Get the free Client directed portfolio invesment instruction Form

Show details

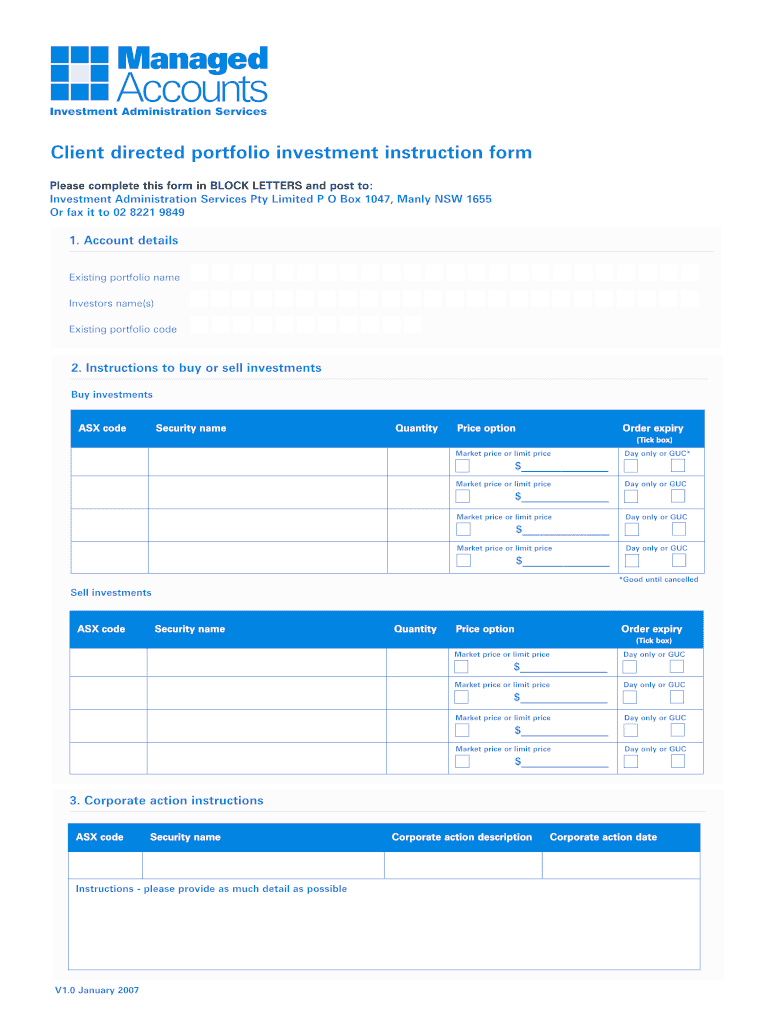

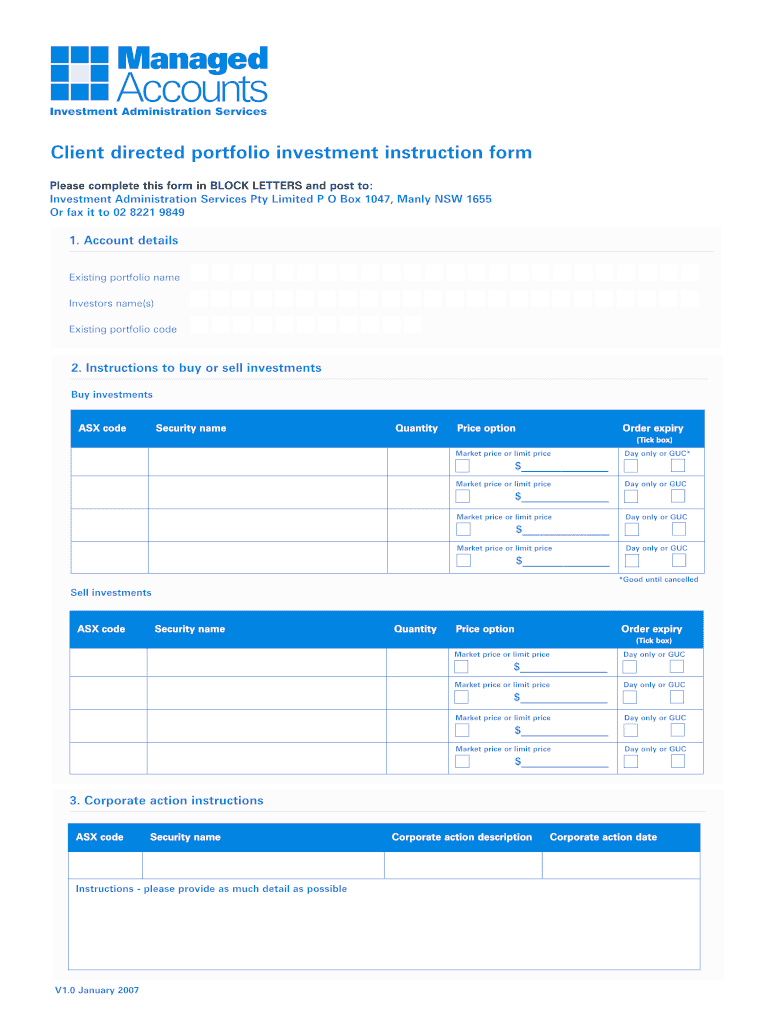

Client directed portfolio investment instruction form Please complete this form in BLOCK LETTERS and post to: Investment Administration Services Pty Limited P O Box 1047, Manly NSW 1655 Or fax it

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign client directed portfolio invesment

Edit your client directed portfolio invesment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your client directed portfolio invesment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing client directed portfolio invesment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit client directed portfolio invesment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out client directed portfolio invesment

To fill out client directed portfolio investment, follow these steps:

01

Determine your investment goals: Consider what you want to achieve with your investments and how long you plan to invest. This will help you decide the right allocation of assets in your portfolio.

02

Assess your risk tolerance: Understand your comfort level when it comes to taking risks with your investments. This will help you determine the appropriate asset mix and investment strategies.

03

Research investment options: Research different investment options such as stocks, bonds, mutual funds, ETFs, and real estate investment trusts. Learn about their potential risks and returns to make informed decisions.

04

Determine asset allocation: Based on your investment goals and risk tolerance, decide how much of your portfolio should be allocated to each asset class. This will help diversify your investments and reduce risk.

05

Select specific investments: Once you have determined the asset allocation, choose specific investments within each asset class. Consider factors such as historical performance, management fees, and any specific investment objectives.

06

Open a brokerage account: To execute your investment strategy, open a brokerage account with a reputable financial institution. Provide the necessary documentation and complete the account opening process.

07

Fill out the necessary forms: Contact your brokerage firm and ask for the client directed portfolio investment forms. These forms may include a client agreement, risk disclosure statement, and investment policy statement. Fill them out accurately and thoroughly.

08

Submit the forms: After completing the forms, submit them to your brokerage firm. Ensure that you've included all the required signatures and any additional documentation requested.

09

Monitor and review your portfolio: Regularly review your portfolio's performance and make adjustments as necessary. Consider rebalancing your investments if the asset allocation deviates significantly from your target.

Who needs client directed portfolio investment?

01

Experienced investors: Those with extensive knowledge and experience in managing their investments may opt for a client-directed portfolio. They can personalize their investment strategy based on their preferences and expertise.

