Get the free Church payroll - The California - Nevada Annual Conference of the bb

Show details

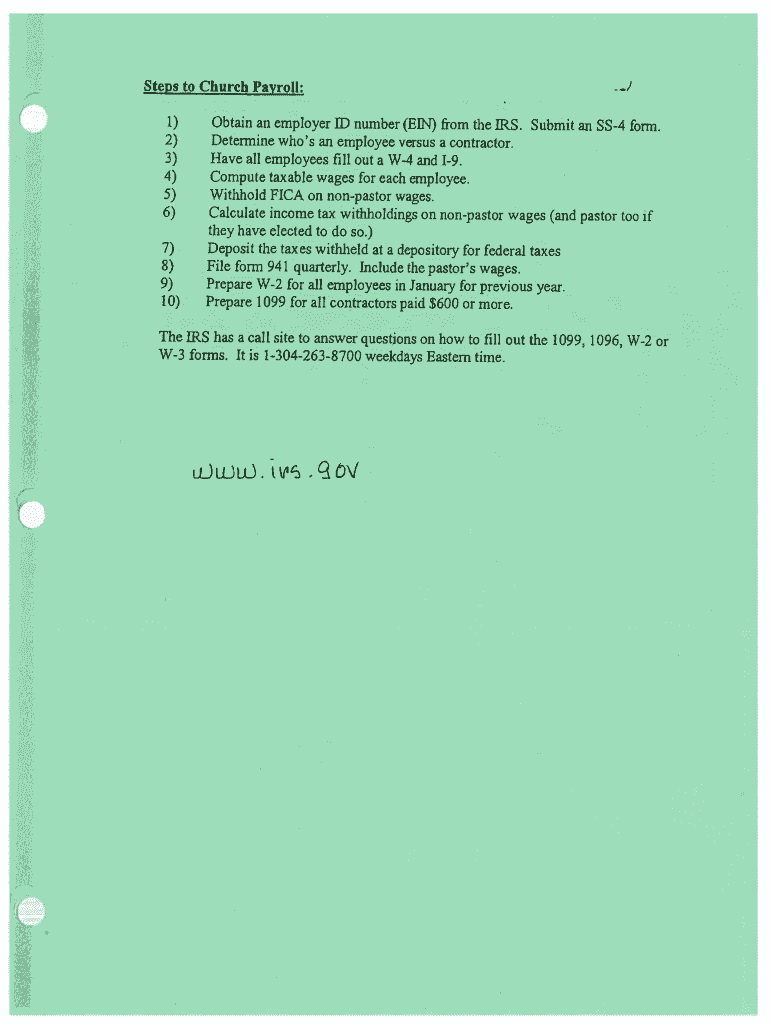

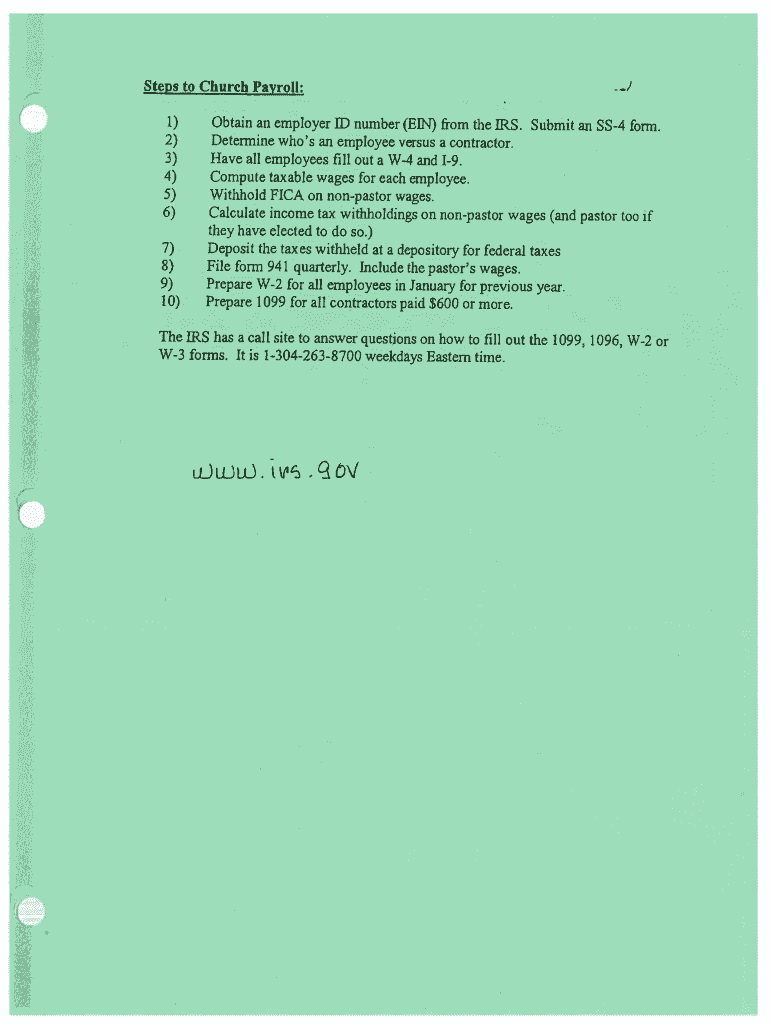

Steps to Church Payroll: 1) 2) 3) 4) 5) 6) 4 7) 8) 9) 10) Obtain an employer ID number (EIN) from the IRS. Submit an SS4 form. Determine who's an employee versus a contractor. Have all employees fill

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign church payroll - form

Edit your church payroll - form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your church payroll - form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit church payroll - form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit church payroll - form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out church payroll - form

How to fill out church payroll - form?

01

Gather necessary information: Collect all relevant details such as the church's name, address, Federal Employer Identification Number (FEIN), and the employee's personal information like name, address, social security number, and job position.

02

Calculate wages and deductions: Calculate the employee's wages, taking into account the number of hours worked, hourly or salary rate, and any applicable overtime or bonuses. Deduct federal and state income tax, Social Security, Medicare, and any other applicable deductions.

03

Fill out employee information: Enter the employee's name, Social Security Number, and address in the designated fields on the form. Ensure accuracy to avoid any issues with tax reporting.

04

Record wages and deductions: Input the employee's wages, both gross and net, in the respective fields on the form. Include any deductions such as federal and state income tax, Social Security, Medicare, retirement contributions, healthcare premiums, etc.

05

Report tax withholdings: Indicate the total amount of federal income tax, Social Security tax, and Medicare tax withheld from the employee's wages. This information is required for accurate tax reporting and employee records.

06

Include employer contributions: If the church provides additional contributions such as retirement funds or healthcare benefits, record these amounts accurately in the corresponding sections of the form.

07

Calculate and report any employment taxes: Depending on the church's size and circumstances, there may be additional employment taxes to consider, such as federal and state unemployment taxes. Ensure proper calculation and reporting of these taxes to meet legal requirements.

08

Double-check for accuracy: Before submitting the church payroll form, review all the information entered to ensure accuracy, particularly for employee names, Social Security Numbers, and tax calculations. Any mistakes could lead to penalties or issues with tax reporting.

