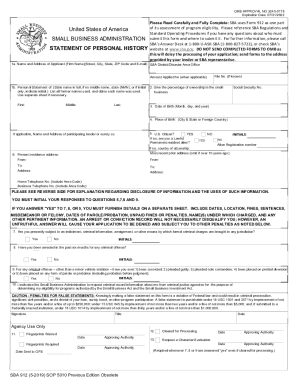

Who needs a Form SBA-912?

Form SBA-912 is an important document for legal identities and individuals, who need loan for opening or supporting their small business.

What is for Form SBA-912?

SBA-912 is a form, which is a proof of businessman’s trustworthiness. Granted information will be used as background for check your small business and reliability. And it relates not only to business and to owner’s partners too.

The following form must be filed if you are: principal, owner of 20% of shares and more, officer, general partner or play other key role inside the business.

If your credit score is 680 and above, you are more than 2 years in business and this business is profitable —? You can get loan in over $350.000.

Is SBA-912 Form accompanied by other forms?

SBA-912 is usually files with SBA loan request.

When is SBA-912 due?

SBA-912 expires on Friday, May 31, 2019

How do I feel out Form SBA-912?

You must note in this form the following information:

-

Personal statement.

-

Note your level of ownership in the business (in percent)

-

Date of birth

-

Place of birth

-

U.S. Citizen? (check the needed checkbox)

-

Address of your residence

Other fields are related to crime past (if it had a place). All checkboxes must be checked correctly and any information must be supported by related documents and reports. Any false in statement causes quite strict penalties.

Where do I send Form SBA-912?

Completed form SBA-912 must be sent to SBA for processing. US Small Business Administration

409 3rd St, SW, Washington DC 20416.

Note: completed form must not be sent to the IBM. It will delay processing of this application. Send SBA forms only to SBA official addresses and representatives.