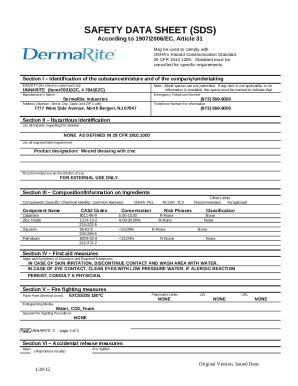

Get the Tax-Free Alcohol Custodians - materiel ucdavis

Show details

This document is used to authorize changes to the list of tax-free alcohol custodians within a department, ensuring compliance with specific policies regarding the storage and control of ethyl alcohol.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax- alcohol custodians

Edit your tax- alcohol custodians form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax- alcohol custodians form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax- alcohol custodians online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax- alcohol custodians. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax- alcohol custodians

How to fill out Tax-Free Alcohol Custodians

01

Obtain a Tax-Free Alcohol Custodian application form from the relevant government agency.

02

Fill in personal details such as your name, address, and contact information.

03

Provide details of the business or organization for which you are applying.

04

Include information about the types of tax-free alcohol you intend to handle.

05

Submit any required supporting documents, such as proof of business registration or a letter of intent.

06

Review the completed application for accuracy and completeness.

07

Submit the application form and any additional documentation to the appropriate tax authority.

Who needs Tax-Free Alcohol Custodians?

01

Businesses involved in the production, distribution, or sale of alcohol that qualify for tax-exempt status.

02

Nonprofit organizations that host events serving alcohol without charging for it.

03

Exporters of alcohol who need to comply with tax-free alcohol regulations.

04

Educational institutions that conduct research involving the use of alcohol.

Fill

form

: Try Risk Free

People Also Ask about

How many bottles of alcohol can I bring into the US duty free?

Generally, one liter per person may be entered into the U.S. duty-free by travelers who are 21 or older. Additional quantities may be entered, although they will be subject to duty and IRS taxes.

How much alcohol can you take in checked baggage in the UK?

Alcoholic drinks You can bring up to five litres of alcohol with an alcohol volume between 24% and 70%. This can travel in your cabin bag if you purchased it in the airport duty-free shop, or you can pack in your checked baggage.

Why is alcohol cheaper at Duty Free?

It's basic retail. The duty free probably has a low volume and is probably buying from a distributor. Tesco is a big chain they're probably buying direct from the distillery. Tesco and liquor distributors have similar cost. Liquor distributors add a margin when they sell to duty free shops.

What is the duty free threshold in the UK?

This will depend on how you have shipped the items a what value they are. Goods that have a value below £39 will be duty and tax free. Goods between £40 a d £135 will be duty free but subject to VAT @ 29% for most goods. Goods over £135 will be charged duty and VAT .

How much alcohol can you buy in Duty Free UK airport?

You are unable to purchase more than 10 of the same product or more than 100 products in any one transaction. You are unable to purchase more than 4 litres of spirits or other liquor over 22% ABV in any one transaction.

How does duty free work in the UK?

Therefore, if you buy something in a duty free shop, you're not paying taxes on it in the country you purchased it. But in some cases, the products could cost more depending on geography (where the duty free store is located) and currency exchange rates.

How much duty free spirits can I bring back to the UK?

You can also bring in either: spirits and other liquors over 22% alcohol - 4 litres. alcoholic drinks up to 22% alcohol (not including beer or still wine) - 9 litres.

What is the duty free allowance for spirits in the UK?

You can also bring in either: spirits and other liquors over 22% alcohol - 4 litres. alcoholic drinks up to 22% alcohol (not including beer or still wine) - 9 litres.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax-Free Alcohol Custodians?

Tax-Free Alcohol Custodians are entities or individuals authorized to store, handle, and distribute alcohol that is exempt from federal excise taxes, typically for specific purposes such as research, medical use, or industrial applications.

Who is required to file Tax-Free Alcohol Custodians?

Individuals or organizations that qualify as custodians of tax-free alcohol, including manufacturers, importers, and certain research institutions, are required to file Tax-Free Alcohol Custodians.

How to fill out Tax-Free Alcohol Custodians?

To fill out Tax-Free Alcohol Custodians, the entity must provide detailed information about their operations, including contact information, the volume of tax-free alcohol held, and the specific uses of the alcohol in compliance with regulations.

What is the purpose of Tax-Free Alcohol Custodians?

The purpose of Tax-Free Alcohol Custodians is to ensure the proper management and accountability of alcohol that is exempt from taxation, facilitating its use for legitimate purposes while preventing misuse or diversion.

What information must be reported on Tax-Free Alcohol Custodians?

Information that must be reported includes the custodian's name and address, types and quantities of alcohol stored, the intended use of the alcohol, and any transactions involving the alcohol, such as transfers or disposals.

Fill out your tax- alcohol custodians online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax- Alcohol Custodians is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.