Get the free Map & tax lot # - eugene-or

Show details

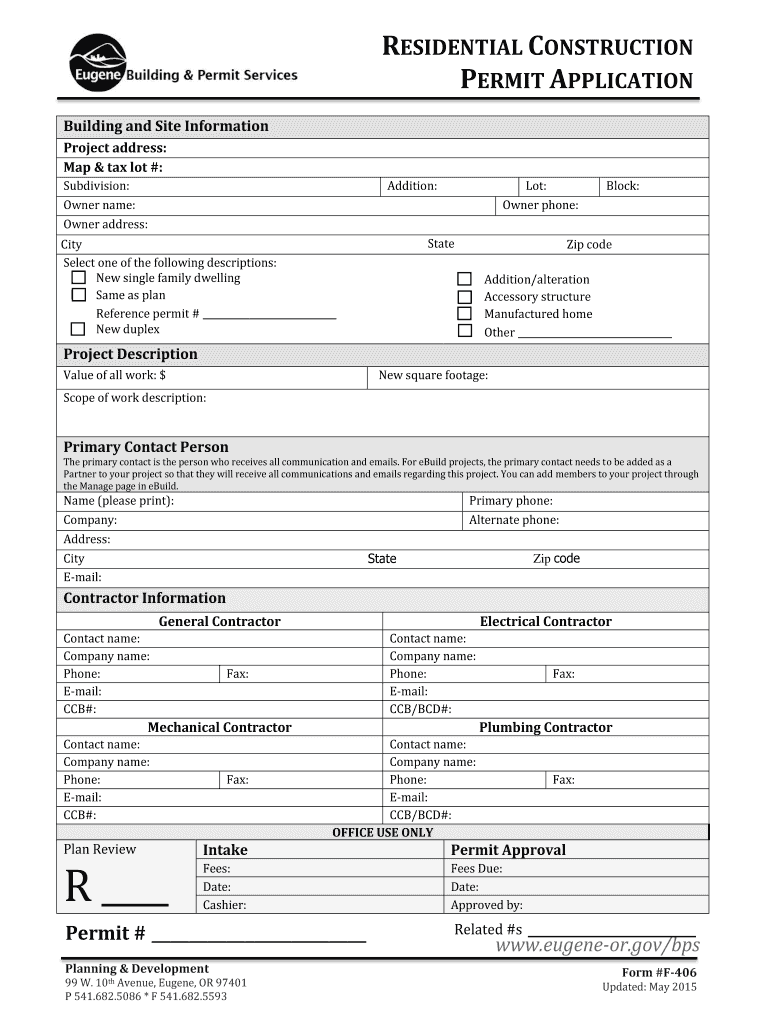

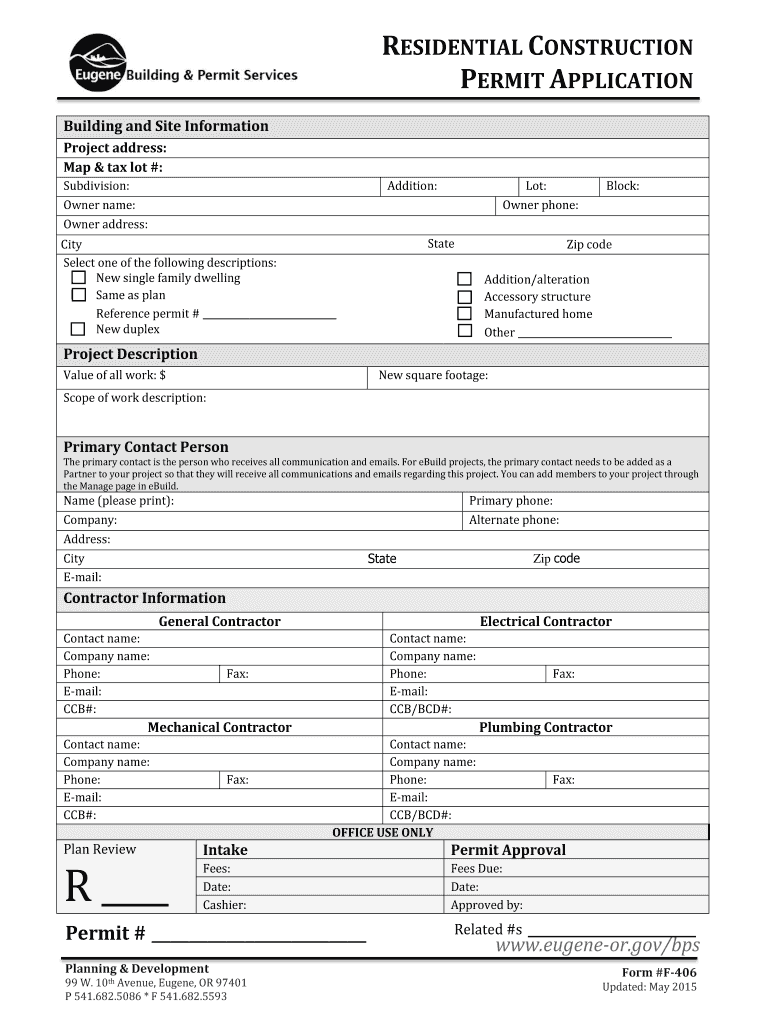

RESIDENTIAL CONSTRUCTION PERMIT APPLICATION Building and Site Information Project address: Map & tax lot #: Subdivision: Owner name: Owner address: Addition: Lot: Owner phone: State City Select one

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign map amp tax lot

Edit your map amp tax lot form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your map amp tax lot form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit map amp tax lot online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit map amp tax lot. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out map amp tax lot

How to fill out a map and tax lot:

01

Gather the necessary information: Start by collecting all relevant documents and information you will need to fill out the map and tax lot. This could include property deeds, survey maps, recorded easements, and any other relevant paperwork.

02

Understand the required fields: Familiarize yourself with the required fields on the map and tax lot form. This may vary depending on your location, but typically includes information such as the property owner's name, address, parcel number, and a detailed description of the property boundaries.

03

Accurately plot the property boundaries: Use the provided map to accurately plot the property boundaries. This can be done by referencing any existing survey markers or landmarks on the property, or by hiring a professional surveyor if necessary. Make sure to include any relevant measurements or coordinates as required.

04

Provide accurate property information: Fill out all requested information about the property accurately. This may include details such as the property's zoning designation, land use codes, or any other relevant information about the property's characteristics.

05

Include any additional required documentation: Depending on the specific requirements of the map and tax lot form, you may need to attach additional documentation. This could include copies of property deeds, previous survey maps, or any other relevant paperwork that supports the information provided.

Who needs a map and tax lot?

01

Property owners: Map and tax lot information is crucial for property owners as it helps identify the exact boundaries and details of their property for legal and tax purposes. It ensures accurate property assessments and helps in determining property taxes.

02

