Get the free DEBT TO INCOME RATIO WORKSHEET 2015-2016 Award Year - xula

Show details

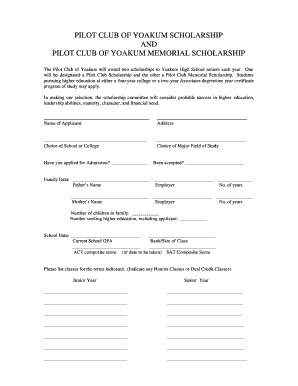

DEBT TO INCOME RATIO WORKSHEET 20152016 Award Year Your Federal Direct PLUS Loan was approved, however you have indicated due to extenuating circumstances you are not able to repay the loan. Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt to income ratio

Edit your debt to income ratio form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt to income ratio form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing debt to income ratio online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit debt to income ratio. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt to income ratio

How to fill out debt to income ratio:

01

Gather your financial documents: To accurately calculate your debt to income ratio, you'll need to collect information about your monthly debt payments and your income. Gather documents such as loan statements, credit card statements, pay stubs, and tax returns.

02

Calculate your monthly debt payments: Add up all your monthly debt payments, including mortgages, car loans, student loans, credit card payments, and any other outstanding loans or debts. This total will represent your monthly debt obligations.

03

Determine your monthly income: Calculate your total monthly income from all sources, such as your salary, bonuses, rental income, or any additional sources of income. This will be the amount of money you earn before taxes and deductions.

04

Divide your monthly debt payments by your monthly income: Take your total monthly debt payments and divide them by your monthly income. Multiply the result by 100 to convert it into a percentage. For example, if your total monthly debt payments are $1,500 and your monthly income is $5,000, your debt to income ratio would be (1,500 / 5,000) * 100 = 30%.

05

Interpret your debt to income ratio: Once you have calculated your debt to income ratio, you need to understand what it means. Generally, a lower debt to income ratio indicates a healthier financial situation, as it signifies that a smaller portion of your income is going towards debt payments. Lenders often use this ratio to assess your ability to repay loans, so it's important to keep it within a reasonable range.

Who needs debt to income ratio:

01

Mortgage applicants: When applying for a mortgage loan, lenders typically evaluate your debt to income ratio to determine your creditworthiness and ability to make mortgage payments. A lower debt to income ratio can improve your chances of getting approved for a mortgage at favorable terms.

02

Personal loan applicants: Lenders offering personal loans also consider your debt to income ratio when assessing your loan application. They want to ensure that you have enough income to cover the loan payments and manage your existing debt obligations.

03

Renters: Some landlords may request your debt to income ratio to assess your financial stability before renting out a property. It helps them determine if you have the financial capacity to consistently pay rent on time.

04

Individuals managing their finances: Monitoring your debt to income ratio can be beneficial for individuals who want to track their financial health and make informed decisions about their debt. It can help you gauge how much you can afford to borrow and identify areas where you may need to reduce debt or increase income.

Overall, the debt to income ratio is a useful tool for both lenders and individuals to assess financial health, determine creditworthiness, and make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit debt to income ratio straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing debt to income ratio.

Can I edit debt to income ratio on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign debt to income ratio on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete debt to income ratio on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your debt to income ratio, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is debt to income ratio?

Debt to income ratio is a financial metric used to measure an individual's or a household's debt relative to their income.

Who is required to file debt to income ratio?

Individuals or households who are seeking a loan or mortgage may be required to provide their debt to income ratio.

How to fill out debt to income ratio?

To calculate your debt to income ratio, you need to add up all your monthly debt payments and divide it by your gross monthly income.

What is the purpose of debt to income ratio?

The purpose of debt to income ratio is to determine an individual's ability to manage their debt and repay any additional loans.

What information must be reported on debt to income ratio?

The information that must be reported on debt to income ratio includes all monthly debt payments and gross monthly income.

Fill out your debt to income ratio online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt To Income Ratio is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.