Get the free Application for Advance Ruling of a Co-production Project

Show details

Application for Advance Ruling of a Coproduction Project (including application for selective assistance minitreaty Canada/France Production Feature Film or Animation) Page 1 of 6 TITLE OF PROJECT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for advance ruling

Edit your application for advance ruling form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for advance ruling form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for advance ruling online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for advance ruling. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for advance ruling

How to fill out an application for advance ruling:

01

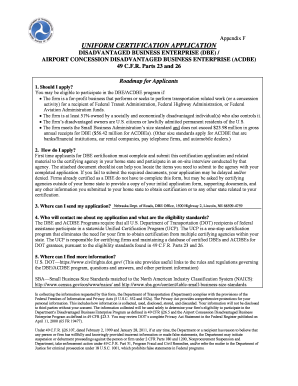

Start by familiarizing yourself with the purpose and requirements of an advance ruling. Understand that an advance ruling is a legally binding decision made by a government authority on how certain tax or customs laws will apply to a specific transaction or situation.

02

Access the official website or portal of the relevant government authority that handles advance ruling applications. This could be the tax department or customs department, depending on the nature of the ruling you are seeking.

03

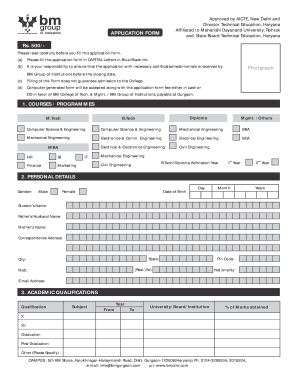

Locate the application form for advance ruling on the website. It may be available for download or accessible through an online submission system.

04

Carefully read through the instructions provided with the application form. Make sure you understand the required information, supporting documents, and any specific guidelines for completing the application accurately.

05

Gather all the necessary information and documents that are requested in the application form. This may include details about the transaction, relevant laws and regulations, descriptions of goods or services involved, financial statements, contracts, and any other relevant supporting material.

06

Fill out the application form accurately and completely. Provide all the requested information in the appropriate fields, ensuring clarity and precision. Be sure to double-check for any errors or omissions before submitting.

07

Attach all the required supporting documents to the application form. Ensure that all documents are properly labeled and organized to facilitate the review process.

08

Review the completed application form and gathered documents to ensure they meet the specified requirements. Verify that all necessary signatures, dates, and certifications are in place, where applicable.

09

Submit the application and accompanying documents as instructed in the application form. This could be via an online submission system, postal mail, or in-person at the designated government office.

10

After submission, regularly monitor the status of your application. Check for any updates, requests for additional information, or notifications regarding the progress of the review process. Respond promptly to any inquiries or requirements from the government authority.

11

Once the advance ruling is issued, carefully review the decision and understand its implications. Adhere to the ruling provided by the government authority to ensure compliance with the applicable laws and regulations.

Who needs an application for advance ruling?

01

Businesses or individuals involved in complex or significant transactions that may have ambiguous interpretations of tax or customs laws.

02

Importers or exporters seeking clarity on the customs duties, tariffs, or valuation of goods.

03

Taxpayers looking for guidance on the applicability of specific tax laws to their transactions or operations.

04

Entities engaged in cross-border transactions or foreign investments, requiring certainty on the tax implications.

05

Any individual or business facing uncertainties or disputes regarding the interpretation or application of tax or customs laws and seeking legal certainty through an advance ruling.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

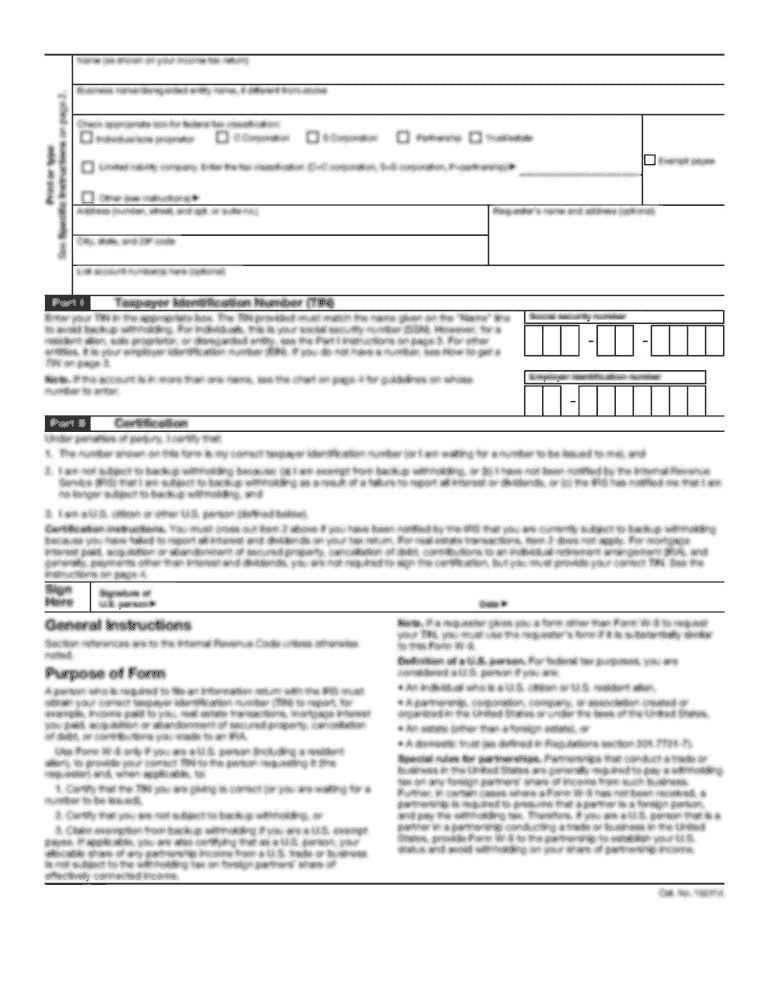

What is application for advance ruling?

The application for advance ruling is a formal request submitted to the relevant authorities seeking a decision on the proper interpretation of tax laws in relation to a specific transaction or situation.

Who is required to file application for advance ruling?

Any taxpayer who wants clarity on the tax implications of a transaction or situation can file an application for advance ruling.

How to fill out application for advance ruling?

The application for advance ruling typically requires details about the taxpayer, the transaction or situation in question, and the specific questions for which clarification is sought. It is advisable to seek professional guidance for filling out the application.

What is the purpose of application for advance ruling?

The purpose of the application for advance ruling is to obtain certainty on the tax implications of a transaction or situation before it is undertaken, allowing the taxpayer to plan accordingly and avoid potential disputes with tax authorities.

What information must be reported on application for advance ruling?

The application for advance ruling must include details about the taxpayer, the transaction or situation in question, the relevant tax laws, and the specific questions for which clarification is sought.

How do I modify my application for advance ruling in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your application for advance ruling and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I fill out the application for advance ruling form on my smartphone?

Use the pdfFiller mobile app to complete and sign application for advance ruling on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit application for advance ruling on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share application for advance ruling from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your application for advance ruling online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Advance Ruling is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.