Get the free Savings Plan - arlington k12 ma

Show details

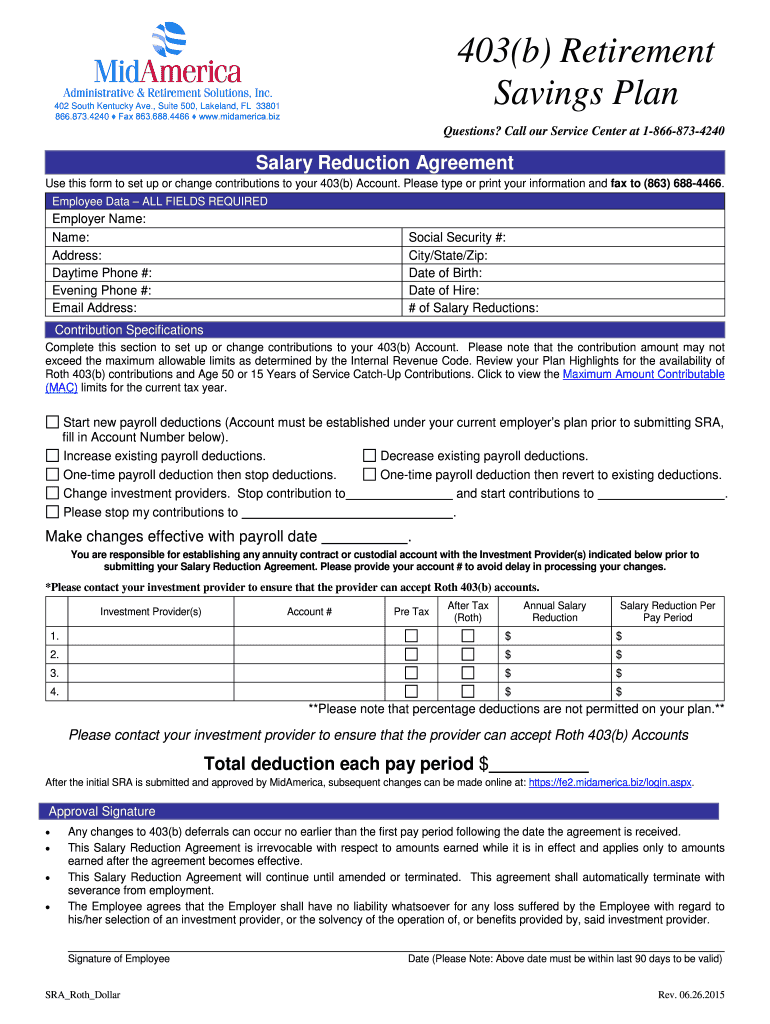

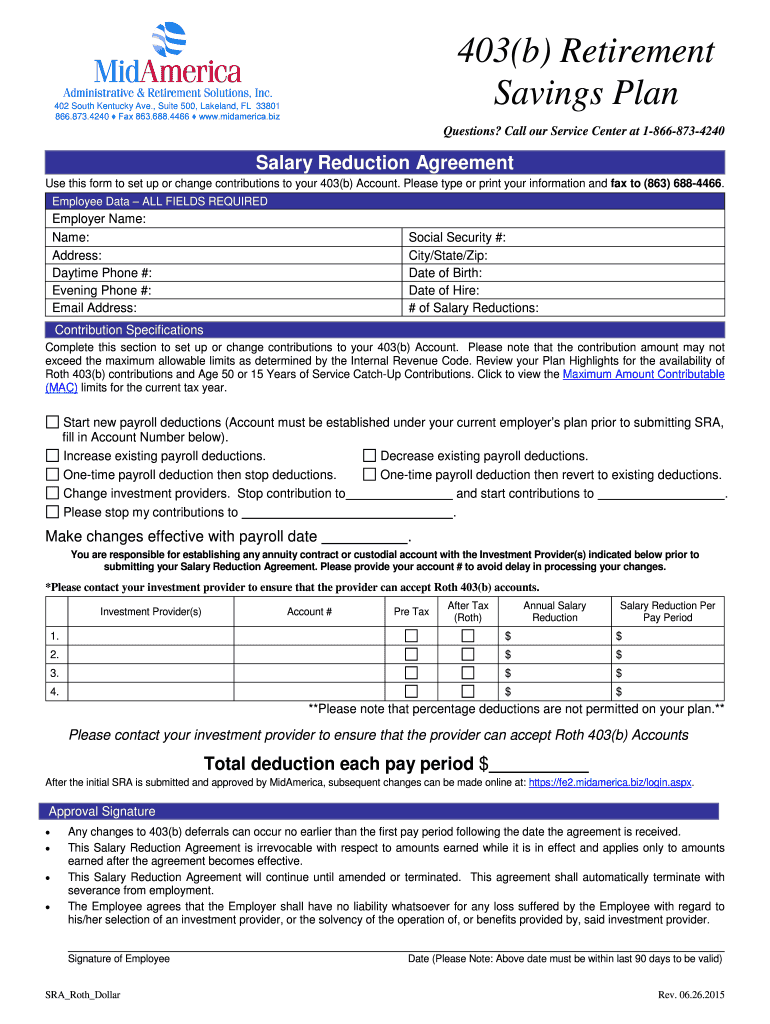

403(b) Retirement Savings Plan 402 South Kentucky Ave., Suite 500, Lakeland, FL 33801 866.873.4240 Fax 863.688.4466 www.midamerica.biz Questions? Call our Service Center at 1-866-873-4240 Salary Reduction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign savings plan - arlington

Edit your savings plan - arlington form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your savings plan - arlington form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing savings plan - arlington online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit savings plan - arlington. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out savings plan - arlington

How to Fill Out a Savings Plan:

01

Start by determining your financial goals and objectives. Think about what you want to achieve with your savings and set specific targets.

02

Assess your current financial situation. Calculate your income, expenses, and debt to determine how much you can afford to save each month.

03

Create a budget. Track your expenses and identify areas where you can cut back in order to allocate more funds towards savings.

04

Choose the right savings account. Research different types of savings accounts, such as traditional savings accounts, high-yield savings accounts, or certificates of deposit (CDs), and select the one that aligns with your goals and offers competitive interest rates.

05

Set up automatic transfers. To ensure consistent savings, consider setting up automatic transfers from your primary bank account to your designated savings account on a regular basis, such as monthly or bi-weekly.

06

Monitor your progress. Regularly review your savings plan and track how you're progressing towards your goals. Make adjustments as needed to stay on track.

07

Stay disciplined and avoid dipping into your savings unnecessarily. Remember that a savings plan requires commitment and self-control to be successful.

Who Needs a Savings Plan?

01

Individuals with short-term financial goals: If you have a specific financial goal in mind, such as saving for a vacation, a down payment on a home, or a new car, a savings plan can help you achieve it within a specific timeframe.

02

Those seeking financial security: A savings plan is essential for individuals who want to build an emergency fund to cover unexpected expenses or loss of income. It provides financial stability and peace of mind during challenging times.

