Get the free Reliable Low-Cost Credit Card Processing Since b1998b

Show details

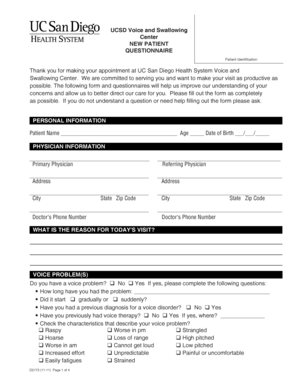

Reliable, The Lowest Credit Card Processing Since 1998 Stateoftheart credit card terminal Personal, expert customer service24/7 No locked in contracts or termination fees The Lowest rates in the entire

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reliable low-cost credit card

Edit your reliable low-cost credit card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reliable low-cost credit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reliable low-cost credit card online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit reliable low-cost credit card. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reliable low-cost credit card

How to fill out a reliable low-cost credit card:

01

Research different credit card options: Start by comparing different credit cards available in the market to find a reliable low-cost option. Look for credit cards that offer low or no annual fees, low interest rates, and other benefits that suit your needs.

02

Check your credit score: Before applying for a credit card, it's important to know where you stand financially. Check your credit score to ensure you meet the eligibility requirements of the credit card you plan to apply for. A higher credit score may help you secure better terms and lower interest rates.

03

Gather necessary documents: Fill out the credit card application form accurately and completely. Prepare the necessary documents such as identification proof, income proof, address proof, and any other documents required by the credit card issuer. Make sure all the information provided is correct and up to date.

04

Compare terms and conditions: Read through the terms and conditions of the credit card thoroughly to understand the fees, interest rates, and any other charges associated with the card. Pay attention to the repayment terms, grace period, and any additional benefits such as cashback or rewards programs.

05

Apply for the card: Once you have gathered all the required information and documents, apply for the reliable low-cost credit card through the chosen bank or credit card issuer. You can usually apply online or visit a local branch to complete the application process.

06

Wait for approval: After submitting your application, wait for the credit card issuer to review and process your application. This may take a few days or weeks depending on the issuer's policies. Be patient and avoid applying for multiple credit cards simultaneously, as it may negatively affect your credit score.

07

Activate the card: Once your credit card application is approved, you will receive the card in the mail. Activate it as per the instructions provided by the credit card issuer. Typically, this involves calling a toll-free activation number or activating the card online through the issuer's website.

Who needs a reliable low-cost credit card?

01

Students: College students or young individuals who are new to credit may benefit from having a reliable low-cost credit card. It can help them establish credit history and learn responsible spending habits without incurring high fees or interest charges.

02

Individuals on a budget: Those who are looking to manage their finances effectively and minimize costs may find a reliable low-cost credit card useful. Such cards often have lower fees, lower interest rates, and can help individuals make affordable purchases or manage unexpected expenses.

03

Individuals with lower credit scores: Having a reliable low-cost credit card can be advantageous for individuals with lower credit scores. These cards may offer better terms and conditions compared to other credit card options and can help rebuild credit with responsible usage.

04

Travelers: Travelers who seek a credit card primarily for travel-related expenses may find value in a reliable low-cost credit card. Look for credit cards that offer travel rewards, waived foreign transaction fees, or travel insurance benefits to make the most of your travel experiences while minimizing costs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is reliable low-cost credit card?

A reliable low-cost credit card is a credit card with low fees and competitive interest rates that is known for its dependability.

Who is required to file reliable low-cost credit card?

Any individual or entity seeking to obtain a reliable low-cost credit card is required to file an application with the credit card issuer.

How to fill out reliable low-cost credit card?

To fill out a reliable low-cost credit card application, you will need to provide personal information such as your name, address, income, and employment status.

What is the purpose of reliable low-cost credit card?

The purpose of a reliable low-cost credit card is to provide individuals with access to credit at affordable rates and with minimal fees.

What information must be reported on reliable low-cost credit card?

Information that must be reported on a reliable low-cost credit card includes the cardholder's name, account number, transaction details, and any fees or charges.

How do I modify my reliable low-cost credit card in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your reliable low-cost credit card and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find reliable low-cost credit card?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific reliable low-cost credit card and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the reliable low-cost credit card electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your reliable low-cost credit card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reliable Low-Cost Credit Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.