Get the free Business Balance Sheet - Clackamas Federal Credit Union

Show details

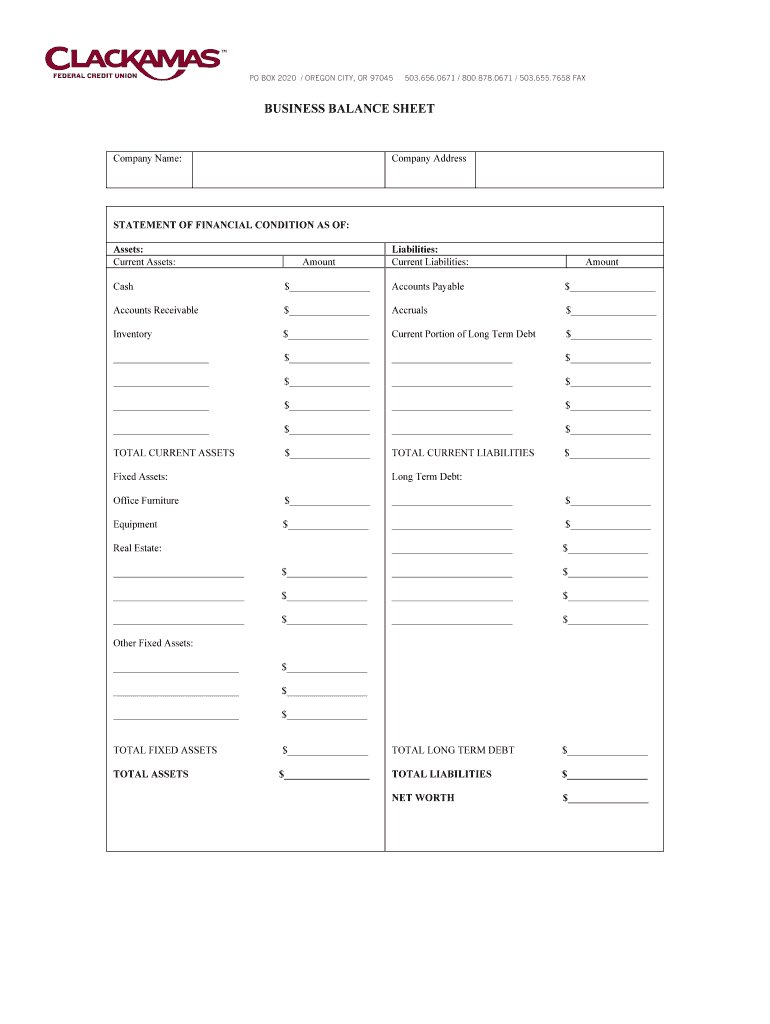

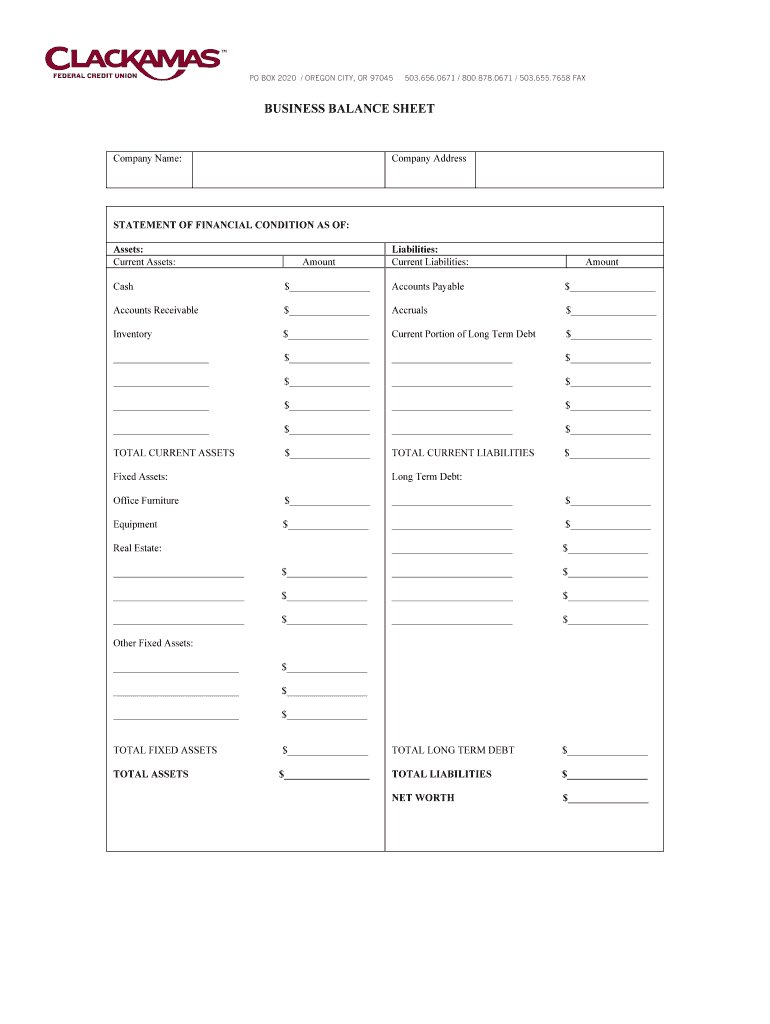

PO BOX 2020 / OREGON CITY, OR 97045 503.656.0671 / 800.878.0671 / 503.655.7658 FAX BUSINESS BALANCE SHEET Company Name: Company Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business balance sheet

Edit your business balance sheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business balance sheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business balance sheet online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business balance sheet. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business balance sheet

How to fill out a business balance sheet?

01

Start by gathering all the necessary financial information for your business. This includes your income statements, cash flow statements, and other financial records.

02

Begin by listing all your assets. This includes your cash on hand, accounts receivable, inventory, and any property or equipment owned by the business. Assign a monetary value to each asset.

03

Next, list all your liabilities. This includes any debts, loans, or outstanding bills that need to be paid. Include both short-term and long-term liabilities.

04

Calculate your owner's equity. This represents the value of the business that belongs to the owner(s) or shareholders. It is calculated by subtracting total liabilities from total assets.

05

Add up all the values from the assets, liabilities, and owner's equity to ensure they balance. The total assets should be equal to the total liabilities and owner's equity.

Who needs a business balance sheet?

01

Small business owners: Having a balance sheet is crucial for small business owners to keep track of their financial status and make informed decisions. It helps them have a clear understanding of their assets, liabilities, and equity.

02

Investors and lenders: Investors and lenders often require a balance sheet when making financial decisions about a business. It provides them with important financial information and helps them assess the financial health and stability of the business.

03

Accountants and financial advisors: Accountants and financial advisors need a business balance sheet to accurately analyze and provide financial advice for their clients. It allows them to identify strengths, weaknesses, and areas of improvement in a business's financial performance.

04

Government authorities and tax agencies: Business balance sheets are required by government authorities and tax agencies for compliance and reporting purposes. They use it to verify financial information and ensure businesses are meeting their tax obligations.

In conclusion, filling out a business balance sheet requires gathering financial information, listing assets and liabilities, calculating owner's equity, and ensuring the values balance. It is essential for small business owners, investors, lenders, accountants, and government authorities for various financial and compliance purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business balance sheet to be eSigned by others?

business balance sheet is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute business balance sheet online?

pdfFiller has made it easy to fill out and sign business balance sheet. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit business balance sheet online?

With pdfFiller, the editing process is straightforward. Open your business balance sheet in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Fill out your business balance sheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Balance Sheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.