Get the free TRAVEL AND ACCOMMODATION EXPENSES JANUARY 1ST TO MARCH 31, 2009

Show details

NATIONAL BATTLEFIELDS COMMISSION TRAVEL AND ACCOMMODATION EXPENSES JANUARY 1ST TO MARCH 31, 2009, The National Battlefields Commission has pledged to observe the principles of economy and transparency

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign travel and accommodation expenses

Edit your travel and accommodation expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your travel and accommodation expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit travel and accommodation expenses online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit travel and accommodation expenses. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out travel and accommodation expenses

How to Fill Out Travel and Accommodation Expenses:

01

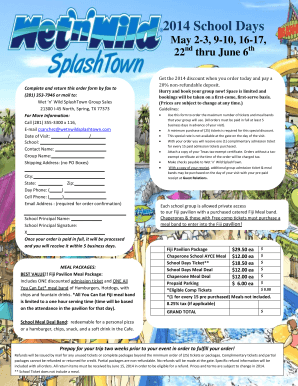

Collect all necessary receipts and documentation for your travel and accommodation expenses. This includes invoices or receipts from hotels, transportation companies, meals, and any other expenses related to your trip.

02

Fill out the appropriate expense reimbursement form provided by your company or organization. Make sure to include all required information such as your name, employee ID or department, and the purpose of your trip.

03

Start with the travel expenses section of the form. Provide details about your transportation expenses including flight or train tickets, rental car expenses, or any other mode of transportation you used during your trip. Be sure to attach the corresponding receipts to support your claims.

04

Move on to the accommodation expenses section. Indicate the dates of your stay, the name and address of the hotel or accommodation, and the total amount spent. Include all relevant receipts for accommodation-related expenses such as room charges and any additional fees.

05

If you incurred any meal expenses during your trip, fill out the meals section of the form. Specify the dates and locations where the meals were consumed and provide the total amount spent. If your company has specific meal per diem rates, make sure to adhere to them.

06

Include any other miscellaneous expenses that are allowed by your organization. This can include conference fees, parking fees, tolls, or any other expenses directly related to your business travel. Attach supporting documentation for these expenses as well.

07

Review your completed expense form to ensure accuracy and completeness. Double-check all figures and confirm that all required receipts are attached.

Who Needs Travel and Accommodation Expenses:

01

Business travelers: Employees who frequently travel for business purposes such as sales representatives, consultants, or executives need to fill out travel and accommodation expenses. These expenses are necessary to track and reimburse the costs incurred during their business trips.

02

Non-profit organizations: Representatives or volunteers traveling on behalf of non-profit organizations often need to track and fill out travel and accommodation expenses. These organizations rely on accurate expense reporting to allocate funds and maintain financial transparency.

03

Government employees: Government employees, including civil servants and officials, may be required to fill out travel and accommodation expenses. These expenses are crucial for government entities to ensure accountability and comply with budgeting regulations.

04

Students and researchers: Individuals attending conferences, research trips, or educational events as part of their academic pursuits may need to document and fill out travel and accommodation expenses. These expenses are often reimbursed by educational institutions or grant funding agencies.

05

Freelancers and contractors: Self-employed professionals, freelancers, and contractors who travel for business purposes need to track and report their travel and accommodation expenses. This enables them to deduct these expenses from their taxable income or submit them for reimbursement from clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is travel and accommodation expenses?

Travel and accommodation expenses refer to the costs incurred for transportation, lodging, and related expenses during a trip or stay away from home for work or business purposes.

Who is required to file travel and accommodation expenses?

Employees or individuals who incur travel and accommodation expenses for work-related purposes are typically required to file these expenses for reimbursement or tax purposes.

How to fill out travel and accommodation expenses?

To fill out travel and accommodation expenses, one must document all relevant expenses, including receipts, dates, locations, and purposes of travel, and submit them according to the organization's reimbursement or tax filing guidelines.

What is the purpose of travel and accommodation expenses?

The purpose of travel and accommodation expenses is to track and reimburse employees or individuals for expenses incurred during work-related travel, as well as to ensure compliance with tax regulations regarding deductible business expenses.

What information must be reported on travel and accommodation expenses?

Information that must be reported on travel and accommodation expenses may include dates of travel, locations visited, purpose of travel, transportation costs, lodging expenses, and any other relevant expenses incurred during the trip.

How can I send travel and accommodation expenses for eSignature?

To distribute your travel and accommodation expenses, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the travel and accommodation expenses electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your travel and accommodation expenses in minutes.

Can I edit travel and accommodation expenses on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share travel and accommodation expenses from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your travel and accommodation expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Travel And Accommodation Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.