Canada T1036 E 2015 free printable template

Show details

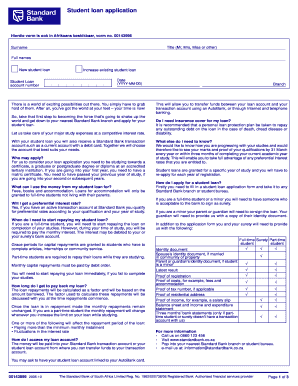

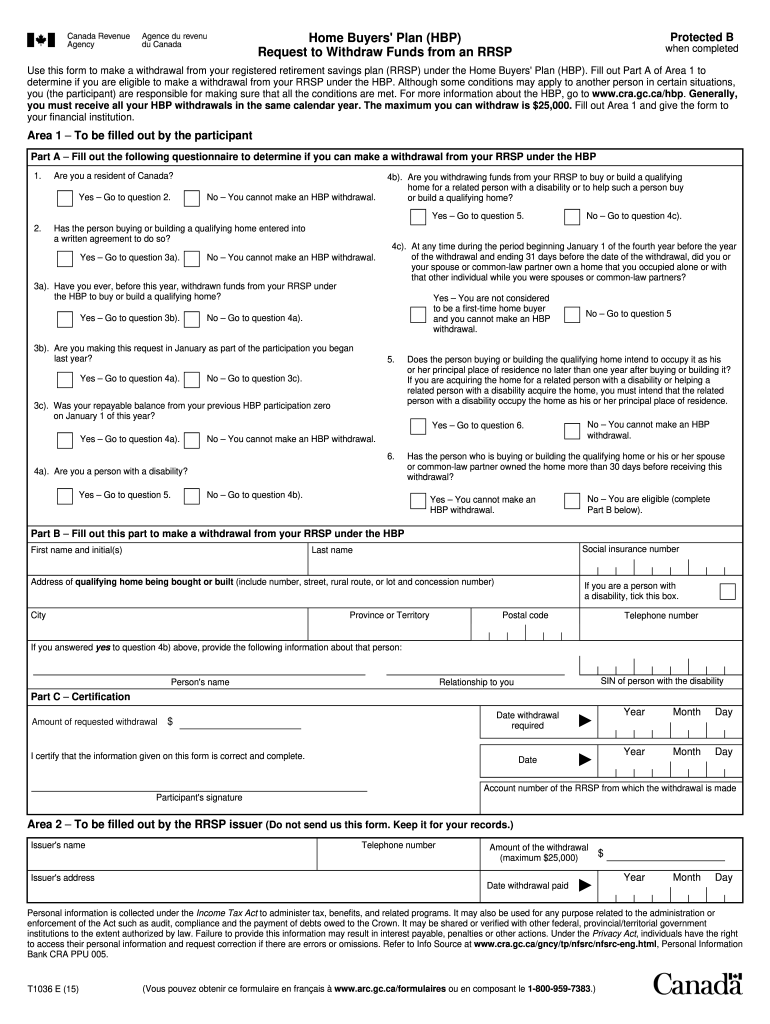

Protected B Home Buyers Plan HBP Request to Withdraw Funds from an RRSP when completed Use this form to make a withdrawal from your registered retirement savings plan RRSP under the Home Buyers Plan HBP. The maximum you can withdraw is 25 000. Fill out Area 1 and give the form to your financial institution. Area 1 To be filled out by the participant Part A Fill out the following questionnaire to determine if you can make a withdrawal from your RRSP under the HBP Are you a resident of Canada...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T1036 E

Edit your Canada T1036 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T1036 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T1036 E online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada T1036 E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T1036 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T1036 E

How to fill out Canada T1036 E

01

Obtain a copy of the Canada T1036 E form from the Canada Revenue Agency (CRA) website.

02

Fill out your personal information at the top of the form, including your name, address, and social insurance number.

03

Indicate the tax year for which you are filing the form.

04

Complete Part A - Details of the Tax Shelter by providing information about the investment and the tax credit you are claiming.

05

Complete Part B - Certification by signing and dating the form to confirm the information provided is accurate.

06

Submit the completed form to the appropriate tax authority as instructed on the form itself.

Who needs Canada T1036 E?

01

Individuals who are claiming a tax credit for certain eligible investments or tax shelters.

02

Taxpayers who have participated in a specific tax shelter program and need to report it on their tax return.

03

Investors looking to receive tax benefits related to their investments under the specified program.

Fill

form

: Try Risk Free

People Also Ask about

How do I report a withdrawal from HBP?

Fill out Schedule 7, RRSP, PRPP, and SPP Unused Contributions, Transfers, and HBP or LLP Activities, and attach it to your income tax and benefit return. This schedule will also show the CRA your total HBP withdrawals and repayments in the year: In the year of the first HBP withdrawal, fill out Part E of Schedule 7.

How do I send a fax to tangerine?

Step 2: Mail your Direct Transfer Form to Tangerine Investment Funds Limited at the address below or fax it to 416-497-8908 or 1-877-464-7797. If this transfer is your first purchase into your Tangerine Investment Fund Account, please remember to include your Investment Fund Account Enrollment Form.

How long does it take to withdraw RRSP for HBP?

Your RRSP contributions must stay in the RRSP for at least 90 days before you can withdraw them under the HBP.

What is Form T1036?

To withdraw funds from your RRSPs under the HBP, fill out Form T1036, Home Buyers' Plan (HBP) Request to Withdraw Funds from an RRSP. You have to fill out this form for each withdrawal you make. After filling out Area 1 of Form T1036, give it to your RRSP issuer.

Does masquerading match legitimate name or location?

Masquerading occurs when the name or location of an object, legitimate or malicious, is manipulated or abused for the sake of evading defenses and observation.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada T1036 E from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your Canada T1036 E into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit Canada T1036 E online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Canada T1036 E to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the Canada T1036 E in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your Canada T1036 E and you'll be done in minutes.

What is Canada T1036 E?

Canada T1036 E is a form used to apply for a tax credit for contributions made to a registered retirement savings plan (RRSP) or a registered pension plan (RPP).

Who is required to file Canada T1036 E?

Individuals who wish to claim the RRSP or RPP contributions tax credit and meet the eligibility criteria are required to file Canada T1036 E.

How to fill out Canada T1036 E?

To fill out Canada T1036 E, you need to provide personal information, including your Social Insurance Number (SIN), details of your contributions to the RRSP or RPP, and sign the declaration at the end of the form.

What is the purpose of Canada T1036 E?

The purpose of Canada T1036 E is to facilitate the application for a tax credit that encourages individuals to save for retirement through registered savings plans.

What information must be reported on Canada T1036 E?

Information required on Canada T1036 E includes your identification details, the amount contributed to your RRSP or RPP, the dates of contributions, and the purpose of the contributions.

Fill out your Canada T1036 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t1036 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.