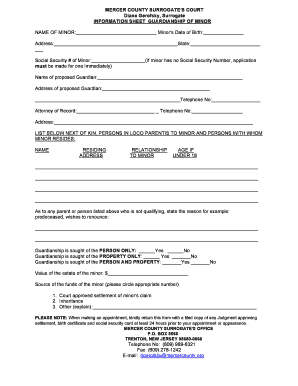

Get the free Streamline Refinance WITH an Appraisal Worksheet The maximum mortgage is the lower o...

Show details

Streamline Refinance WITH an Appraisal Worksheet The maximum mortgage is the lowest of: Outstanding principal balance1 minus the applicable refund of FLIP, plus closing costs and prepaid items to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign streamline refinance with an

Edit your streamline refinance with an form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your streamline refinance with an form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit streamline refinance with an online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit streamline refinance with an. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out streamline refinance with an

How to Fill Out Streamline Refinance with an:

Gather all necessary financial documents:

01

Current mortgage statements

02

Pay stubs or proof of income

03

Bank statements

04

Tax returns

05

Property insurance information

5.1

Contact your current lender or any other approved lender offering streamline refinancing. Inquire about the specific requirements and application process for streamline refinance with an.

5.2

Complete the application form provided by the lender. Provide accurate and up-to-date information regarding your current mortgage, financial situation, and personal details.

5.3

Submit the required documents along with the completed application. Make sure all documents are legible and contain the necessary information.

5.4

Await approval from the lender. They will assess your application, review your financial documentation, and determine if you meet the eligibility requirements for streamline refinance with an.

5.5

If approved, carefully review the terms and conditions of the new loan offer provided by the lender. Ensure that you understand all aspects of the refinancing terms, such as interest rates, payment schedule, and any associated fees.

5.6

Sign the loan agreement, indicating your agreement to the terms and conditions. Follow any additional instructions provided by the lender to finalize the refinance process.

Who needs streamline refinance with an:

01

Homeowners with an existing FHA loan may consider streamline refinance with an to take advantage of potentially lower interest rates. This allows them to save money on their monthly mortgage payments.

02

Borrowers who wish to simplify the refinancing process may opt for streamline refinance with an. The streamlined process typically requires fewer documentation and eligibility criteria compared to traditional refinancing options.

03

Individuals who have improved their credit scores since obtaining their original FHA loan may find that they qualify for more favorable loan terms through streamline refinance with an.

04

Homeowners who are planning to stay in their current homes for an extended period may benefit from streamline refinance with an. By reducing the interest rate or adjusting the loan term, they can save money over the long term.

05

Borrowers who are experiencing financial difficulties or facing adjustable rates on their current FHA loans may find relief through streamline refinance with an. This can help stabilize their mortgage payments and provide more financial security.

Remember, it is important to consult with a qualified mortgage professional or financial advisor before proceeding with streamline refinance with an. They can provide personalized guidance and ensure that this option is suitable for your specific financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit streamline refinance with an straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit streamline refinance with an.

How do I fill out the streamline refinance with an form on my smartphone?

Use the pdfFiller mobile app to complete and sign streamline refinance with an on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete streamline refinance with an on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your streamline refinance with an. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is streamline refinance with an?

Streamline refinance with an is a process that allows borrowers to replace their existing mortgage with a new one, typically with lower interest rates and better terms, without going through the full underwriting process.

Who is required to file streamline refinance with an?

Borrowers who currently have an existing mortgage and wish to refinance it through a streamlined process are required to file streamline refinance with an.

How to fill out streamline refinance with an?

To fill out streamline refinance with an, borrowers need to provide information about their current mortgage, financial situation, and the new loan they are applying for.

What is the purpose of streamline refinance with an?

The purpose of streamline refinance with an is to make the refinancing process quicker and easier for borrowers by reducing the paperwork and requirements typically involved in a traditional refinance.

What information must be reported on streamline refinance with an?

On streamline refinance with an, borrowers must report their current mortgage details, income, employment status, debts, assets, and any other relevant financial information.

Fill out your streamline refinance with an online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Streamline Refinance With An is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.