Get the free Statement of IncreaseDecrease - anahuacus

Show details

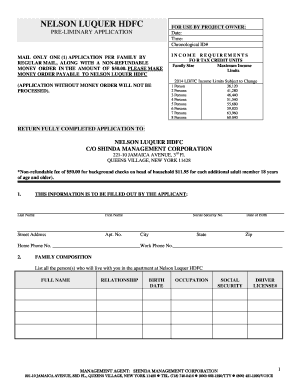

Statement of Increase/Decrease Pr op her t y Ta x Form 50179 If THE CITY OF ANNUAL $100 of value, taxes would adopt a INCREASE 2015 tax rate equal to the effective tax rate of $ compared to 2014 taxes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign statement of increasedecrease

Edit your statement of increasedecrease form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your statement of increasedecrease form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing statement of increasedecrease online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit statement of increasedecrease. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out statement of increasedecrease

How to Fill Out Statement of Increase/Decrease:

01

Begin by gathering all the necessary information and documents required to accurately complete the statement. This may include financial records, sales reports, inventory information, and any other relevant data.

02

Start by identifying the specific changes that have occurred within your business. Whether it is an increase or decrease in sales, profits, or expenses, make sure to have a clear understanding of the changes that need to be documented.

03

Use the provided form or template specifically designed for the statement of increase/decrease. This will help ensure that you provide all the required information in the correct format.

04

Begin by filling in the basic information, such as your business name, contact details, and the period for which the statement is being prepared.

05

Provide a brief overview of the reasons behind the increase or decrease. This could include factors such as market trends, changes in customer behavior, economic conditions, or any other relevant factors that have contributed to the change.

06

Break down the specific areas that have been impacted by the increase/decrease. This may include sales, revenue, expenses, assets, liabilities, or any other relevant categories that apply to your business.

07

Provide detailed information for each category, including specific numbers, percentages, and any supporting documentation or calculations. Ensure that all figures are accurate and properly documented.

08

If necessary, include any explanations or additional information that may help clarify the changes and their impact on your business.

09

Review the completed statement for accuracy and make any necessary revisions or corrections. Double-check all calculations and verify that the information presented is clear and concise.

Who Needs a Statement of Increase/Decrease:

01

Small business owners: The statement of increase/decrease is essential for small business owners to track and analyze their financial performance over a specific period. It provides a clear snapshot of any significant changes and helps identify areas that require further attention or improvement.

02

Investors: Investors often require a statement of increase/decrease when evaluating the financial health and performance of a business. This statement helps them understand the factors contributing to changes and make informed investment decisions.

03

Lenders and creditors: Financial institutions and creditors may request a statement of increase/decrease to assess the creditworthiness and financial stability of a company. This document provides insights into the business's ability to generate revenue, manage expenses, and meet its financial obligations.

04

Business consultants and advisors: Consultants and advisors use the statement of increase/decrease to analyze a company's financial performance and provide strategic recommendations. This information helps them identify growth opportunities or potential risks that may impact the business.

05

Regulatory authorities and tax agencies: Government agencies often require businesses to submit a statement of increase/decrease as part of their financial reporting obligations. This document helps ensure compliance with regulations and provides a transparent overview of the company's financial activities.

In conclusion, filling out a statement of increase/decrease involves gathering and organizing financial information, accurately documenting changes, and providing a clear overview of the factors contributing to the changes. This statement is important for small business owners, investors, lenders, advisors, and regulatory authorities to evaluate the financial performance and stability of a company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get statement of increasedecrease?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific statement of increasedecrease and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit statement of increasedecrease on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as statement of increasedecrease. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out statement of increasedecrease on an Android device?

Complete statement of increasedecrease and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is statement of increasedecrease?

Statement of increasedecrease is a form used to report any changes in ownership or control of a company.

Who is required to file statement of increasedecrease?

Any individual or entity that experiences a change in ownership or control of a company is required to file a statement of increasedecrease.

How to fill out statement of increasedecrease?

To fill out a statement of increasedecrease, one must provide details about the change in ownership or control, including the names and details of the parties involved.

What is the purpose of statement of increasedecrease?

The purpose of statement of increasedecrease is to provide transparency and maintain accurate records of ownership and control of companies.

What information must be reported on statement of increasedecrease?

The information reported on a statement of increasedecrease includes details about the parties involved in the change of ownership or control, as well as the specifics of the change.

Fill out your statement of increasedecrease online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Increasedecrease is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.