Get the free REVOLVING LOAN FUND POLICY - Cheyenne Wyoming

Show details

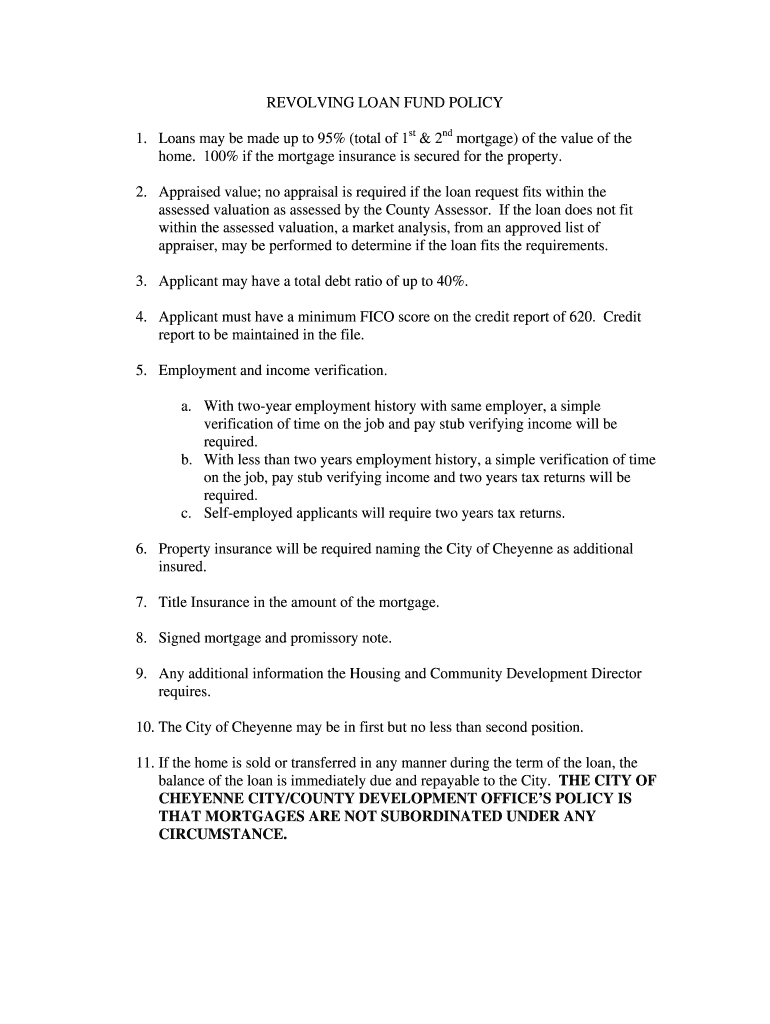

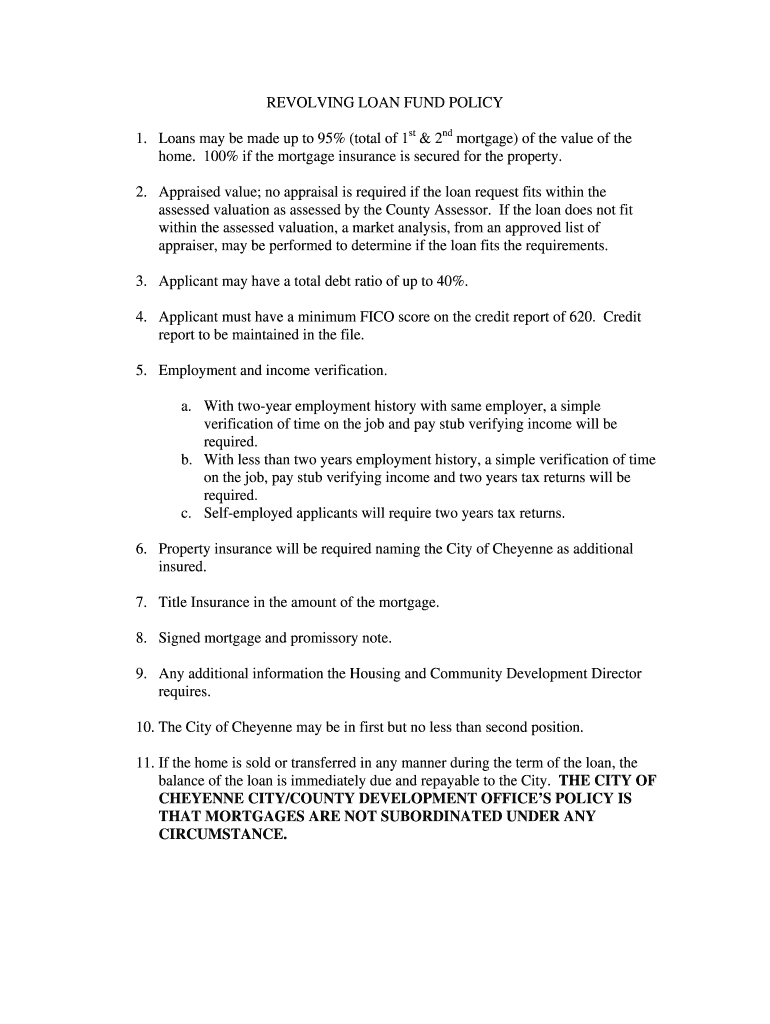

REVOLVING LOAN FUND POLICY 1. Loans may be made up to 95% (total of 1st & 2nd mortgage) of the value of the home. 100% if the mortgage insurance is secured for the property. 2. Appraised value; no

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revolving loan fund policy

Edit your revolving loan fund policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revolving loan fund policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revolving loan fund policy online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit revolving loan fund policy. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revolving loan fund policy

01

To start filling out the revolving loan fund policy, gather all the necessary information and documents related to the policy. This may include details about the loan fund, its purpose, terms and conditions, and any guidelines or regulations that need to be followed.

02

Begin by identifying the different sections or components of the policy. This can include sections about eligibility criteria, loan application procedures, loan approval process, interest rates, repayment terms, and any other relevant details. Create headings or subheadings for each section to maintain a clear and organized structure.

03

Write a comprehensive introduction that outlines the purpose and objectives of the revolving loan fund policy. This section should provide a brief overview of why the policy is needed, who it will benefit, and how it aligns with the organization's goals.

04

In each section, provide clear and concise instructions for filling out the policy. Use simple language and avoid jargon or technical terms that may confuse readers. Include any specific requirements or documentation that applicants need to provide when applying for a loan from the fund.

05

If there are any forms or templates that need to be used when filling out the policy, include them as annexes or attachments. Make sure to explain how to correctly complete these forms and provide examples or sample entries, if possible.

06

Consider including a section with frequently asked questions (FAQs) that address common queries or concerns regarding the revolving loan fund policy. This can help applicants and other stakeholders find answers to their questions quickly and efficiently.

07

Proofread and edit the policy thoroughly to ensure clarity, accuracy, and consistency. Check for any grammar or spelling errors, and make sure that the policy flows logically from one section to the next. It may be helpful to have someone else review the policy as well to provide fresh insights and suggestions for improvement.

Who needs revolving loan fund policy?

01

