Get the free appraisal waiver form

Show details

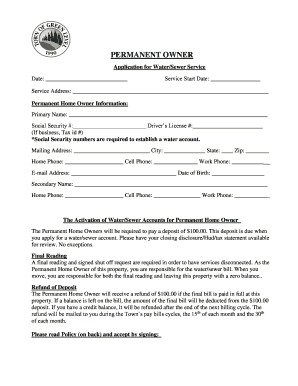

APPRAISAL / VALUATION TIMING WAIVER Borrowers Name & Current Address: Lenders Name & Address Michigan Mutual, Inc. Suite 210 100 Galleria Officer Southfield, MI 48034 Loan Number Date: Subject Property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appraisal waiver form

Edit your appraisal waiver form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appraisal waiver form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing appraisal waiver form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit appraisal waiver form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out appraisal waiver form

How to fill out an appraisal waiver:

01

First, review the requirements and guidelines set by your lender or the organization requesting the waiver. Familiarize yourself with the specific information they need and any forms or documents that may need to be submitted.

02

Gather all the necessary information and documents that are usually required for a traditional appraisal. This may include property details, recent sales data of similar properties in the area, any renovations or improvements made to the property, and any relevant market data.

03

Ensure that you understand the implications of requesting an appraisal waiver. Assess whether not having an appraisal done will affect the terms of your loan, particularly in terms of interest rates, loan-to-value ratios, or mortgage insurance requirements. Consider consulting with a mortgage professional or your lender if you have any questions or concerns.

04

Completing the appraisal waiver itself will depend on the specific form or process required by your lender or the organization requesting the waiver. Follow the provided instructions carefully and accurately enter all the requested information.

05

Review and double-check all the information provided on the waiver form for accuracy and completeness. Any errors or omissions could delay the processing of your request or even require it to be resubmitted.

06

Once you are confident that all the necessary information has been provided and the form is complete, sign and date the appraisal waiver as required. Be sure to keep a copy of the signed waiver for your records.

07

Submit the completed waiver form and any additional supporting documents as instructed by your lender or the requesting organization. Follow up to ensure that the waiver request has been received and is being processed.

Who needs an appraisal waiver:

01

Borrowers who are refinancing their mortgage and meet specific eligibility criteria set by their lender or the organization handling the refinance transaction.

02

Homebuyers who are purchasing a property, particularly if they are obtaining a mortgage, and their lender offers the option of an appraisal waiver based on certain requirements and loan-to-value ratios.

03

Some lenders or loan programs may also offer appraisal waivers to certain borrowers based on their creditworthiness, loan amount, or other factors. It is important to check with your lender to determine if you qualify for an appraisal waiver.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my appraisal waiver form directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your appraisal waiver form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit appraisal waiver form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing appraisal waiver form.

How do I fill out appraisal waiver form using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign appraisal waiver form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is appraisal waiver?

An appraisal waiver is a provision that allows borrowers to bypass the traditional property appraisal process when obtaining a mortgage, typically resulting in faster loan processing.

Who is required to file appraisal waiver?

Lenders and borrowers who meet certain eligibility criteria set by agencies like Fannie Mae or Freddie Mac may be required to file for an appraisal waiver.

How to fill out appraisal waiver?

To fill out an appraisal waiver, lenders must input necessary borrower and property information into the designated software used by the relevant underwriting agency to determine eligibility.

What is the purpose of appraisal waiver?

The purpose of an appraisal waiver is to expedite the home loan process, reduce costs for borrowers, and streamline the transaction if value can be reliably established through alternative methods.

What information must be reported on appraisal waiver?

Information such as property address, loan amount, borrower details, and any other relevant data about the property's condition or market can be reported on the appraisal waiver.

Fill out your appraisal waiver form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appraisal Waiver Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.