Get the free IRS - BSA Managersxls

Show details

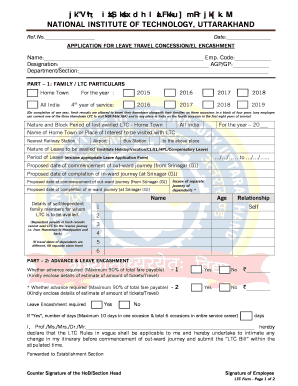

IRS BSA Manager/Territory Manager Personnel listing as of 9/1/2011 Name Akins Robert M (Acting) Bob Carolyn L Ca lamas William S Carmen Jason R Cheatham Teresa A Cornet David S Davis Robert K Hetherington

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs - bsa managersxls

Edit your irs - bsa managersxls form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs - bsa managersxls form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs - bsa managersxls online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs - bsa managersxls. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs - bsa managersxls

How to Fill Out IRS - BSA Managersxls:

01

Open the IRS - BSA Managersxls form on your computer. This form is used by businesses to report suspicious or potentially illegal activities as required by the Bank Secrecy Act (BSA).

02

Start by entering your business's name, address, and Employer Identification Number (EIN) in the designated fields at the top of the form. This information helps the IRS identify your business accurately.

03

Next, fill in the date this report is being filed and the name and title of the person responsible for completing the form. This ensures accountability for the information provided.

04

Proceed to Section A - Currency Transaction Report (CTR) Information. Here, you will need to enter details about any cash transactions exceeding $10,000 in a single day. Include the customer's name, identification details, transaction date, and amount. If no transactions meet this reporting threshold, you can leave this section blank.

05

In Section B - Suspicious Activity Report (SAR) Information, you will describe any suspicious activities your business has identified. This can include unusual transactions, patterns of activity, or behaviors that raise reasonable suspicions. Provide a clear narrative explaining the suspicious activity, along with supporting documentation when available.

06

If you have filed a FinCEN Form 111 (formerly TD F 90-22.1) for this reporting period, indicate it in Section C - Report of Foreign Bank and Financial Accounts (FBAR) Information. Otherwise, you can leave this section blank.

07

Move on to Section D - Monetarization of Bank Instruments. This section pertains to transactions involving the conversion of bank instruments, such as money orders or traveler's checks, into currency or other monetary instruments.

08

Finally, complete Section E - Persons Involved in the Transaction. Here, you will provide information about individuals or entities involved in the reported transactions, including their names, addresses, and identification details. Include both the subjects of the report and any other individuals or entities that played a significant role.

Who Needs IRS - BSA Managersxls:

01

Financial Institutions: Banks, credit unions, trust companies, and other financial institutions are required to fill out the IRS - BSA Managersxls form. These institutions handle large amounts of cash transactions and are subject to reporting requirements under the Bank Secrecy Act.

02

Money Service Businesses: Money transmitters, check-cashing businesses, and currency exchangers fall under the category of money service businesses. These entities are also obligated to complete the IRS - BSA Managersxls form due to their involvement in potentially high-risk financial activities.

03

Casinos and Card Clubs: Casinos, racetracks, and card clubs that facilitate large cash transactions are required to comply with the reporting obligations outlined in the Bank Secrecy Act. Consequently, these establishments are expected to complete and submit the IRS - BSA Managersxls form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs - bsa managersxls?

The irs - bsa managersxls is a form used by financial institutions to report suspicious activities to the Internal Revenue Service (IRS) and the Financial Crimes Enforcement Network (FinCEN).

Who is required to file irs - bsa managersxls?

Financial institutions such as banks, credit unions, and money service businesses are required to file irs - bsa managersxls.

How to fill out irs - bsa managersxls?

The irs - bsa managersxls form must be filled out with information about the suspicious activity, including details about the individual or entity involved, the nature of the activity, and any supporting documentation.

What is the purpose of irs - bsa managersxls?

The purpose of irs - bsa managersxls is to help prevent money laundering, terrorist financing, and other financial crimes by monitoring and reporting suspicious activities.

What information must be reported on irs - bsa managersxls?

Information such as the individual or entity involved, details of the suspicious activity, and any supporting documentation must be reported on irs - bsa managersxls.

How can I send irs - bsa managersxls for eSignature?

To distribute your irs - bsa managersxls, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete irs - bsa managersxls online?

Easy online irs - bsa managersxls completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit irs - bsa managersxls on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share irs - bsa managersxls on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your irs - bsa managersxls online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs - Bsa Managersxls is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.