Get the free We can cover your overdrafts in different ways

Show details

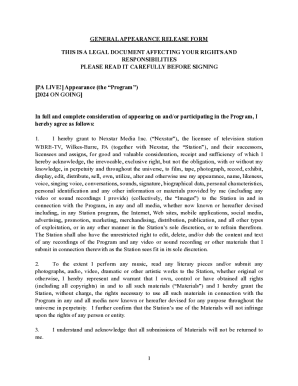

What You Need to Know about Overdrafts and Overdraft Fees An overdraft occurs when you do not have enough money in your account to cover a transaction, but we pay it anyway. We can cover your overdrafts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign we can cover your

Edit your we can cover your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your we can cover your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit we can cover your online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit we can cover your. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out we can cover your

How to fill out "we can cover your":

01

Start by accessing the "we can cover your" form online or obtaining a physical copy.

02

Ensure that you have all the necessary information available, such as personal details, contact information, and any specific coverage requirements.

03

Begin by providing your name, address, and contact details in the designated fields.

04

Next, indicate the type of coverage you are seeking. This may include health insurance, car insurance, home insurance, or any other relevant type of coverage.

05

Specify any additional options or features you would like to include in your coverage. For example, if you are seeking health insurance, you may want to include dental and vision coverage as well.

06

If prompted, provide details about your current insurance coverage, including the company name and policy number, if applicable.

07

Carefully review the entire form to ensure all information is accurate and complete. Double-check for any spelling or typographical errors.

08

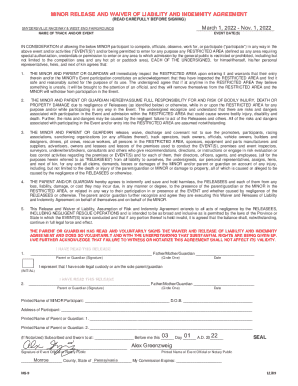

If required, sign and date the form to verify your consent and understanding of the provided information.

09

Submit the completed form as instructed, either by mailing it to the designated address or submitting it online through the provided platform.

Who needs "we can cover your":

01

Individuals who require insurance coverage for various aspects of their lives, such as health, automobile, or property.

02

People who want to secure financial protection and peace of mind in the event of unforeseen circumstances, accidents, or damage.

03

Those who are dissatisfied with their current insurance coverage and are seeking better options or more comprehensive plans.

04

Anyone who wants to ensure that their loved ones or assets are protected and provided for in case of emergencies or unexpected events.

05

Business owners or entrepreneurs who need insurance coverage for their commercial ventures, including liability insurance, business property insurance, or workers' compensation coverage.

Remember, it is important to carefully consider your insurance needs and research different options to find the best coverage that suits your individual requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the we can cover your in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your we can cover your in seconds.

Can I edit we can cover your on an Android device?

The pdfFiller app for Android allows you to edit PDF files like we can cover your. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I complete we can cover your on an Android device?

Use the pdfFiller mobile app and complete your we can cover your and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is we can cover your?

We can cover your refers to assessing your insurance needs and providing coverage options to protect you from potential risks.

Who is required to file we can cover your?

Anyone who wants to protect themselves or their assets from potential risks is required to assess their insurance needs and file for coverage options.

How to fill out we can cover your?

You can fill out a we can cover your form by carefully assessing your insurance needs, providing accurate information, and selecting the appropriate coverage options.

What is the purpose of we can cover your?

The purpose of we can cover your is to provide individuals or businesses with protection against potential risks or losses by offering insurance coverage options.

What information must be reported on we can cover your?

The information that must be reported on we can cover your includes personal or business details, assets to be protected, potential risks, and desired coverage options.

Fill out your we can cover your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

We Can Cover Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.