Canada T1036 E 2024 free printable template

Show details

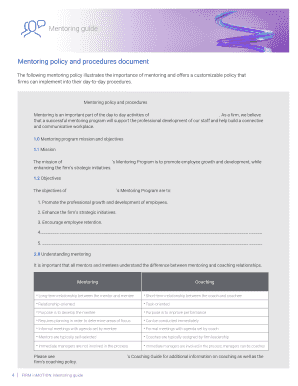

If Form T2201 is not approved your withdrawals will not be considered eligible withdrawals under the HBP and will have to be included in your income for the year you receive them. Continued on next page T1036 E 24 Ce formulaire disponible en fran ais. Clear Data Protected B when completed Home Buyers Plan HBP Request to Withdraw Funds from an RRSP Use this form to make a withdrawal from your registered retirement savings plan RRSP under the Home Buyers Plan HBP. Fill out Part A of Area 1 to...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada T1036 E

Edit your Canada T1036 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T1036 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T1036 E online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada T1036 E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T1036 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T1036 E

How to fill out Canada T1036 E

01

Obtain the Canada T1036 E form from the Canada Revenue Agency website or a local office.

02

Fill in your personal information including your name, address, and Social Insurance Number (SIN).

03

Indicate the type of investment account you are transferring funds from.

04

Provide details about the funds being transferred, including the amount and type of assets.

05

Complete any additional sections related to your specific investment or situation.

06

Review the form for accuracy and ensure all necessary documentation is attached.

07

Sign and date the form before submitting it to the appropriate financial institution.

Who needs Canada T1036 E?

01

Individuals who wish to transfer funds from a registered retirement savings plan (RRSP) or registered retirement income fund (RRIF) to a Tax-Free Savings Account (TFSA).

02

Residents of Canada looking to consolidate their retirement savings within a tax-advantaged account.

03

Anyone who wants to take advantage of the benefits associated with a TFSA, such as tax-free growth on investments.

Fill

form

: Try Risk Free

People Also Ask about

What is a T1036 form?

To withdraw funds from your RRSPs under the HBP, fill out Form T1036, Home Buyers' Plan (HBP) Request to Withdraw Funds from an RRSP. You have to fill out this form for each withdrawal you make. After filling out Area 1 of Form T1036, give it to your RRSP issuer.

What is the T1036 form for RRSP withdrawal?

To withdraw funds from your RRSPs under the HBP, fill out Form T1036, Home Buyers' Plan (HBP) Request to Withdraw Funds from an RRSP. You have to fill out this form for each withdrawal you make. After filling out Area 1 of Form T1036, give it to your RRSP issuer. The issuer must fill out Area 2.

What happens when you withdraw from RRSP?

You can choose to withdraw all the funds in your RRSP as a lump sum, but the withdrawn amount will be subject to withholding tax. The withholding tax gets taken out of your withdrawal immediately and paid to the government. Additionally, this amount must be added to your income when filing your taxes.

Where do I send my T1036 form?

Conversation. Send us your T1036 form by fax at 1-888-464-2929 or mail to: Tangerine 3389 Steeles Ave E., Toronto, ON M2H 0A1 Remember to include your Client Number + which account you'd like your funds to be deposited into. You can write this anywhere on the form.

How long does it take to withdraw RRSP for HBP?

Your RRSP contributions must stay in the RRSP for at least 90 days before you can withdraw them under the HBP.

Do you have to repay RRSP withdrawals?

Over a period of 10 years, you have to repay your RRSP, PRPP or SPP the amounts you withdrew under the LLP. Generally, for each year of your repayment period, you have to repay 1/10 of the total amount you withdrew until the LLP balance is zero.

What is the payback for RRSP withdrawal?

The payback amount is at least a 15th per year of the amount you withdrew from your RRSP. Your repayment period starts the second year after the year you first withdrew funds from your RRSP for the HBP. For example, if you withdrew funds in 2022, your first year of repayment will be 2024.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada T1036 E in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your Canada T1036 E, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I fill out Canada T1036 E on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your Canada T1036 E by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I fill out Canada T1036 E on an Android device?

Use the pdfFiller mobile app to complete your Canada T1036 E on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is Canada T1036 E?

Canada T1036 E is a form used by individuals to apply for the Lifelong Learning Plan (LLP), which allows Canadians to withdraw funds from their registered retirement savings plan (RRSP) to finance their education.

Who is required to file Canada T1036 E?

Individuals who wish to withdraw funds from their RRSP under the Lifelong Learning Plan to finance their education are required to file Canada T1036 E.

How to fill out Canada T1036 E?

To fill out Canada T1036 E, individuals must provide personal information, details about their educational program, and the amounts they wish to withdraw from their RRSP. It's important to follow the instructions provided on the form carefully.

What is the purpose of Canada T1036 E?

The purpose of Canada T1036 E is to facilitate the withdrawal of RRSP funds for the purpose of financing the education of individuals participating in qualifying educational programs.

What information must be reported on Canada T1036 E?

The information that must be reported on Canada T1036 E includes the individual's identification details, the name of the educational institution, the program of study, the amount being withdrawn, and the dates of enrollment.

Fill out your Canada T1036 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t1036 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.