Get the free Fidelity Advisor IRA Distribution Request - adpcom

Show details

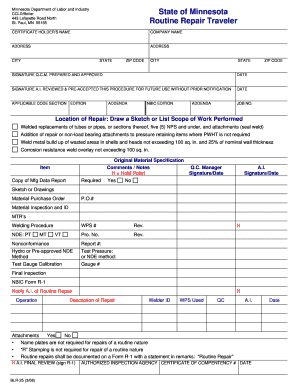

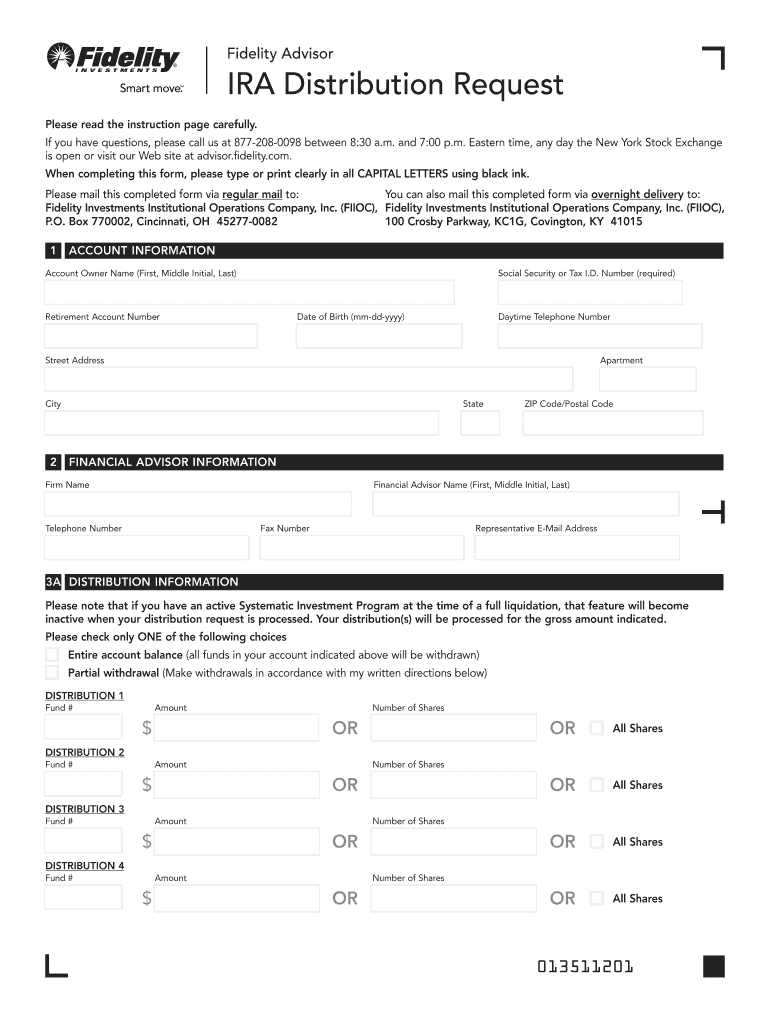

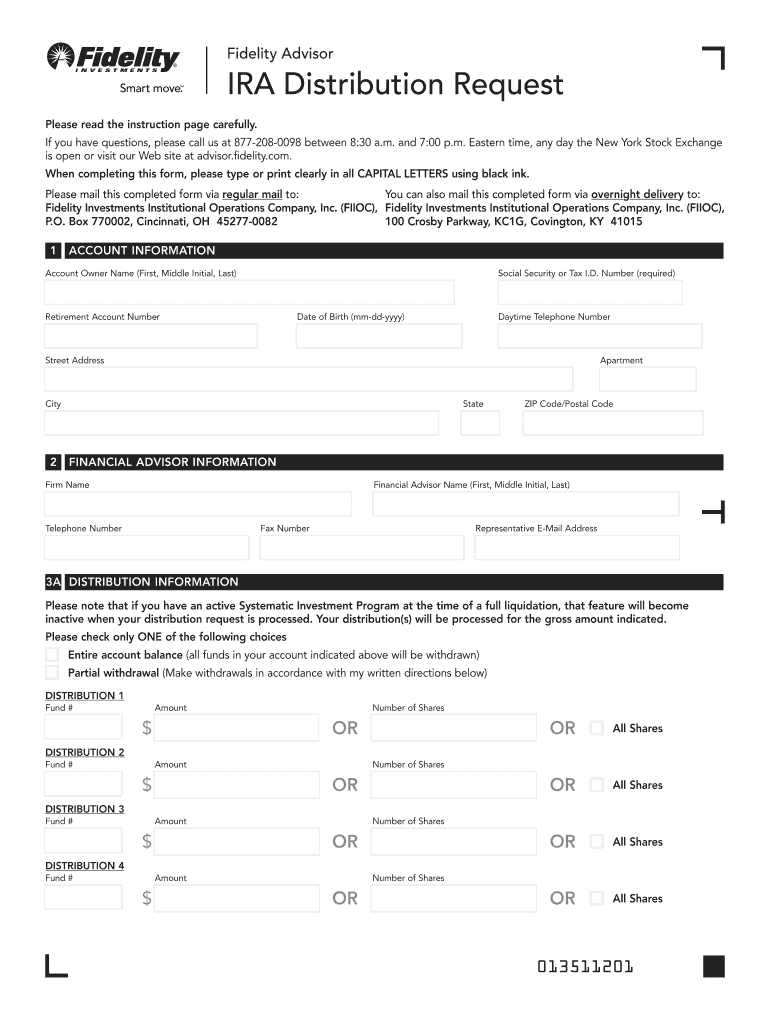

This is a writable PDF file. Simply type your information in the boxes below then print. The Best if used with Adobe Acrobat 4.0 or better. Fidelity Advisor IRA Distribution Request Note: Please use

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity advisor ira distribution

Edit your fidelity advisor ira distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity advisor ira distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fidelity advisor ira distribution online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fidelity advisor ira distribution. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity advisor ira distribution

Point by point guide to fill out Fidelity Advisor IRA distribution:

01

Determine eligibility: Before filling out a Fidelity Advisor IRA distribution form, make sure you are eligible to take a distribution from your IRA account. Generally, individuals who have reached the age of 59 ½ are eligible, as well as those facing certain financial hardships or qualified disability expenses.

02

Obtain the necessary forms: Visit Fidelity's website or contact their customer service to obtain the required forms for an IRA distribution. These forms may also be available in physical branches or through your financial advisor.

03

Provide account information: Fill out the required sections to provide your account information, such as your Fidelity account number, account owner's name, and contact details. This information is crucial for ensuring the distribution is processed correctly.

04

Specify distribution type: Indicate whether you want a one-time lump-sum distribution or a periodic distribution. If you choose the latter, you may need to decide on the frequency and amount of each payment.

05

Select tax withholding options: Decide whether you want to have taxes withheld from your IRA distribution. Fidelity offers various options for federal and state tax withholding, and it's important to consider your tax obligations before making a decision.

06

Provide distribution instructions: Clearly state the details of your distribution, such as the amount you wish to withdraw, the destination account, and any specific instructions regarding the disbursement. Ensure all information is accurate and double-check for any errors.

07

Review and sign the form: Carefully review all the information you provided on the form and make any necessary corrections. Sign and date the form as required to certify the accuracy of the information provided.

08

Submit the form: Once you have completed the form, submit it to Fidelity according to their instructions. This may involve mailing it to a specific address or submitting it electronically through their website.

Who needs Fidelity Advisor IRA distribution?

01

Individuals with a Fidelity Advisor IRA account: The Fidelity Advisor IRA distribution is specifically designed for individuals who have an IRA account with Fidelity. If you hold an IRA account with Fidelity, you may need to take distributions at some point to meet your financial needs or fulfill retirement obligations.

