Get the free 2013 – 2014 FINANCIAL AID ADDENDUM - tulane

Show details

This document is for Tulane Medical School students to apply for financial aid and includes instructions for submitting the form, eligibility for various loan programs, and personal financial data

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 2014 financial aid

Edit your 2013 2014 financial aid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 2014 financial aid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 2014 financial aid online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2013 2014 financial aid. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 2014 financial aid

How to fill out 2013 – 2014 FINANCIAL AID ADDENDUM

01

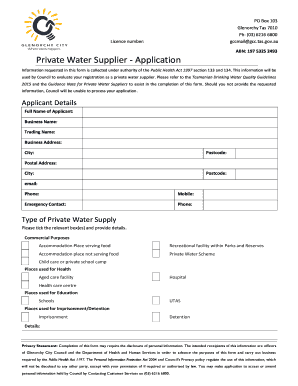

Obtain the 2013 – 2014 FINANCIAL AID ADDENDUM form from the financial aid office or website.

02

Read the instructions carefully to understand what information is required.

03

Gather all necessary financial documents, including tax returns, W-2s, and any other relevant income statements.

04

Fill in the student’s personal information at the top of the form, including name, address, and student ID.

05

Provide details about the family’s financial situation, including income from all sources and other financial aid received.

06

Answer any additional questions required on the form that pertain to special circumstances.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form to certify that the information provided is accurate.

09

Submit the completed FINANCIAL AID ADDENDUM to the financial aid office by the specified deadline.

Who needs 2013 – 2014 FINANCIAL AID ADDENDUM?

01

Students who are seeking financial aid for the 2013 – 2014 academic year may need to fill out the addendum if their financial circumstances have changed since their FAFSA was submitted.

02

Students who have special circumstances not reflected in the standard financial aid application which could affect their eligibility for aid.

03

Parents or guardians of students who are required to provide additional financial documentation or clarification.

Fill

form

: Try Risk Free

People Also Ask about

How do you qualify for financial aid in California?

Eligibility Requirements submit the FAFSA or CA Dream Act Application and your verified Cal Grant GPA by the deadline. be a U.S. citizen or eligible noncitizen or meet AB540 eligibility criteria. be a California resident for 1 year. attend a qualifying California college. not have a bachelor's or professional degree.

How do I edit my financial aid?

Select your processed FAFSA submission from the “My Activity” section. If you have an action required, start a correction by selecting the action listed under “Errors Found in Your Application,” such as “Start Your Correction” or “Provide Signature.”

What is the financial aid verification policy?

Verification is the process your school uses to confirm that the data reported on your FAFSA form is accurate. If you're selected for verification, your school will request additional documentation that supports the information you reported. Don't assume you're being accused of doing anything wrong.

What is the highest income to qualify for financial aid?

What are the FAFSA income limits? A common myth is that students from high-income families won't qualify for FAFSA funding. In reality, there's no maximum income cap that determines your eligibility for aid. Although your earnings are a factor on the FAFSA, only some programs are based on need.

How to apply for financial aid in California?

The easiest way to apply is through the Free Application for Federal Student Aid (FAFSA®) form. Undocumented students who meet AB 540 requirements will need to apply through the California Dream Act Application (CADAA).

What is the best way to apply for financial aid?

The most vital step in applying for federal grants, work-study, and loans for college is the Free Application for Federal Student Aid (FAFSA®) form.

How much does financial aid give you in California?

California ranks in the top ten of states in the amount of grant aid — which students don't have to pay back — it provides per student. In 2016–17, the California Student Aid Commission (CSAC) distributed just under $1,200 per full-time equivalent undergraduate student, about $400 more than the national average.

What is the income limit for FAFSA in California?

There are no income limits for the FAFSA, so it's always worth applying for each year. Your financial aid offer is based on factors like your school's cost of attendance, your enrollment status, and other aid you've been awarded.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2013 – 2014 FINANCIAL AID ADDENDUM?

The 2013 – 2014 Financial Aid Addendum is a supplementary form used by applicants to provide additional information related to their financial situation during the 2013-2014 academic year, which may impact their eligibility for financial aid.

Who is required to file 2013 – 2014 FINANCIAL AID ADDENDUM?

Students who are applying for financial aid and whose financial circumstances do not accurately reflect those reported on the FAFSA, or who have unusual circumstances that may affect their ability to pay for college, are typically required to file the addendum.

How to fill out 2013 – 2014 FINANCIAL AID ADDENDUM?

To fill out the 2013 – 2014 Financial Aid Addendum, applicants should gather relevant financial documents, clearly explain any unusual circumstances, and follow the instructions provided on the form to ensure accurate reporting of their financial situation.

What is the purpose of 2013 – 2014 FINANCIAL AID ADDENDUM?

The purpose of the 2013 – 2014 Financial Aid Addendum is to give students the opportunity to provide additional context regarding their financial situation, allowing financial aid offices to make informed decisions about their aid eligibility.

What information must be reported on 2013 – 2014 FINANCIAL AID ADDENDUM?

Applicants must report any changes in financial circumstances, additional income sources, unusual expenses (e.g., medical expenses), or any other information that may affect their financial need for the 2013-2014 academic year.

Fill out your 2013 2014 financial aid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 2014 Financial Aid is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.