Get the free Mortgage Brokers Professional Indemnity Proposal Form

Show details

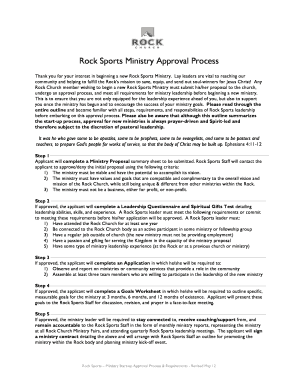

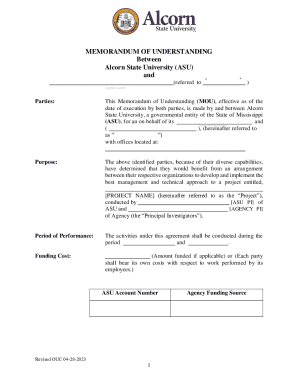

Professional Indemnity Insurance Proposal Form Mortgage Brokers Ref: TS You MUST complete all sections of this Proposal Form. The Proposal Form must be signed and dated once completed. This Proposal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage brokers professional indemnity

Edit your mortgage brokers professional indemnity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage brokers professional indemnity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage brokers professional indemnity online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage brokers professional indemnity. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage brokers professional indemnity

Question:

How to fill out mortgage brokers professional indemnity and who needs it?

01

Start by gathering the necessary information: Before filling out the mortgage brokers professional indemnity form, you need to have specific information on hand. This includes details about your business, such as the name, address, and contact information.

02

Understand the coverage requirements: Familiarize yourself with the coverage requirements for mortgage brokers professional indemnity. Different jurisdictions may have varying rules and regulations. It is essential to ensure that you meet these requirements to protect yourself and your business adequately.

03

Determine your coverage needs: Assess the nature of your business and identify the risks specific to mortgage brokering. This will help you determine the appropriate level of coverage you need to protect yourself from potential liability claims. Consider factors like your client base, the volume of transactions, and the types of services you offer.

04

Find an insurance provider: Research and choose a reputable insurance provider that specializes in professional indemnity coverage for mortgage brokers. Look for companies with experience in the industry and a solid track record of providing reliable and comprehensive coverage.

05

Gather the required documents: Each insurance provider may have specific documentation requirements. Generally, you will need to provide details about your business operations, financial statements, client contracts, and any previous claims or professional incidents. Ensure you have all the necessary paperwork readily available.

06

Fill out the application form: Carefully complete the mortgage brokers professional indemnity application form. Provide accurate and honest answers to all the questions. Double-check the information before submission to avoid any potential errors or discrepancies that may delay the processing or approval of your coverage.

07

Review and submit the application: Before submitting the form, thoroughly review all the information provided. Ensure that you have answered all the questions accurately and have attached any required supporting documents. Once you are satisfied with the application, submit it to the insurance provider for review.

08

Pay the premium: If your application is approved, the insurance provider will provide you with a premium amount that needs to be paid. Make sure to pay the premium promptly to activate your mortgage brokers professional indemnity coverage. Keep records of your payment for future reference.

Who needs mortgage brokers professional indemnity?

Mortgage brokers, whether operating as individuals or as part of a larger brokerage firm, typically need professional indemnity coverage. This type of insurance protects mortgage brokers from potential liability claims arising from errors, omissions, or negligence in their professional services. It is an essential safeguard for those involved in the complex world of mortgage brokering, where even small mistakes or oversights can lead to significant financial repercussions.

If you are a mortgage broker or operate a mortgage brokerage firm, it is crucial to consider obtaining professional indemnity coverage. Having this insurance safeguards your business and personal assets and provides peace of mind in an industry where clients rely heavily on your expertise and advice. Consult with an insurance professional who specializes in professional indemnity coverage to determine the appropriate level of protection for your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mortgage brokers professional indemnity online?

pdfFiller has made it easy to fill out and sign mortgage brokers professional indemnity. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit mortgage brokers professional indemnity online?

With pdfFiller, it's easy to make changes. Open your mortgage brokers professional indemnity in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit mortgage brokers professional indemnity on an Android device?

You can make any changes to PDF files, like mortgage brokers professional indemnity, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is mortgage brokers professional indemnity?

Professional indemnity insurance for mortgage brokers protects them from claims made by clients alleging financial loss due to negligence, errors, or omissions.

Who is required to file mortgage brokers professional indemnity?

Mortgage brokers who are licensed and operating in certain jurisdictions are typically required to have professional indemnity insurance.

How to fill out mortgage brokers professional indemnity?

To fill out mortgage brokers professional indemnity, brokers must provide details about their business activities, coverage limits, claims history, and other relevant information to the insurance provider.

What is the purpose of mortgage brokers professional indemnity?

The purpose of mortgage brokers professional indemnity is to protect brokers from financial losses resulting from claims of professional negligence.

What information must be reported on mortgage brokers professional indemnity?

Information such as business activities, coverage limits, claims history, and any relevant details must be reported on mortgage brokers professional indemnity.

Fill out your mortgage brokers professional indemnity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Brokers Professional Indemnity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.