Get the free Lifetime income benefit rider termination form - American Equity

Show details

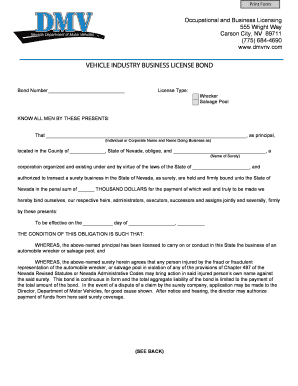

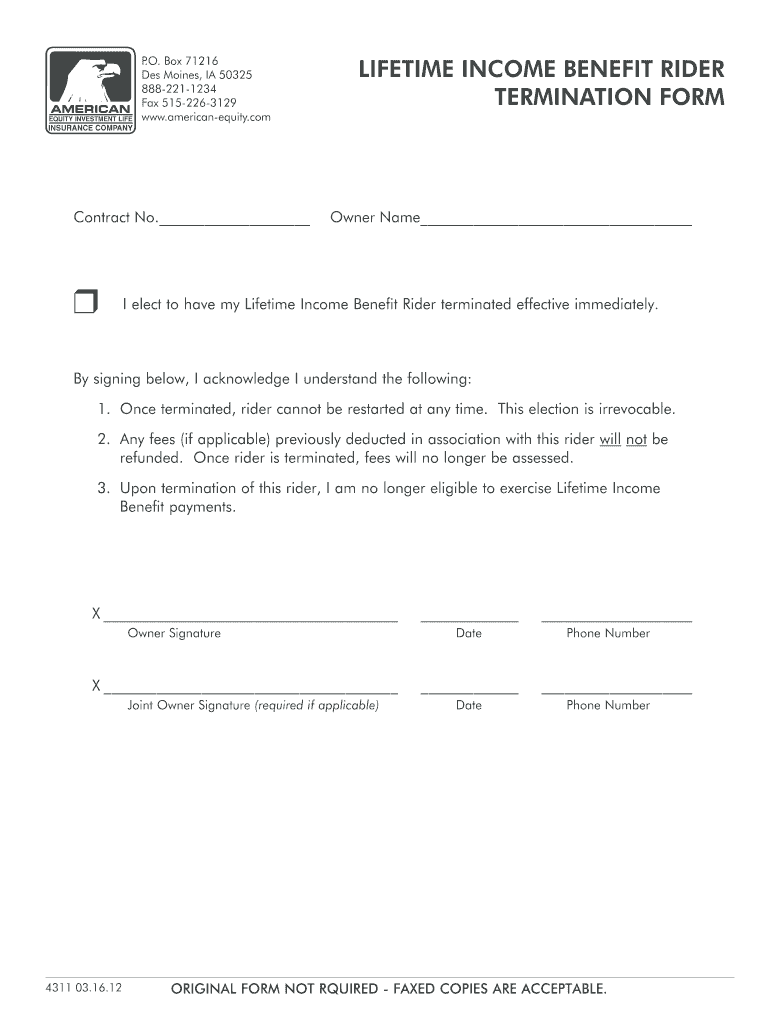

Print P Box 71216. O. Des Moines, IA 50325 8882211234 Fax 5152263129 www.americanequity.com Contract No. r Reset Lifetime income benefit rider Termination form Owner Name I elect to have my Lifetime

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lifetime income benefit rider

Edit your lifetime income benefit rider form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lifetime income benefit rider form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lifetime income benefit rider online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lifetime income benefit rider. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lifetime income benefit rider

How to fill out lifetime income benefit rider:

01

Review the policy: Before filling out the lifetime income benefit rider, carefully review the terms and conditions of your insurance policy. Understand the coverage and benefits provided by the rider.

02

Gather necessary information: Collect all the required information and documents needed to complete the rider form. This may include personal details, policy information, and any additional information requested by the insurance company.

03

Consult with a financial advisor: It is recommended to seek the guidance of a financial advisor who specializes in life insurance. They can provide valuable insights and help you understand the implications and benefits of the lifetime income benefit rider.

04

Determine coverage amount: Decide the desired amount of income you would like to receive from the rider. Consider factors such as your current income, future expenses, and financial goals.

05

Fill out the form accurately: Carefully fill out the lifetime income benefit rider form, ensuring that all the information provided is accurate and complete. Double-check the form before submitting it to avoid any potential errors or omissions.

06

Submit the form: Once the form is filled out, sign and date it, and submit it to your insurance company. Follow any specific instructions provided by the insurer regarding submission methods or additional documentation required.

Who needs lifetime income benefit rider:

01

Individuals nearing retirement: The lifetime income benefit rider can be particularly beneficial for individuals who are approaching retirement age. It provides a guaranteed stream of income during retirement, ensuring financial security.

02

Those seeking income protection: If you are concerned about outliving your retirement savings or want to ensure a consistent income even if your other investments underperform, the lifetime income benefit rider can provide additional income protection.

03

Individuals with specific financial goals: People who have specific financial goals, such as funding their child's education or paying off a mortgage, can utilize the income generated by the rider to meet these goals without tapping into their retirement savings.

04

Those looking for flexibility: The lifetime income benefit rider offers flexibility by allowing policyholders to choose when and how they receive the income payments. This can be an attractive feature for individuals who value financial flexibility and control.

05

Individuals with a variable income: If you have an irregular or variable income, the lifetime income benefit rider can provide a stable and predictable income stream, supplementing any fluctuations in your other income sources.

It is important to note that the suitability of the lifetime income benefit rider may vary depending on individual circumstances, financial goals, and risk appetite. It is advisable to consult with a qualified financial professional to determine if this rider aligns with your specific needs and objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find lifetime income benefit rider?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the lifetime income benefit rider in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the lifetime income benefit rider in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your lifetime income benefit rider in seconds.

Can I create an eSignature for the lifetime income benefit rider in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your lifetime income benefit rider right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is lifetime income benefit rider?

The lifetime income benefit rider is an optional add-on feature to a life insurance policy that provides a guaranteed income stream for the policyholder during retirement.

Who is required to file lifetime income benefit rider?

Policyholders who wish to have a guaranteed income stream during retirement may choose to add the lifetime income benefit rider to their policy.

How to fill out lifetime income benefit rider?

To fill out the lifetime income benefit rider, policyholders must contact their insurance provider and request to add the rider to their policy. They may need to provide additional personal and financial information.

What is the purpose of lifetime income benefit rider?

The purpose of the lifetime income benefit rider is to provide a secure source of income for the policyholder during retirement, supplementing their retirement savings and Social Security benefits.

What information must be reported on lifetime income benefit rider?

Policyholders must report their personal information, policy details, and desired income payment options when adding the lifetime income benefit rider to their policy.

Fill out your lifetime income benefit rider online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lifetime Income Benefit Rider is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.