09

Submit the form to the appropriate authorities: Depending on the regulations of your location, submit the properly filled out church payroll form to the respective tax authorities, such as the Internal Revenue Service (IRS) or state tax agencies.

Who needs church payroll - form?

01

Churches and religious institutions: The primary users of church payroll forms are the churches themselves. These forms are essential for accurate payroll management, tax reporting, and compliance with employment and tax regulations.

02

Church administrators or payroll personnel: Individuals responsible for managing payroll within a church organization need church payroll forms. They utilize these forms to accurately calculate wages, deductions, and taxes for church employees.

03

Tax authorities: Additionally, tax authorities such as the IRS or state tax agencies require church payroll forms to ensure proper tax reporting by churches. These forms assist in verifying the accuracy of reported income, deductions, and tax withholdings.

Overall, church payroll forms are necessary tools for churches, administrators, and tax authorities to maintain accurate payroll records, calculate wages and taxes correctly, and comply with applicable employment and tax regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit church payroll - form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your church payroll - form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the church payroll - form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your church payroll - form in minutes.

How do I edit church payroll - form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share church payroll - form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is church payroll - form?

The church payroll form is used by churches and religious organizations to report payroll information for employees.

Who is required to file church payroll - form?

Churches and religious organizations that have employees are required to file the church payroll form.

How to fill out church payroll - form?

The church payroll form must be filled out with information about employee wages, taxes withheld, and other payroll details.

What is the purpose of church payroll - form?

The purpose of the church payroll form is to report payroll information to the IRS and state tax agencies.

What information must be reported on church payroll - form?

Information such as employee wages, taxes withheld, and other payroll details must be reported on the church payroll form.

Fill out your church payroll - form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Church Payroll - Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.