Get the free WORKERS COMPENSATION INSURANCE PAYROLL REPORT

Show details

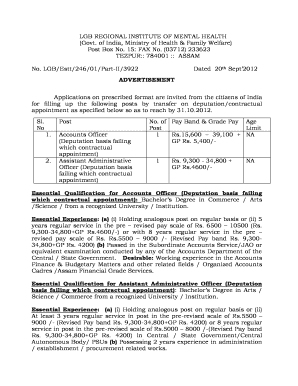

WORKERS COMPENSATION INSURANCE PAYROLL REPORT P O BOX 9102 PLEASANT ON, CA 945669102 ABC INDUSTRIES, INC 123 MAIN STREET ANTON, CA 98765 GROUP 12345678910 PAYROLL PERIOD 03/01/1006/01/10 POLICY CHECK

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign workers compensation insurance payroll

Edit your workers compensation insurance payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your workers compensation insurance payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit workers compensation insurance payroll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit workers compensation insurance payroll. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out workers compensation insurance payroll

How to Fill Out Workers Compensation Insurance Payroll:

01

Gather necessary information: Before filling out the workers compensation insurance payroll, make sure you have all the required information. This may include the employee's name, social security number, job classification, wages, and hours worked during the pay period.

02

Understand job classifications: Familiarize yourself with the various job classifications used in workers compensation insurance. Each classification corresponds to a specific industry or type of work. Properly categorizing employees ensures they are covered under the appropriate workers compensation policy.

03

Calculate payroll: Use the gathered information to calculate the total payroll for each employee. Multiply their wages by the number of hours worked to determine the amount owed. Be sure to include any overtime, bonuses, or other forms of compensation.

04

Double-check accuracy: Review the payroll calculations to ensure accuracy. Mistakes or discrepancies may lead to incorrect insurance premiums being charged or claims being denied. Verify that all calculations are correct before submitting the payroll.

05

Complete the necessary forms: Every workers compensation insurance provider has their own forms and procedures for submitting payroll information. Fill out the required forms with the employee information, job classifications, and corresponding payroll amounts.

06

Submit the payroll: Once the necessary forms are completed, send them to your workers compensation insurance provider. Follow their instructions regarding submission methods, deadlines, and any additional documents required.

Who Needs Workers Compensation Insurance Payroll:

01

Employers: Employers with employees in industries that require workers compensation coverage typically need workers compensation insurance payroll. This applies to businesses of all sizes, from small startups to large corporations.

02

Employees: Workers compensation insurance payroll is important for employees who want to ensure they would receive proper compensation for work-related injuries or illnesses. It provides them with financial benefits, including medical expenses, lost wages, and rehabilitation costs.

03

Legal and Regulatory Compliance: Depending on the jurisdiction, employers may be legally required to obtain workers compensation insurance and submit payroll information to stay compliant with local or state laws. Failure to do so can result in penalties or legal consequences.

In conclusion, filling out workers compensation insurance payroll requires gathering accurate information, understanding job classifications, calculating payroll correctly, completing necessary forms, and submitting them to the insurance provider. It is essential for both employers and employees to ensure compliance with legal requirements and provide proper coverage in case of work-related injuries or illnesses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is workers compensation insurance payroll?

Workers compensation insurance payroll is the amount of money that a company pays to provide insurance coverage for employees who are injured or become ill on the job.

Who is required to file workers compensation insurance payroll?

Employers are required to file workers compensation insurance payroll for their employees.

How to fill out workers compensation insurance payroll?

To fill out workers compensation insurance payroll, employers need to report information about their employees, wages, and work-related injuries.

What is the purpose of workers compensation insurance payroll?

The purpose of workers compensation insurance payroll is to provide financial protection for employees who are injured or become ill on the job.

What information must be reported on workers compensation insurance payroll?

Information such as employee wages, job duties, and work-related injuries must be reported on workers compensation insurance payroll.

Where do I find workers compensation insurance payroll?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific workers compensation insurance payroll and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the workers compensation insurance payroll in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your workers compensation insurance payroll in seconds.

How do I fill out workers compensation insurance payroll on an Android device?

Use the pdfFiller app for Android to finish your workers compensation insurance payroll. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your workers compensation insurance payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Workers Compensation Insurance Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.