Small businesses or entrepreneurs seeking financial assistance for their projects or ventures may need a revolving loan fund policy. This policy can outline the criteria for eligibility, the application process, and the terms of the loan that they can access.

02

Non-profit organizations or community development institutions that provide financial support to individuals or groups in need may require a revolving loan fund policy. This policy can serve as a guideline for evaluating loan applications, disbursing funds, and establishing a framework for repayment.

03

Government agencies or municipalities responsible for economic development initiatives may also benefit from having a revolving loan fund policy. This policy can help ensure that loans are distributed fairly and transparently, and that the funds are used effectively to stimulate local economies and promote job creation.

In summary, the process of filling out a revolving loan fund policy involves gathering relevant information, identifying the different sections, providing clear instructions, including necessary forms or templates, and reviewing the policy for accuracy. The policy may be needed by small businesses, non-profit organizations, and government agencies involved in providing financial assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send revolving loan fund policy for eSignature?

Once your revolving loan fund policy is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute revolving loan fund policy online?

pdfFiller has made it simple to fill out and eSign revolving loan fund policy. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my revolving loan fund policy in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your revolving loan fund policy and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is revolving loan fund policy?

Revolving loan fund policy is a financial program that provides loans to borrowers, and the repayments from these loans are then used to fund new loans.

Who is required to file revolving loan fund policy?

Organizations or institutions that maintain a revolving loan fund are required to file a revolving loan fund policy.

How to fill out revolving loan fund policy?

To fill out a revolving loan fund policy, one must provide detailed information about the fund's purpose, management, repayment terms, and reporting requirements.

What is the purpose of revolving loan fund policy?

The purpose of revolving loan fund policy is to establish guidelines for the management and operation of a revolving loan fund.

What information must be reported on revolving loan fund policy?

Information such as fund's objectives, loan terms, borrower eligibility criteria, repayment schedules, and reporting requirements must be reported on revolving loan fund policy.

Fill out your revolving loan fund policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revolving Loan Fund Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.