Real estate professionals: Real estate agents, brokers, and professionals involved in property transactions often require map and tax lot information to assist clients in accurately identifying and evaluating properties. It helps in determining property value, market analysis, and verifying property information.

03

Government agencies: Government agencies, such as tax assessors, land use planning departments, and zoning boards, rely on map and tax lot information for various purposes. It helps in property taxation, land use planning, zoning regulations, issuing permits, and ensuring compliance with local ordinances.

04

Land developers: Map and tax lot information is essential for land developers as it aids in identifying available parcels, evaluating development potential, and complying with regulatory requirements. It helps in determining property boundaries and access, assessing development feasibility, and obtaining necessary permits for construction.

05

Surveyors and engineers: Surveyors and engineers need map and tax lot information as a reference for accurate boundary surveys, engineering design, and construction projects. It helps in understanding property boundaries, easements, and other legal considerations when planning and executing land development projects.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my map amp tax lot directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your map amp tax lot as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I sign the map amp tax lot electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your map amp tax lot in seconds.

Can I edit map amp tax lot on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share map amp tax lot on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is map amp tax lot?

Map amp tax lot refers to a detailed map showing property lines and identifying tax lots designated by a tax assessor.

Who is required to file map amp tax lot?

Property owners or individuals responsible for managing the property are required to file map amp tax lot.

How to fill out map amp tax lot?

Map amp tax lot can be filled out by accurately marking property lines and indicating the tax lots on the map.

What is the purpose of map amp tax lot?

The purpose of map amp tax lot is to provide a visual representation of property boundaries and tax lot designations for assessment and tax purposes.

What information must be reported on map amp tax lot?

The map amp tax lot must include property lines, tax lot numbers, and any relevant property information required by the tax assessor.

Fill out your map amp tax lot online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Map Amp Tax Lot is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.