Get the free Limited CompanyLimited Liability Partnership or

Show details

Limited Company/Limited Liability Partnership or Charitable Incorporated Organization Additional Party/Remove a Party Form p Your information For details of how we and others will use your information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign limited companylimited liability partnership

Edit your limited companylimited liability partnership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limited companylimited liability partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing limited companylimited liability partnership online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit limited companylimited liability partnership. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limited companylimited liability partnership

How to fill out a limited company / limited liability partnership:

01

Choose a business name: Start by selecting a unique and appropriate name for your company or LLP. Make sure it complies with any legal requirements and does not infringe on existing trademarks.

02

Register your business: Visit the appropriate government website or contact the relevant authority to register your limited company or LLP. Provide all the necessary information and documentation, such as company details, registered office address, and director/partner details.

03

Define the business structure: Determine whether you are establishing a limited company or a limited liability partnership. Understand the legal implications and benefits of each structure before proceeding.

04

Obtain necessary licenses and permits: Depending on your industry and location, certain licenses and permits may be required to operate legally. Research and obtain any applicable licenses or permits before commencing operations.

05

Appoint directors/partners: If forming a limited company, appoint directors who will be responsible for managing the company's affairs. In the case of an LLP, designate partners who will share the responsibility.

06

Draft a Memorandum of Association/Partnership Agreement: Create a legal document outlining the rights, powers, and obligations of the company's shareholders/members or the LLP's partners. This document will serve as a reference for future decision-making.

07

Allocate shares/capital: For a limited company, allocate shares among the shareholders based on the agreed-upon capital contribution. In an LLP, determine the capital contributions and profit-sharing among the partners.

08

Obtain an Employer Identification Number (EIN): If your limited company/LLP plans to hire employees, an EIN must be obtained from the relevant tax authority. This identification number is used for tax purposes.

09

Fulfill ongoing compliance requirements: Understand and meet the legal obligations associated with operating a limited company or LLP. This includes maintaining proper company records, filing annual accounts, paying taxes and fees, and adhering to corporate governance rules.

Who needs a limited company / limited liability partnership:

01

Entrepreneurs and Startups: Establishing a limited company or LLP provides a legal structure to conduct business, separate from personal assets, and potentially attract investment.

02

Small and Medium-sized Enterprises (SMEs): SMEs often choose a limited company or LLP structure as it allows for growth, separates personal finances from business liabilities, and provides credibility to clients or suppliers.

03

Professionals and Consultants: Lawyers, accountants, consultants, and other professionals often prefer LLPs as it offers liability protection while allowing partners to share profits and collaborate.

In summary, filling out a limited company or limited liability partnership involves choosing a name, registering the business, defining the structure, obtaining licenses, appointing directors/partners, drafting legal documents, allocating shares or capital, obtaining an EIN (if applicable), and fulfilling ongoing compliance requirements. This business structure is beneficial for entrepreneurs, SMEs, and professionals seeking liability protection and growth opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

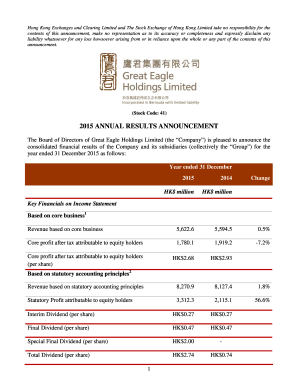

What is limited companylimited liability partnership?

A limited company is a type of business structure that limits the liability of its owners, while a limited liability partnership is a type of partnership where the partners' liability is limited to the amount they have invested in the business.

Who is required to file limited companylimited liability partnership?

Limited companies and limited liability partnerships are required to file annual accounts and annual returns with the relevant government authorities.

How to fill out limited companylimited liability partnership?

To fill out a limited company or limited liability partnership, you will need to provide information about the company's financial performance, ownership structure, and any changes to the company during the reporting period.

What is the purpose of limited companylimited liability partnership?

The purpose of a limited company or limited liability partnership is to provide a legal structure for business operations that limits the personal liability of the owners.

What information must be reported on limited companylimited liability partnership?

Information that must be reported on a limited company or limited liability partnership includes financial statements, ownership details, and any changes to the company's structure.

How can I edit limited companylimited liability partnership from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your limited companylimited liability partnership into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get limited companylimited liability partnership?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the limited companylimited liability partnership in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my limited companylimited liability partnership in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your limited companylimited liability partnership right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your limited companylimited liability partnership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Limited Companylimited Liability Partnership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.