Get the free A-3 - extension usu

Show details

This document serves as an informed consent form for participants in the Utah State University Wild Horse Behavior Summer Experience, outlining the risks involved and the rights of the participants.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a-3 - extension usu

Edit your a-3 - extension usu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a-3 - extension usu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a-3 - extension usu online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit a-3 - extension usu. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a-3 - extension usu

How to fill out A-3

01

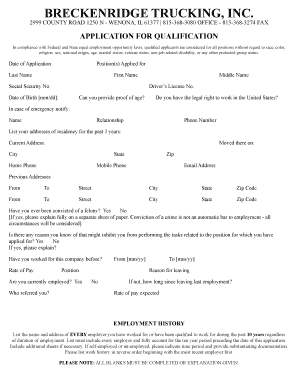

Begin with your personal details: Enter your full name, address, and contact information at the top of the A-3 form.

02

Provide your social security number or taxpayer identification number if applicable.

03

Indicate your employment status by checking the appropriate box (e.g., employed, unemployed, self-employed).

04

Fill out the section regarding your dependents: list their names, relationship to you, and social security numbers.

05

Complete the income section by reporting your total income from all sources for the relevant tax year.

06

Review any deductions or credits you may qualify for and list them in the designated area.

07

Double-check all information for accuracy before signing and dating the form at the end.

Who needs A-3?

01

Individuals who are filing their taxes and need to declare their income, dependents, or claim deductions.

02

Self-employed individuals who need to report their earnings and expenses.

03

Families who must provide information about dependents for tax credits or benefits.

04

Anyone seeking to amend a previous tax return or correct errors in their filing.

Fill

form

: Try Risk Free

People Also Ask about

What is English level 3?

Your English Level LevelClass LevelDescription 3 Pre-intermediate I can communicate simply and understand in familiar situations but only with some difficulty. 2 Elementary I can say and understand a few things in English. 1 Beginner I do not speak any English.6 more rows

What is level 3 teaching English?

The Level 3 English Literacy and Language for Teachers qualification is designed specifically for individuals who are looking to improve their proficiency in English literacy and language, and is especially useful for those who wish to work with learners who have special educational needs or are non-native speakers.

What happens if you get a 3 in English?

While grades 1-3 technically count as a pass, many sixth forms insist on a minimum number of 5s or 6s as a condition of entry for further study. The government's school league tables are based on the percentage of pupils who achieve a 5 or above in English and maths GCSEs.

What is A1, A2, B1, B2, C1, C2 level in English?

Common European Framework of Reference (CEFR) LevelCEFR level A Beginners level A1 A2 B Intermediate level B1 B2 C Advanced level C1 C2

What is level 3 English level?

Your English Level LevelClass LevelDescription 3 Pre-intermediate I can communicate simply and understand in familiar situations but only with some difficulty. 2 Elementary I can say and understand a few things in English. 1 Beginner I do not speak any English.6 more rows

What is 3A in English?

In English 3A, students will read and analyze American fiction, poetry, essays, and historical documents as well as create their own pieces of writing inspired by these mentor texts. As part of this course, students are expected to create poetry and short fiction, literary analysis, and argumentative essays.

Is level 3 good in English?

Level 3 English is a qualification that shows advanced reading, writing, and communication skills, typically for work or further study.

What is A3 in English?

a standard international paper size, measuring 297mm × 420mm. (Definition of A3 from the Cambridge Business English Dictionary © Cambridge University Press)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is A-3?

A-3 is a tax form used for reporting specific information related to income and withholding for certain taxpayers.

Who is required to file A-3?

Taxpayers who have income that is subject to withholding and who meet certain criteria set by tax authorities are required to file A-3.

How to fill out A-3?

To fill out A-3, taxpayers should provide their identification information, report their income details, and accurately calculate the withholding amounts as per the instructions provided with the form.

What is the purpose of A-3?

The purpose of A-3 is to ensure that income and tax withholdings are reported accurately to tax authorities, thereby facilitating proper tax processing and compliance.

What information must be reported on A-3?

The information that must be reported on A-3 includes taxpayer identification details, types of income received, amounts withheld, and any other relevant financial information as specified by tax regulations.

Fill out your a-3 - extension usu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A-3 - Extension Usu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.