Get the free Payroll Change - ccsu

Show details

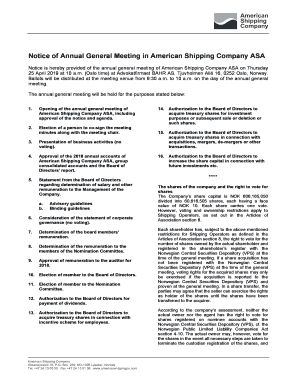

STUDENT WORKER PAY INCREASE JUSTIFICATION Student's Name: Last First MIC CSU ID Number: Position Code: Proposed Pay Rate: $ / hour Date employed as a Student Worker in your department: / / Student

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll change - ccsu

Edit your payroll change - ccsu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll change - ccsu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll change - ccsu online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payroll change - ccsu. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll change - ccsu

How to fill out payroll change:

01

Obtain the necessary form from your employer. This form may vary depending on the company, but it typically includes fields for your personal information, such as name, employee ID, and contact details.

02

Fill in the required fields accurately. Make sure to verify and enter your correct name, social security number, and any other identifying information.

03

Specify the effective date of the payroll change. This is the date when the changes to your payroll will take effect. It could be a future date or a retroactive date, depending on the circumstances.

04

Indicate the type of change you are making to your payroll. This could include changes to your tax withholding, retirement contributions, insurance coverage, or any other payroll-related adjustments.

05

Provide detailed information about the changes you wish to make. For example, if you are changing your tax withholding, specify the new percentage or dollar amount you want withheld from your paycheck.

06

Review the completed form for accuracy. Double-check all the information you have provided to ensure there are no mistakes or omissions.

07

Sign and date the form. By doing so, you certify that the information you have provided is true and accurate to the best of your knowledge.

Who needs payroll change?

01

Employees who have experienced a change in their personal or financial circumstances may need to fill out a payroll change. This could include individuals who have recently gotten married, divorced, or had a child, as they may need to update their tax withholding or insurance coverage.

02

Employees who have opted to contribute to a retirement plan or make changes to their existing retirement contributions may need to fill out a payroll change. This allows them to adjust the amount withheld from their paychecks and ensure it aligns with their retirement savings goals.

03

Employees who have had a change in their employment status, such as transitioning from part-time to full-time or vice versa, may need to fill out a payroll change. This ensures that their pay rate, benefits, and other payroll-related information are updated accordingly.

04

Employees who have experienced a change in their banking information, such as opening a new bank account or closing an existing one, may need to fill out a payroll change. This allows them to update their direct deposit information and ensure their paychecks are deposited into the correct account.

Overall, anyone who has experienced a change that affects their payroll information should consider filling out a payroll change form to ensure their records are accurate and up to date.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find payroll change - ccsu?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific payroll change - ccsu and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my payroll change - ccsu in Gmail?

Create your eSignature using pdfFiller and then eSign your payroll change - ccsu immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit payroll change - ccsu on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing payroll change - ccsu.

What is payroll change?

Payroll change is a process of updating and making adjustments to an employee's payroll information, such as salary, deductions, and benefits.

Who is required to file payroll change?

Employers or their designated payroll administrators are typically required to file payroll changes.

How to fill out payroll change?

To fill out a payroll change, employers need to gather updated information from employees, such as changes in salary, tax withholding, benefits, or deductions, and update their payroll system accordingly.

What is the purpose of payroll change?

The purpose of payroll change is to ensure that employees are paid accurately and on time, reflecting any changes in their compensation or benefits.

What information must be reported on payroll change?

The information reported on a payroll change may include employee's name, employee ID, updated salary, tax withholding information, benefit changes, and any other relevant updates.

Fill out your payroll change - ccsu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Change - Ccsu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.