02

Investors looking for retirement income: The Fidelity Advisor IRA distribution can be a valuable tool for individuals seeking a regular income during retirement. By taking distributions from their IRA, investors can supplement their other sources of income and cover living expenses.

03

Those facing financial hardships: In certain situations, individuals may face financial hardships that necessitate taking distributions from their IRA account. Fidelity Advisor IRA distribution offers flexibility for those who require funds due to unforeseen circumstances.

04

Individuals with qualified disability expenses: If you or your dependent has qualified disability expenses, Fidelity's IRA distribution can be utilized to cover these expenses. This can provide financial support for medical treatments, assistive devices, or other disability-related costs.

Note: It is essential to consult with a financial advisor or tax professional to understand the specific rules, implications, and potential tax consequences associated with IRA distributions based on your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fidelity advisor ira distribution without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your fidelity advisor ira distribution into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get fidelity advisor ira distribution?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the fidelity advisor ira distribution in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit fidelity advisor ira distribution on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing fidelity advisor ira distribution, you can start right away.

What is fidelity advisor ira distribution?

A fidelity advisor ira distribution is a distribution of funds from an Individual Retirement Account managed by Fidelity Advisor.

Who is required to file fidelity advisor ira distribution?

Individuals who have an Individual Retirement Account managed by Fidelity Advisor and have taken a distribution from it are required to file fidelity advisor ira distribution.

How to fill out fidelity advisor ira distribution?

To fill out fidelity advisor ira distribution, one must report the distribution amount, distribution date, and any relevant tax withholding information on the appropriate tax forms provided by Fidelity Advisor or the IRS.

What is the purpose of fidelity advisor ira distribution?

The purpose of fidelity advisor ira distribution is to report and document the distribution of funds from an Individual Retirement Account managed by Fidelity Advisor for tax purposes.

What information must be reported on fidelity advisor ira distribution?

The information that must be reported on fidelity advisor ira distribution includes the distribution amount, distribution date, any tax withholding amounts, and any other relevant details related to the distribution.

Fill out your fidelity advisor ira distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Advisor Ira Distribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.