03

People preparing for retirement: Saving for retirement is crucial to ensure a comfortable and financially secure future. A savings plan can help you accumulate the necessary funds to support your desired lifestyle during retirement.

04

Individuals with long-term financial aspirations: Whether you're saving for your children's education, starting a business, or planning for a major life event, a savings plan helps you allocate funds strategically over an extended period.

05

Anyone who wants to improve their financial well-being: Regardless of your financial goals, a savings plan promotes responsible money management, reduces financial stress, and allows you to make sound financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send savings plan - arlington to be eSigned by others?

savings plan - arlington is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in savings plan - arlington?

The editing procedure is simple with pdfFiller. Open your savings plan - arlington in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit savings plan - arlington on an iOS device?

Create, edit, and share savings plan - arlington from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is savings plan?

A savings plan is a strategy or method that individuals use to reach their financial goals by setting aside a portion of their income on a regular basis.

Who is required to file savings plan?

There is no specific requirement to file a savings plan, as it is a personal financial tool rather than a formal document that needs to be submitted to any authority.

How to fill out savings plan?

To fill out a savings plan, individuals can list their financial goals, determine how much they can save regularly, and choose appropriate saving instruments to achieve those goals.

What is the purpose of savings plan?

The purpose of a savings plan is to help individuals achieve their financial goals, such as saving for retirement, buying a house, or building an emergency fund.

What information must be reported on savings plan?

Information such as the individual's financial goals, current income, expenses, saving targets, and chosen saving instruments must be included in a savings plan.

Fill out your savings plan - arlington online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Savings Plan - Arlington is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.