Get the free Summer Loan Skip-a-Payment - goldencirclecucom

Show details

Summer Loan SkipaPayment

We will again offer our Summer Skipapayment program to most borrowers, and you can sign up to skip the

July 2014 payment on your loan. Please review the following: Interest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign summer loan skip-a-payment

Edit your summer loan skip-a-payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your summer loan skip-a-payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit summer loan skip-a-payment online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit summer loan skip-a-payment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out summer loan skip-a-payment

How to fill out summer loan skip-a-payment:

01

Contact your loan provider: Reach out to your loan provider and inquire about their policy for summer loan skip-a-payment. They will provide you with the necessary forms and instructions on how to proceed.

02

Understand the eligibility criteria: Familiarize yourself with the eligibility criteria for the summer loan skip-a-payment program. Some lenders may require you to have made a certain number of consecutive payments or meet specific financial criteria.

03

Gather required documentation: Collect any supporting documentation that may be required by your loan provider. This may include proof of income, employment verification, or other relevant documents.

04

Complete the skip-a-payment form: Fill out the skip-a-payment form provided by your loan provider accurately and thoroughly. Double-check all the information before submitting it to avoid any delays or complications.

05

Review terms and conditions: Carefully read and understand the terms and conditions associated with the summer loan skip-a-payment program. Pay close attention to any fees or interest charges that may apply during the skip period.

06

Submit the form: Submit the completed skip-a-payment form to your loan provider as per their instructions. Some lenders may allow you to submit it online, while others may require you to mail or fax it.

07

Confirmation and follow-up: Once your loan provider receives your skip-a-payment request, they will review it and send you a confirmation. Keep track of the communication and follow up if you do not receive confirmation within a reasonable time frame.

Who needs summer loan skip-a-payment?

01

Individuals experiencing financial hardships: Summer loan skip-a-payment can be beneficial for individuals facing financial difficulties during the summer season, whether it's due to reduced income, unexpected expenses, or other reasons.

02

Students and seasonal workers: Students and seasonal workers who rely on income from part-time jobs or temporary employment often experience income fluctuations during the summer months. A summer loan skip-a-payment can provide temporary relief from loan obligations during this period.

03

Families on vacation: Families who plan on taking a summer vacation and want to allocate their funds towards travel expenses may find it helpful to skip a loan payment temporarily. This allows them to enjoy their vacation without the additional burden of monthly loan payments.

04

Small business owners: Small business owners may face seasonal fluctuations in revenue during the summer months. Skipping a loan payment can help free up cash flow to cover other pressing business expenses or invest in growth opportunities.

05

Anyone looking for financial flexibility: Even individuals who are not facing specific financial hardships but desire more financial flexibility during the summer months may opt for a summer loan skip-a-payment. It allows them to allocate their resources to other priorities temporarily.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

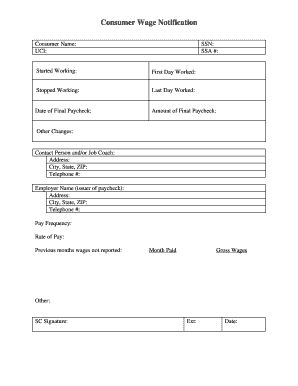

What is summer loan skip-a-payment?

Summer loan skip-a-payment is a program that allows eligible borrowers to skip making their loan payment for a specified month during the summer.

Who is required to file summer loan skip-a-payment?

Borrowers who meet the eligibility criteria set by the lending institution are required to file for summer loan skip-a-payment.

How to fill out summer loan skip-a-payment?

Borrowers can usually fill out the necessary form provided by their lending institution or contact their loan officer for assistance in filling out the summer loan skip-a-payment application.

What is the purpose of summer loan skip-a-payment?

The purpose of summer loan skip-a-payment is to provide borrowers with financial relief during the summer months when expenses may be higher due to vacations, child care, etc.

What information must be reported on summer loan skip-a-payment?

Borrowers may be required to provide information such as their loan account number, reason for requesting skip-a-payment, and contact information.

How do I edit summer loan skip-a-payment online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your summer loan skip-a-payment and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I edit summer loan skip-a-payment on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing summer loan skip-a-payment, you can start right away.

How do I fill out summer loan skip-a-payment using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign summer loan skip-a-payment and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your summer loan skip-a-payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Summer Loan Skip-A-Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.