02

Financially savvy individuals: People who have a good understanding of investment principles and financial markets may prefer having control over their portfolio. They may enjoy the hands-on approach of selecting and managing their investments.

03

Investors seeking customization: Some individuals have specific investment preferences or social values they want to incorporate into their portfolio. A client-directed investment approach allows them to align their investments with their personal beliefs.

04

Those with unique financial goals: If you have specific financial goals, such as saving for retirement or a child's education, a client-directed portfolio allows you to tailor your investments to achieve those objectives.

05

Individuals who value transparency: For those who want full visibility and control over their investments, a client-directed portfolio provides transparency into investment decisions and allows for greater involvement in the investment process.

Remember, before making any investment decisions, it's always wise to consult with a qualified financial advisor to ensure that the investment strategy aligns with your financial goals and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete client directed portfolio invesment online?

Completing and signing client directed portfolio invesment online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out client directed portfolio invesment on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your client directed portfolio invesment. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit client directed portfolio invesment on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute client directed portfolio invesment from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is client directed portfolio invesment?

Client directed portfolio investment is an investment strategy where clients have the authority to make decisions regarding investments in their portfolio without needing approval from the investment advisor.

Who is required to file client directed portfolio invesment?

Individuals or entities managing client directed portfolio investments are required to file this information.

How to fill out client directed portfolio invesment?

Client directed portfolio investment forms can be filled out by providing details of the investments made by the client, including asset types, values, and any changes in the portfolio.

What is the purpose of client directed portfolio invesment?

The purpose of client directed portfolio investment is to give clients greater control and flexibility in managing their investments.

What information must be reported on client directed portfolio invesment?

Information such as the client's investment decisions, asset allocation, changes in the portfolio, and overall performance must be reported on client directed portfolio investment forms.

Fill out your client directed portfolio invesment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Client Directed Portfolio Invesment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.