Get the free WIN1041 - hawaii

Show details

This document provides a comprehensive guide for installing Microsoft Office XP Professional on Windows 2000/XP, including pre-installation processes, installation steps, applying updates, and getting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign win1041 - hawaii

Edit your win1041 - hawaii form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your win1041 - hawaii form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing win1041 - hawaii online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit win1041 - hawaii. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out win1041 - hawaii

How to fill out WIN1041

01

Obtain the WIN1041 form from the official website or your local IRS office.

02

Review the instructions provided with the form carefully.

03

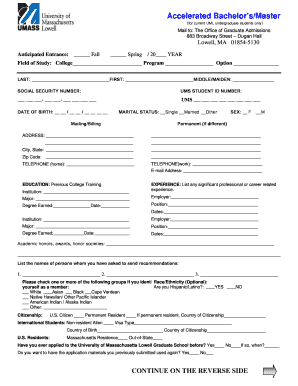

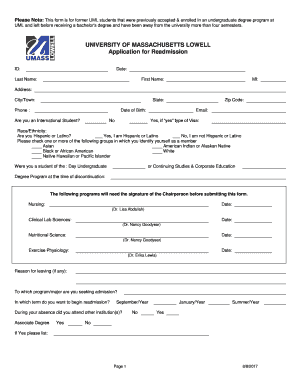

Fill out the personal information section, including your name, address, and Social Security number.

04

Provide details on your income sources for the relevant tax year.

05

Enter any deductions or credits you qualify for in the appropriate sections.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form before submitting it.

Who needs WIN1041?

01

Individuals who have income that needs to be reported for tax purposes.

02

Taxpayers who want to claim deductions or credits related to their income.

03

Anyone filing taxes as part of their annual obligation to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How do I change the default language back to English?

Change your web language settings Sign in to your Google Account. On the left, click Personal info. Under "General preferences for the web," click Language Edit . Search for and select your preferred language. Click Select. If you understand multiple languages, click + Add another language.

How to change Windows 10 single language to English?

Type and search [Language settings] in the Windows search bar①, and then click [Open]②. Select the language you want from the drop-down menu under Windows display language③. After selecting the Windows display language, you will receive the following notification.

How do I change my settings back to English?

Change the language on your Android device On your Android device, tap Settings . Tap System Languages & input. Languages. If you can't find "System," then under "Personal," tap Languages & input Languages. Tap Add a language. and choose the language that you want to use. Drag your language to the top of the list.

How do I reset my computer to English?

Click the Clock Icon for Time and Language settings. Click Language & Region. Click the world Icon with language symbols to open Language and Region settings. In the Language section, click the Add a language button for the Preferred languages setting.

How do I change my Windows 10 language back to English?

Select Start and then select Settings > Time & language > Language . In the Language window, under Windows display language, select the desired Windows display language from the drop-down menu.

How do I change my Windows 10 back to English?

Save all work and close out of any open apps. Select Start and then select Settings > Time & language > Language & region . In the Time & language > Language & region window, under the Language section, select the desired Windows display language in the drop-down menu next to Windows display language.

How do I put Windows 10 in English?

0:22 3:47 And they do not speak the same native language that you do so in this brief tutorial I'll be showingMoreAnd they do not speak the same native language that you do so in this brief tutorial I'll be showing you how to change the default language within windows 10 so this is going to be a very

What is the difference between English and English International Windows 10?

Essentially, they are the same. The International version contains localized English keyboard languages (like United Kingdom, Australia, etc.). While the en-US (English) only contains the minimum of English-based languages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WIN1041?

WIN1041 is a tax form used in the United States for reporting income, deductions, and credits for certain estates and trusts.

Who is required to file WIN1041?

The fiduciary of any estate or trust that has gross income of $600 or more during the tax year, or any estate that has a beneficiary who is a non-resident alien, is required to file WIN1041.

How to fill out WIN1041?

To fill out WIN1041, a fiduciary should gather all income and expenses related to the estate or trust, complete each section of the form accurately, and ensure that all supporting documents are attached before submitting it to the IRS.

What is the purpose of WIN1041?

The purpose of WIN1041 is to report the income, deductions, and tax liability associated with estates and trusts to the Internal Revenue Service for tax assessment.

What information must be reported on WIN1041?

WIN1041 requires reporting of income earned, deductions claimed, distributions made to beneficiaries, and any tax credits that may apply for the estate or trust.

Fill out your win1041 - hawaii online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

win1041 - Hawaii is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.