Get the free NON-TRADITIONAL CREDIT OR CREDIT BY EXPERIENCE - sw

Show details

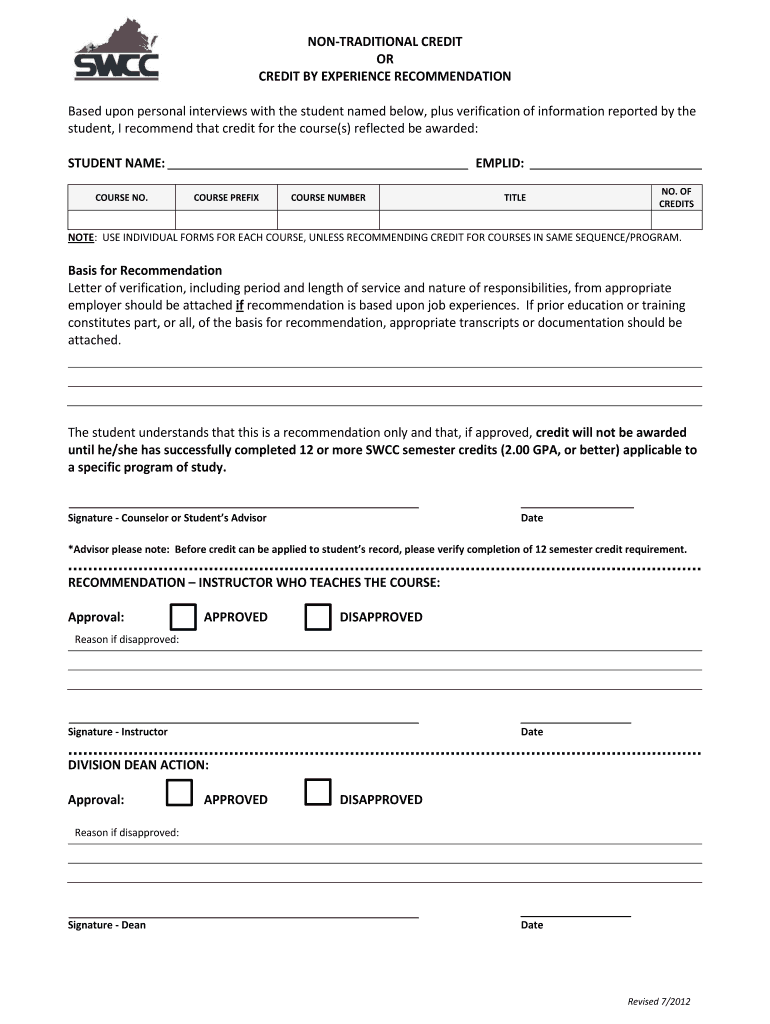

NONTRADITIONAL CREDIT OR CREDIT BY EXPERIENCE RECOMMENDATION Based upon personal interviews with the student named below, plus verification of information reported by the student, I recommend that

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-traditional credit or credit

Edit your non-traditional credit or credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-traditional credit or credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-traditional credit or credit online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit non-traditional credit or credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-traditional credit or credit

How to fill out non-traditional credit or credit:

01

Before starting the application process, gather all the necessary documents such as identification, proof of income, and any other required paperwork.

02

Research different financial institutions or lenders that offer non-traditional credit options, such as online lenders or credit unions.

03

Once you have chosen a lender, visit their website or contact them to inquire about their application process. Some lenders may require you to apply online, while others may allow for in-person applications.

04

Complete the application form accurately and provide all the requested information. Be sure to double-check for any errors or missing details before submitting the application.

05

If required, provide any additional documentation or supporting materials that may be necessary to support your application, such as bank statements or tax returns.

06

Wait for the lender's response. The processing time may vary depending on the lender and the complexity of your application. In the meantime, be prepared to answer any follow-up questions that the lender may have.

07

If your application is approved, review the terms and conditions of the non-traditional credit or credit carefully. Make sure you understand the interest rates, repayment terms, and any other fees or charges associated with the credit.

08

If you agree with the terms, proceed with accepting the credit offer. Some lenders may require you to sign an agreement electronically, while others may provide physical documents for you to sign.

09

Use the credit responsibly and make timely repayments to build a positive credit history.

Who needs non-traditional credit or credit:

01

Individuals with no or limited credit history - Non-traditional credit options can be beneficial for individuals who are starting to build their credit history or have limited credit information available.

02

Borrowers with a poor credit score - If you have a low credit score due to past financial mistakes, non-traditional credit options can provide an opportunity to access credit and potentially improve your creditworthiness over time.

03

Self-employed individuals or freelancers - Non-traditional credit options can be more flexible and accommodating for individuals with irregular income or those who are self-employed.

04

Immigrants or international students - People who have recently moved to a new country or are studying abroad may have difficulties accessing traditional credit immediately. Non-traditional credit options can provide a stepping stone for establishing a credit history in a new place.

05

Small business owners - Non-traditional credit can be a lifeline for small business owners who may not qualify for traditional business loans but still require financing to start or expand their ventures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-traditional credit or credit directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your non-traditional credit or credit as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in non-traditional credit or credit?

The editing procedure is simple with pdfFiller. Open your non-traditional credit or credit in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out non-traditional credit or credit on an Android device?

On an Android device, use the pdfFiller mobile app to finish your non-traditional credit or credit. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is non-traditional credit or credit?

Non-traditional credit or credit refers to alternative forms of credit assessment that do not rely on traditional credit history, such as rent payments or utility bills.

Who is required to file non-traditional credit or credit?

Individuals or businesses seeking to demonstrate creditworthiness through non-traditional means are required to file non-traditional credit or credit.

How to fill out non-traditional credit or credit?

Non-traditional credit or credit can be filled out by providing documentation of alternative credit sources and payment history.

What is the purpose of non-traditional credit or credit?

The purpose of non-traditional credit or credit is to provide a more comprehensive picture of an individual or business's creditworthiness beyond traditional credit history.

What information must be reported on non-traditional credit or credit?

Information such as rent payments, utility bills, and other non-traditional credit sources must be reported on non-traditional credit or credit.

Fill out your non-traditional credit or credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Traditional Credit Or Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.