Get the free Federal Loan Decline Form - utica

Show details

This form is used by students to reduce or decline their federal loans for the 2013-2014 academic year at Utica College. It requires the student's information, loan amounts they wish to decline, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal loan decline form

Edit your federal loan decline form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal loan decline form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal loan decline form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit federal loan decline form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

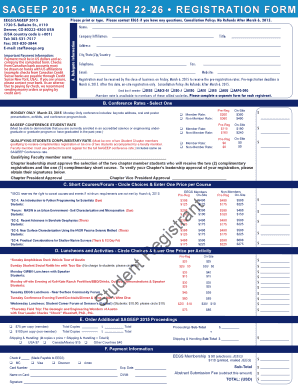

How to fill out federal loan decline form

How to fill out Federal Loan Decline Form

01

Obtain the Federal Loan Decline Form from the official website or your financial aid office.

02

Fill in your personal information, including your name, address, and student ID number.

03

Indicate the specific loan(s) you are declining by checking the appropriate boxes.

04

Provide the reason for declining the loan in the designated section.

05

Sign and date the form to confirm your decision.

06

Submit the completed form to your financial aid office as instructed.

Who needs Federal Loan Decline Form?

01

Students who have been awarded federal loans but do not wish to accept them.

02

Students who are considering alternative financing options and want to decline federal loan assistance.

03

Students who may not need the funds for educational expenses and prefer not to take on debt.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I decline a loan?

Rejecting a loan cannot directly cause any damage to your credit score or your credit report. While any hard inquiries generated in the process may drop your score ever so slightly, you should be able to recover quickly.

How to decline a loan offer?

The key is to be empathetic yet firm in your declination. Avoid oversharing personal financial details or making excuses. Simply state that you're unable to lend the money, but express understanding of their situation. This maintains a professional boundary while preserving the working relationship.

What is a loan change form?

Use the Direct Loan Change Form to reinstate a previously declined Federal Direct Loan or to increase/decrease a loan amount you have already accepted.

What happens if I don't accept a loan?

Fortunately, choosing not to accept a loan that you are approved for does not yield any consequences on your end.

What happens if you get declined for a loan?

If you've been declined for credit, it's important to try to find out why. Asking the lender, reviewing your application details and looking at your credit files are steps you can take to help you understand what went wrong. Remember to be cautious about making lots of credit applications in a short period.

What happens if you don't return a loan?

Legal action: If you continue to default on your personal loan, the lender may initiate legal proceedings to recover the outstanding amount. This may include filing a civil lawsuit, which can result in a court order directing you to repay the loan.

What happens if I refuse to pay a loan?

Defaulting on a loan is likely to lead to severe consequences, such as having your debt passed on to a collection agency, or you being taken to court. If you have a loan secured with a car or your home, then it could be repossessed to recover the costs.

What is a loan deferment form?

A deferment lets you temporarily reduce or postpone payments on your loan(s) if you're returning to college, going to graduate school, or entering an internship, law clerkship, fellowship, or residency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

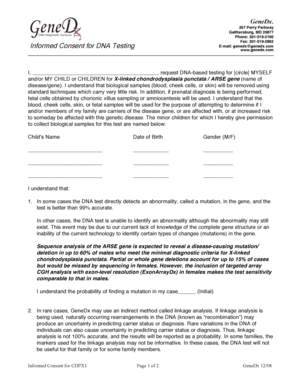

What is Federal Loan Decline Form?

The Federal Loan Decline Form is a document that allows students to officially decline federal student loans that they have been offered by their educational institution.

Who is required to file Federal Loan Decline Form?

Students who have received federal loan offers but choose not to accept them are required to file the Federal Loan Decline Form.

How to fill out Federal Loan Decline Form?

To fill out the Federal Loan Decline Form, a student typically needs to provide personal information, including their name, student ID, and specify the loans they are declining. The form often requires a signature to confirm the decision.

What is the purpose of Federal Loan Decline Form?

The purpose of the Federal Loan Decline Form is to formally document a student's decision not to accept federal loan funds, ensuring clarity for both the student and the institution.

What information must be reported on Federal Loan Decline Form?

The information that must be reported on the Federal Loan Decline Form typically includes the student's name, student ID, loan type and amount being declined, and a signature to confirm the decision.

Fill out your federal loan decline form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Loan Decline Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.