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the us charitable gift trust in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the us charitable gift trust form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign us charitable gift trust. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your us charitable gift trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Charitable Gift Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.